Parisian retail continues its transformation

Fashion brands are rethinking locations as some begin to reduce Paris footprint.

4 minutes to read

After a positive end to 2021, the situation for Paris's major retail districts improved again in the first half of 2022, despite the threats posed by the global political and economic situation. The upswing in footfall is one of the main reasons for this, with the retail market benefiting from both the return of employees to offices and the recovery in international tourism.

For fashion brands in Paris, the strategy is to optimise their network of stores by freeing up unsuitable locations, without necessarily replacing them with larger ones in Paris. This is the case for H&M, who have expanded their presence in the "Les 4 Temps" shopping centre in La Défense and are preparing the first opening in France of ARKET, their more sophisticated concept over a much smaller surface area in the Marais.

Other historical players in the clothing industry are reducing their footprint in Paris even more drastically, such as C&A, who have scheduled the closure of their two flagship stores, including the one at 126 rue de Rivoli. "As with other projects, these vacancies allow us to rework the existing buildings in favour of projects that reduce the proportion of retail space and offer a mixed-use product that is more in line with market trends and new consumption patterns in neighbourhoods benefiting from high footfall," adds Antoine Salmon, director of the Retail Leasing Department at Knight Frank France.

Accelerated by the pandemic and indicative of the transformation of Paris's main retail districts, the gradual reduction in the share of fashion apparel does not only apply to major specialist chains. While fashion still accounts for the largest share of openings (36% of those recorded over the past year on Paris's leading shopping streets), it is also the source of the most departures (32%), ahead of the accessories sector (20%) and the services sector (16%).

On the other hand, some sectors are opening more stores than they are closing: food and beverage, leisure and household goods to name a few. In this last category, diversity of formats is also the name of the game, with the upmarket CARAVANE project on rue Jacob and rue de Passy contrasting with the upcoming opening of FABRIQUE DE STYLES' first Parisian store at 18 boulevard des Capucines. The development of traditionally suburban retailers can also be seen outside the prime shopping areas, such as the recent and upcoming openings of KIABI, ALDI or AVIV A CUISINES in the 13th arrondissement.

Finally, the transformation of Parisian retail is also highlighted by the abundance of pop-up stores. In luxury areas or in the trendiest neighbourhoods like the Marais, their proliferation confirms the importance of the pop-up store as a communication medium for brands adapting to the evolving consumer profiles and the hybridisation of distribution formats. The numerous collaborations between brands (FENDI/VERSACE, GUCCI/ADIDAS, JACQUEMUS/NIKE, APC/LACOSTE, SWATCH/OMEGA, etc.) are a perfect example of this trend. In other cases, the increase in the number of temporary stores highlights the need for flexibility for retailers who cannot commit to long periods or wish to test the relevance of their retail offer by taking advantage of readjusted rental values.

An uncertain but promising retail outlook

After a lively first half of the year, retail real estate demand does not seem likely to slow down between now and the end of 2022. Despite the war in Ukraine, soaring inflation and the ever-present threat of new variants, tourism remains on a positive trajectory thanks to the gradual lifting of travel restrictions. In addition, the main Parisian retail streets are less exposed than other areas to the spending of consumers travelling by car and suffering the full impact of the sharp rise in fuel prices.

Nevertheless, the recovery will remain very uneven and will continue to benefit primarily the best Parisian locations. If nothing occurs that would freeze the expansion plans of retailers (for example a sharp increase in geopolitical tensions, significant deterioration in the Covid crisis etc.), the next few months should confirm the decrease in vacancy rates and the gradual return of rental values in certain areas to pre-pandemic levels.

Conversely, the less desirable locations will take longer to recover from the shock of the health crisis, with persistently high vacancy rates, movements that sometimes reflect a certain decline in quality, and retailers increasingly affected by the revaluation of indexed rents despite the recent change in the calculation of the national quarterly commercial rent index (ILC).

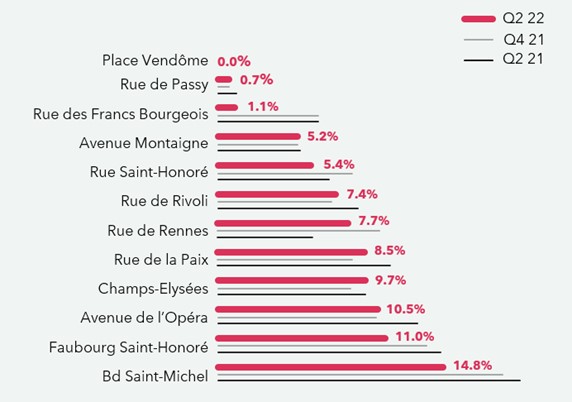

Source: Knight Frank /*Prime section of the street / NB : the rate indicated is for Q2 2022

In the longer term, the outlook is rather encouraging. "The rapid, albeit still limited, return of foreign tourists has shown that Paris remains a destination of choice, while the uptick in spending has confirmed consumers' appetite for physical retail. Without prejudice to the evolution of the global political and economic situation, the recovery could therefore accelerate further thanks to the return of nationalities that are for now still absent, as well as the opportunities linked to the 2024 Olympic Games," concludes Antoine Salmon.