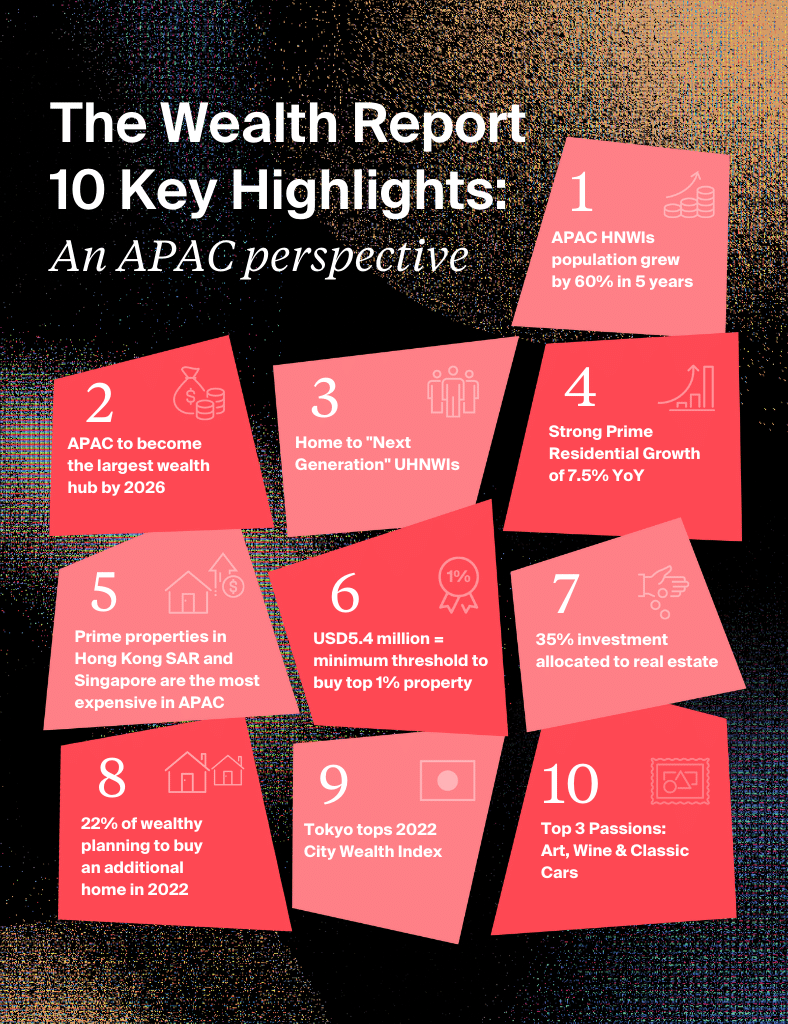

The Wealth Report 2022: 10 Key Highlights in Asia-Pacific property markets

Asia-Pacific is forecast to have the most significant growth in population of high-net-worth-individuals.

3 minutes to read

The Wealth Report is the ultimate guide to prime property markets, global wealth distribution, the threats and opportunities for wealth, commercial property investment opportunities, philanthropy and luxury spending trends. This article breaks down 10 key highlights of The Wealth Report pertaining to the Asia-Pacific landscape.

1. Supercharged Wealth Creation in Asia-Pacific: Between 2021 to 2026, Asia-Pacific is forecasted to experience the most significant growth in the population of HNWIs by 59.8% and UHNWIs by 32.7%, with India, Hong Kong SAR, Taiwan, Australia, and Singapore highlighted as the fastest-growing markets according to The Wealth Sizing Model and The Attitudes Survey.

2. Asia-Pacific as The Largest Regional Wealth Hub by 2026: According to the five-year forecast generated by The Wealth Sizing Model, Asia-Pacific (with 39.6% of UHNWIs) will surpass North America (with 38.6% of UHNWIs) and take the place of the largest regional wealth hub by 2026. Asia alone is projected to surpass Europe as the second-largest regional wealth hub occupying 28.8% of the global UHNWIs as compared to 27.4% in Europe.

3. Asia-Pacific Houses the Largest Number of “Next Generation” UHNWIs: Asia-Pacific houses the greatest number of “Next Generation” UHNWIs (47,932), self-made and under the age of 40, ramping up the demand for more cross-border investments in properties given the more global and tech-savvy nature of this generation. How will this generation disrupt the future wealth trends?

4. Prime Residential Growth Remains Strong in Asia-Pacific: Asia-Pacific Prime Residential growth continues to be strong in 2021, growing by 7.5% YoY, with a stark contrast between the performance of developing and developed markets. Seoul, Gold Coast, Shanghai, and Sydney are part of the top 20 fastest growers in 2021. Interested to find out what is driving the demand?

5. Most Expensive Real Estate in Asia-Pacific: Hong Kong and Singapore continue to be the most expensive real estate in Asia-Pacific due to their land constraints. Did you know that purchasing a property in Mumbai yields 3.05 times more land surface area (in square meters) as compared to Singapore for the same cost?

6. Securing Top 1% of Prime Residential Property in Asia-Pacific: The wealthy population in Asia-Pacific allocates a greater proportion of their wealth to real estate compared to the global population for investment purposes. US$5.4 million to US$7.6 million is required gain access to the top 1% of the residential units in the most expensive Asia-Pacific cities with Beijing having the most expensive entry point followed by Singapore and Sydney.

7. Asia-Pacific UHNWI’s Investment Portfolio Allocated to Real Estate: The Attitudes Survey indicates that 35% of the total wealth of Asia-Pacific’s UHNWI population is allocated to their principal and second homes. New Zealand, the Philippines, and Taiwan rank among the top 3 countries on this list.

8. Top 5 Attractive Destinations for Asia-Pacific’s Wealthy Population: 22% of Asia-Pacific’s wealthy population is planning to buy an additional home in 2022 and Australia, the United States, the United Kingdom, Canada, and Singapore are amongst the top five destinations of interest for this population.

9. Top Ranked Asia-Pacific City: Tokyo is ranked as the top Asia-Pacific city with very high rankings under the “Wealth” and “Lifestyle” divisions according to the 2022 City Wealth Index captured by The Wealth Report.

10. Top 3 Passions of Asia-Pacific’s Wealthy Population: With regards to luxury collectibles, Art, Classic Cars, and Wine rank among the top 3 passions for Asia-Pacific’s wealthy population according to the Luxury Investment Index. What lies ahead for investments of passion?

Dive deeper and discover all the answers by downloading the latest edition of The Wealth Report here.