Australian residential property update: supply suffers under economic challenges

Michelle Ciesielski, head of residential research, Knight Frank Australia, updates following the Australia’s Treasurer addressing the ‘convergence of challenges’ ahead.

3 minutes to read

A few days into the first sitting of the 47th Parliament of Australia, Treasurer Jim Chalmers has outlined a number of ways the Labor government plans to address the current economic challenges.

Inflation to worsen this year, before moderating in 2023

According to the Treasurer, domestic forces – such as soaring dwelling construction costs and higher grocery bills – are contributing to some of the supply side pressures building for the best part of a decade will take some time to dissipate and unwind.

Inflation was recorded at 6.1% in the year to June 2022 and is forecast to peak at 7.8% in the December 2022 quarter, before moderating to 5.5% in mid-2023, to be 3.5% by the end of 2023. Treasury expects inflation to be back inside the Reserve Bank of Australia (RBA) target range of 2-3% the year after, with 2.8% in mid-2024.

Modest economic growth outlook following weaker consumption

The Treasurer described the current economic environment as a once in a generation opportunity, despite the convergence of challenges with tough decisions required to safeguard the future of Australia.

Prior to the 21 May 2022 election, real Gross Domestic Product (GDP) was estimated to be 4.3% for 2021-22, this has now been adjusted down to 3.8%. Forecast GDP growth for 2022-23 is now downgraded to 3%, while growth of 2% is expected for 2023-24.

This modest economic growth outlook can be attributed to weaker consumption, reflecting higher inflation and increasing interest rates. Net exports will also drag the economy as flooding hits commodity exports, and as imports increase as businesses restock goods.

Higher interest rates and capacity constraints in construction have further attributed to weaker dwelling investment.

Australia’s current low unemployment rate of 3.5% is forecast to remain low but is set to lift to 3.8% by mid-2023 and to 4.0% a year later. In tandem, wage growth is expected to rise and stay steady at 3.8% over this time. Although, these higher wages are likely to be absorbed by predicted inflation.

The Treasurer has outlined ways the government plans to address the current challenges by starting with an audit, which plans to:

• Identify wasteful spending

• Help Australians with cost-of-living pressures by reducing childcare and medicine expenses

• Training people into higher-wage opportunities

• Invest in industries which deliver secure, well-paid roles

• Establish The National Reconstruction Fund to make Australian more self-reliant whilst unclogging and untangling supply chains

A complete series of fiscal forecasts will be prepared for the October 2022 budget.

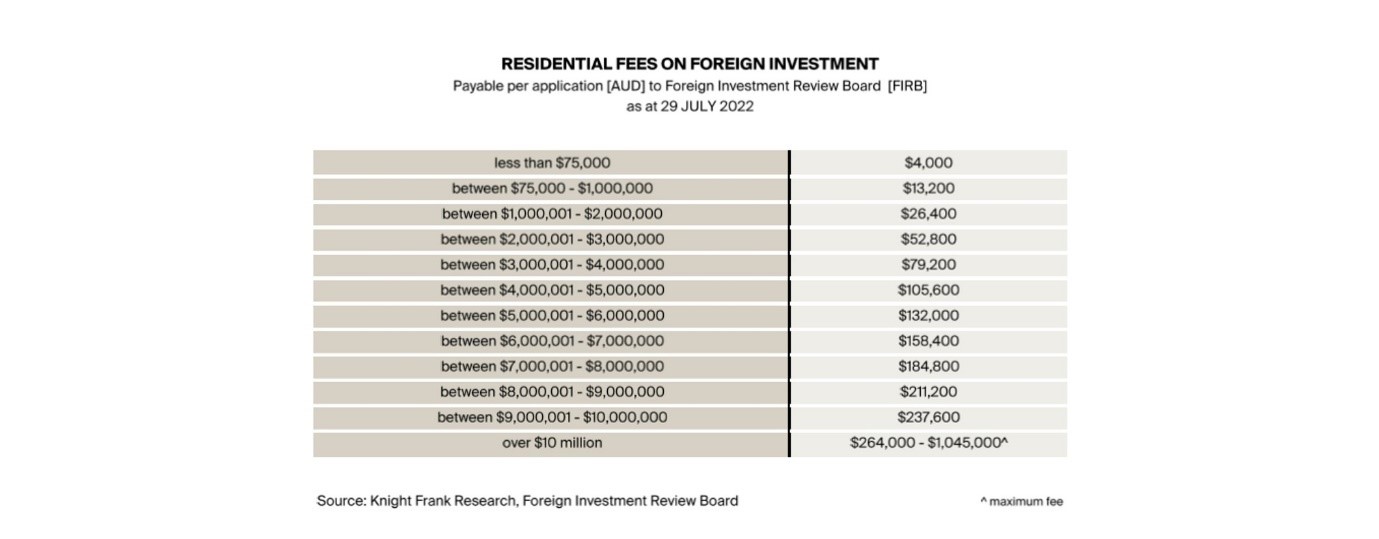

FIRB fees raised for foreign investment as part of Help to Buy housing reform package

Before the spending budget measures are released in October 2022, the government has already followed through on an election campaign commitment—the doubling of Foreign Investment Review Board (FIRB) fees for most foreign investment transactions from 29 July 2022.

This includes the application fees for not only residential land, but commercial land and business acquisitions.

Originally designed to recoup administration costs, the increase to FIRB fees were announced as part of the federal election campaign to combat home ownership affordability within the Help to Buy housing reform package, estimated to raise A$445 million over the forward estimates.

The doubling of FIRB fees follows an already steep increase from 1 January 2021 and is likely to place further pressure on tenants given non-residents are only allowed to buy new properties which add to the Australian residential rental pool.

A summary of FIRB fees is included in the table below: