Building green is an evergreen problem

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Net zero slips away

The government is failing to enact policies that will enable the country to hit its net zero targets, particularly when it comes to emissions from buildings, according to the latest annual progress report from the Climate Change Committee (CCC), the government's own climate watchdog.

This all sounds very familiar - see our coverage of last year's report. Existing homes are still the worst culprits. Since last year there has been "limited progress" on policies to improve the energy efficiency of homes. The government's overarching target is for most homes to achieve EPC C by 2035, but "there are no firm policies or consultations in place on how that will be achieved for the majority of housing stock," the group says. A commitment to finalise proposals to increase minimum energy efficiency standards for the private rented sector to EPC C by 2030 is more than a year behind schedule.

Progress on new homes also comes in for criticism. The government's response to the Future Homes Standard consultation confirmed that the standard will require both low-carbon heating and high levels of efficiency in new homes from 2025. However, the interim building standards intended to help manage the transition can be met without low carbon heating, the group says, and can instead be met with high efficiency and solar PV.

The journey to credibility

It doesn't stop there, and the shortcomings are too numerous for this note. Proposals to introduce a performance-based rating scheme for large commercial buildings and to require a minimum of EPC B by 2030 come in for praise, however no progress has been made on that since last year.

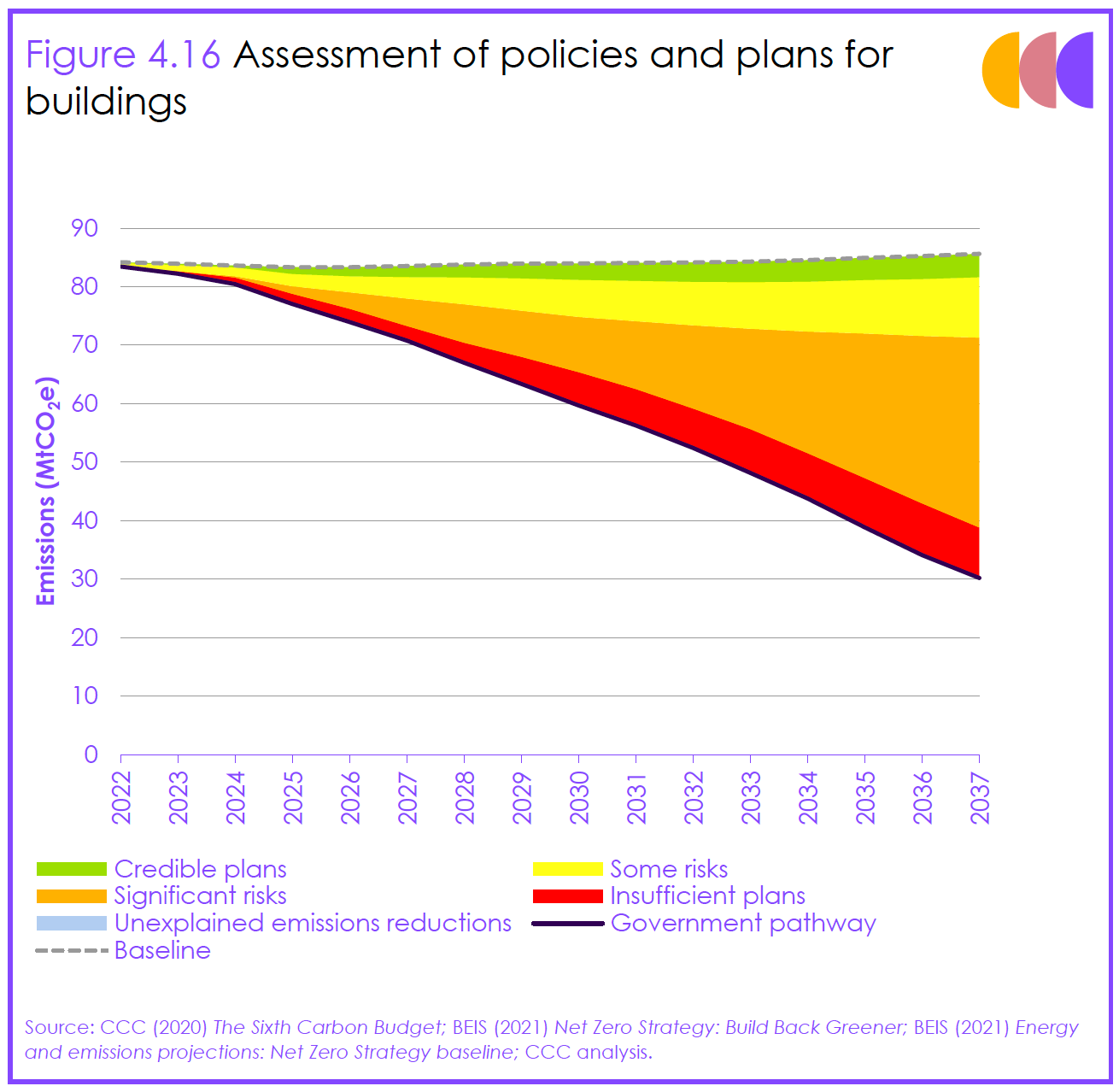

The chart below says it all. The solid black line represents the government's pathway to net zero and the dotted black line represents the baseline. The green pathway is covered by credible policies introduced and implemented. The rest are gaps, the most significant of which relate to energy efficiency in existing homes. There are policies in most other areas, but they have "significant" delivery risks.

Sorting this out is going to be hugely expensive for whoever foots the bill. Whichever combination of public subsidy and private financing is going to be painful. The CCC wants the government to outline a "comprehensive vision" for how it intends to leverage private financing for retrofitting:

"Plans should be designed to operate in tandem with the other enablers needed to unlock home retrofit at scale, such as better buildings data and public engagement. Financial levers to consider include green stamp duty, green mortgages, energy as a service, property-linked finance and using the UK Infrastructure Bank to de-risk retail investment into home retrofit."

Cooling

Annual UK house price growth slowed to 10.7% in June, from 11.2% in May, according to the latest data from Nationwide.

Most regions saw a slight slowing in growth over the course of the quarter. The south west overtook Wales as the strongest performing region, while London remained the weakest.

Here is Knight Frank head of residential research Tom Bill on those numbers:

“The rate of inflation is fast catching up with UK house price growth, which stubbornly remains in double digits. How can house prices rise to such an extent during a cost-of-living squeeze? The answer is that they are both increasing largely for the same reason – a supply chain disruption.

"Property listings are rising as more sellers sense the market is peaking, but it will take time to filter through to prices. We expect UK price growth to end the year at 8% before slowing further in 2023 as supply and demand rebalance and higher mortgage rates increasingly put the brakes on exceptionally high levels of demand.”

Rents

House price growth is set to moderate, but what about rents?

Rental growth is at a multi-year high across the UK, in part due to an ever-deepening mismatch between supply and demand. Knight Frank’s research shows the number of properties available to rent during Q1 2022 was over a third lower than the five-year average pre-pandemic. At the same time demand from tenants is rising. The shortfall iis outweighing any potential drag on values caused by the soaring cost-of-living, so upwards pressure on rents is expected to continue for the time being.

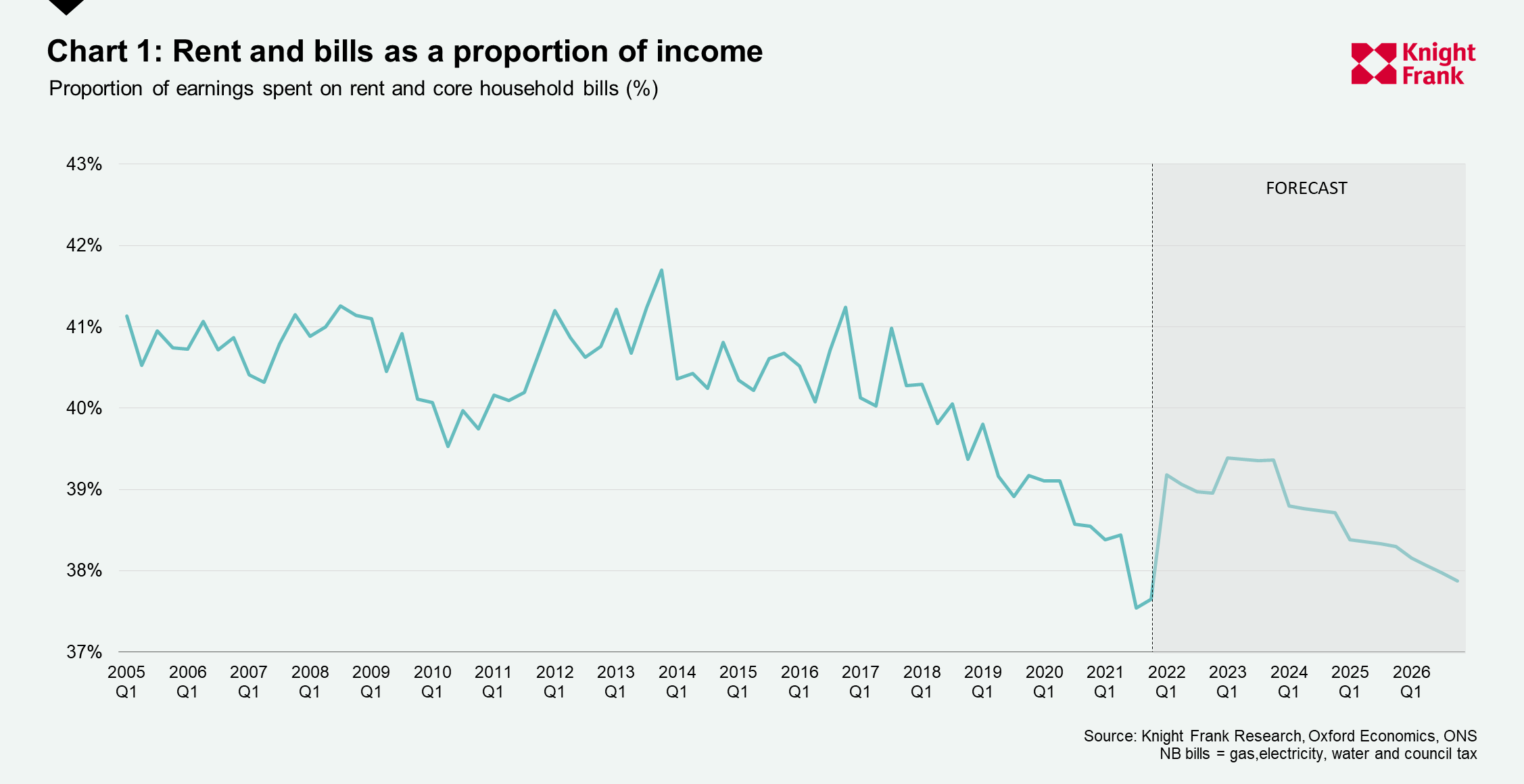

Strong wage growth relative to rents in recent years has been a contributor, and the proportion of earnings spent on rent has been steadily declining in recent years (see chart). Our research indicates that the average household spent 37.5% of their pre-tax income on rent and bills in 2021, down from a high of 42% in 2013. This figure, however, is expected to rise; Knight Frank forecasts that the proportion of earnings spent on rent and bills will spike at close to 40% in 2022 and 2023. Add in the prospect of rising food and transport costs on top, and there is the potential for affordability to be pushed to less sustainable levels.

Given the current climate, many clients are asking us if there is headroom for rental outperformance. Mapping both base case and high growth scenarios paint two slightly different pictures - click here for more.

Seniors housing

One in four people in the country will be over 65 by 2037.

Local authorities are responding to this when it comes to appropriate housing, but they are moving at a slow pace. Our latest research, produced in partnership with law firm Irwin Mitchell, found that three-quarters of councils across England are yet to adopt specific planning policies and site allocations addressing seniors housing.

By overlaying key demographic and economic indicators onto the planning policy data, we can identify areas of the country where the data suggests there are the greatest prospects for seniors housing to develop.

Our top tier local authorities for private seniors housing development include Kensington & Chelsea, Tunbridge Wells and Guildford, which have all seen a combination of strong seniors population growth, high levels of housing wealth and have a healthy future pipeline. See the full analysis for more.

In other news...

Which Cities in Asia-Pacific are most sustainable? Find out here.

Elsewhere - UK consumer activity slowed in mid-June (Reuters), US consumer spending weakens (NYT) as pessimism about the economy grows (NYT), London City airport looks to expand to meet post-Covid recovery (FT), what the energy efficiency drive means for UK property rentals (FT), and finally, the Singapore property boom continues (Bloomberg).