The biggest interest rate hike since 1995

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

0.5%

The Bank of England's gloomy economic forecasts dominate the UK newspaper front pages this morning.

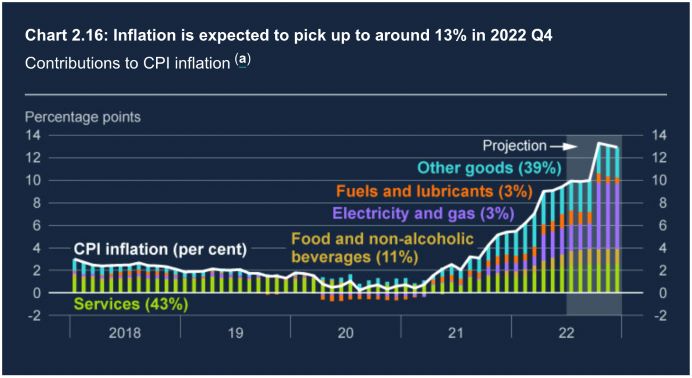

Eight of the nine members of the Monetary Policy Committee voted to hike the base rate by 0.5% to 1.75%, the largest rise since the mid-90s. The Bank now expects inflation to hit 13% in the final quarter and to remain elevated through 2023 - that's another revision from June's forecast of a 9.4% peak - and reflects a near doubling in wholesale gas prices since May (see chart 1).

Households' real income will shrink 1.5% this year and 2.25% next year, the biggest fall since records began in the 1960s. The baseline projection suggests we're about to see five consecutive quarters of economic decline, with the economy shrinking 2.1% over that period.

Mortgages

Everything comes with a massive health warning. Uncertainty around the outlook is "exceptionally high", especially for energy prices, the Bank says in the report, before adding that a scenario in which energy prices follow their downward sloping curves through the forecast period would result in "a very different economic outlook" in the latter half of 2023 and beyond.

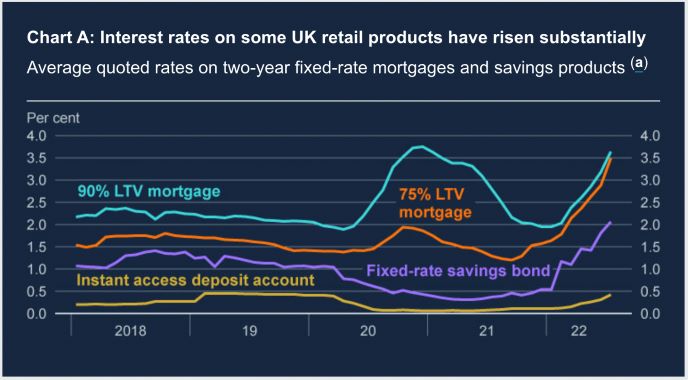

Nevertheless, it sees the base rate reaching 3% in Q3 next year in either scenario. That means mortgage rates, which have climbed substantially since August (see chart), have further to rise. More than half of the outstanding stock of fixed rate mortgages will come up for renewal by Q3 2025, according to Bank data.

A reminder that Flora Harley took stock of how the housing market might look with a base rate of 3% last week. We continue to hold the view that price growth will soften rather than be subject to any sizeable correction as the market returns to a more normal patterns.

The Halifax House Price Index, out this morning, shows house prices fell -0.1% in July – the first decrease since June 2021. That brings the annual growth rate to 11.8%.

Construction

UK construction activity contracted for the first time since January 2021 last month, according to the latest S&P Global / CIPS UK Construction PMI.

The index posted 48.9 in July, down from 52.6 in June - a rating of 50 is considered no change. Although only marginal, the rate of decline was the fastest since May 2020. Civil engineering was the worst-performing segment, with business activity falling to the greatest extent since October 2020. House building declined for the second month running, but the rate of contraction was only slight (index at 49.4). Commercial work bucked the downturn seen elsewhere, although growth was the weakest for 18 months.

Purchase price inflation meanwhile eased considerably (index at 78.1, down from 85.8 in June), with the latest rise in cost burdens the least marked since March 2021. Construction firms noted upward pressure on business expenses from higher energy, fuel and transport costs, but this was partly offset by some easing in commodity prices (especially for metals and timber).

The global perspective

The UK is by no means isolated and various indicators now suggest a global slowdown is imminent.

Danish shipping giant Maersk this week said it loaded 7.4% fewer containers onto ships in the second quarter versus a year earlier. The company warned that the slowdown was especially pronounced in Europe, where stockpiles have been building up at ports and in warehouses as consumer demand wanes.

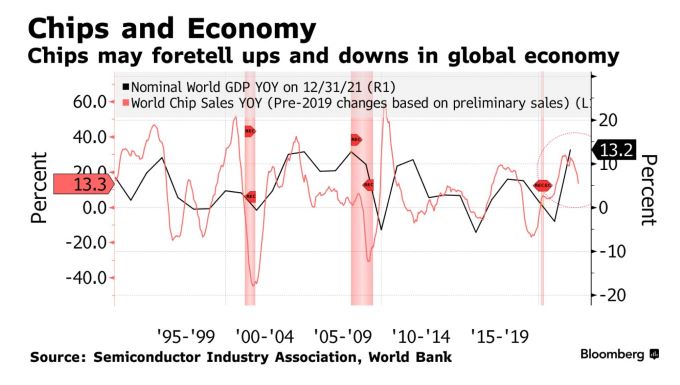

Similarly semiconductor sales have now slowed for six consecutive months, the longest slowdown since the US-China trade war in 2018. The three-month moving average in chip sales has correlated with the global economy’s performance in recent decades (see chart courtesy of Bloomberg).

In other news....

Australian residential property update: supply suffers under economic challenges.

Elsewhere - Accord joins Deposit Unlock (Mortgage Introducer), UK considers divisive home loan revolution to rival Thatcher (Bloomberg), US jobs growth expected to slow as labour demand cools (FT).