Madrid’s buy-to-let sector set for growth as regional government says no to nationwide rent cap

With city centre rents recovering following the pandemic exodus and tenant demand set to rise in the next decade investors are taking a closer look at what Madrid has to offer.

2 minutes to read

The hotel industry and buy-to-let sectors are two areas tipped for growth as tourism recovers post-pandemic and Madrid’s burgeoning rental market expands further according to the new Madrid Residential Market Insight.

Regulation

Although the Spanish government’s new Housing Act is set to introduce national rent controls, the Autonomous Region of Madrid has announced it will not implement such measures.

Prior to the Covid-19 crisis, rents in Madrid reached €16 per sq m, a rise of 45% in the five years to 2019. The pandemic saw rents dip 9% to €14.6 per sq m but steady growth is now expected as tenant demand strengthens and the appeal of urban living gains momentum once more.

Sales

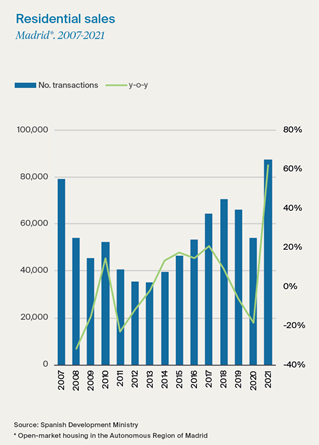

The city saw 87,500 homes change hands in 2021, a 62% increase compared to 2020 and 33% higher than the figure recorded pre-pandemic in 2019.

Nevertheless, the threat of inflation persists, and imminent policy rate rises are likely to weaken buyer sentiment in the coming months.

Luxury prices

Despite the changing economic landscape Madrid’s luxury housing market is forecast to see price growth of 6% in 2022. This follows growth of 46% in the decade to 2021.

Strong wealth creation, the city’s educational offering and its increasing appeal to Latin American buyers as a safe-haven destination are just some of the drivers set to support prices.

The number of ultra-high-net-worth individuals (UHNWIs) in Spain has risen to 11,685 - up 12% from the previous year and is forecast to rise by 59% by 2026 according to The Wealth Report 2022. Madrid is home to 25% of the country’s UHNWIs a figure set to increase 50% over the next five years.

Madrid is now home to 21 international schools and 15 universities, along with a myriad of cultural experiences, consisting of sporting and artistic events, and offers excellent accessibility via Europe’s fifth largest airport, Barajas, with direct flights to over 170 global destinations.

Outlook

Headwinds persist with inflationary pressures and rising mortgage rates leading to deteriorating housing affordability. As a result, the luxury segment is expected to outperform but the key constraint here will be delivering new product due to the construction hiatus during the crisis and resulting supply chain issues.

Read the report here

Sign up to our Spanish research here

Get in touch with Carlos Zamora in our Madrid office to discuss any property requirements you may have.