Inflation at 40-year high

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Inflation

The UK's official measure of consumer price inflation hit an annual rate of 9.1% in May, according to data out this morning. That's largely flat on April's reading, which is still the highest rate for 40 years.

The scope and pace of rising interest rates will be the key influence on the performance of the housing market over the coming year. Speeches from Monetary Policy Committee member Catherine Mann and Bank of England chief economist Huw Pill pull back the curtain on some issues of contention within the Bank.

Mann, who voted for a 0.5% hike at the most recent meeting, argues that the UK's path of interest rates needs to better mirror that of the aggressive approach of the US Federal Reserve. If it lags too much, the pound weakens significantly relative to the dollar, raising the cost of UK imports and further fuelling inflation. Pill takes the opposing view, though he reiterated the Bank would act more aggressively should inflation prove more sticky than the Bank's current forecasts.

Meanwhile, robust levels of housing market activity continued through last month, according to official figures published yesterday. UK property sales were 18% above their five-year average in May – or 9% if you remove 2020.

30-year mortgages

Earlier this month the government announced a string of UK housing policy announcements, few of which were very compelling. A review of the mortgage market, due back in the autumn, was the exception, and Bloomberg appears to have some of the details that were missing at the time:

The Department for Levelling Up, Housing and Communities will consider 30-year fixed rate mortgages, debts worth almost 100% of the property and ways to blend renting and owning a property...

Longer-term fixed rate mortgages are a small part of the UK mortgage market that has so far remained small because the rates often aren't particularly attractive, so it will be interesting to see how the government attempts to tackle that.

Elsewhere in mortgage market policy, the Bank of England on Monday withdrew a compulsory mortgage market affordability test. It's more of a tidy up than a move to free up meaningful amounts of lending. Here is Knight Frank Head of Residential Research Tom Bill on that:

“This particular stress test came to the end of its useful life as interest rates began normalising. Other restrictions remain in place and we are not about to witness an era of exuberant lending. More flexibility in the mortgage market will help sustain demand, including first-time buyers, as the cost-of-living spikes and house price growth retreats.”

US housing

US existing home sales fell 3.4% in May compared to a month earlier and 8.4% compared to the same month a year earlier, according to National Association of Realtors data out yesterday.

That leaves activity roughly where it was back in 2019, before the onset of the pandemic. The group expects sales to slow further over the coming months as mortgage rates rise. Data from Freddie Mac shows mortgage rates climbed the most in a single week since 1987 following the Fed's decision to hike the key interest rate by 0.75%.

Total housing inventory registered at the end of May was 1,160,000 units, an increase of 12.6% from April. That would need to rise substantially – almost doubling – to cool home price appreciation, according to the group's chief economist Lawrence Yun.

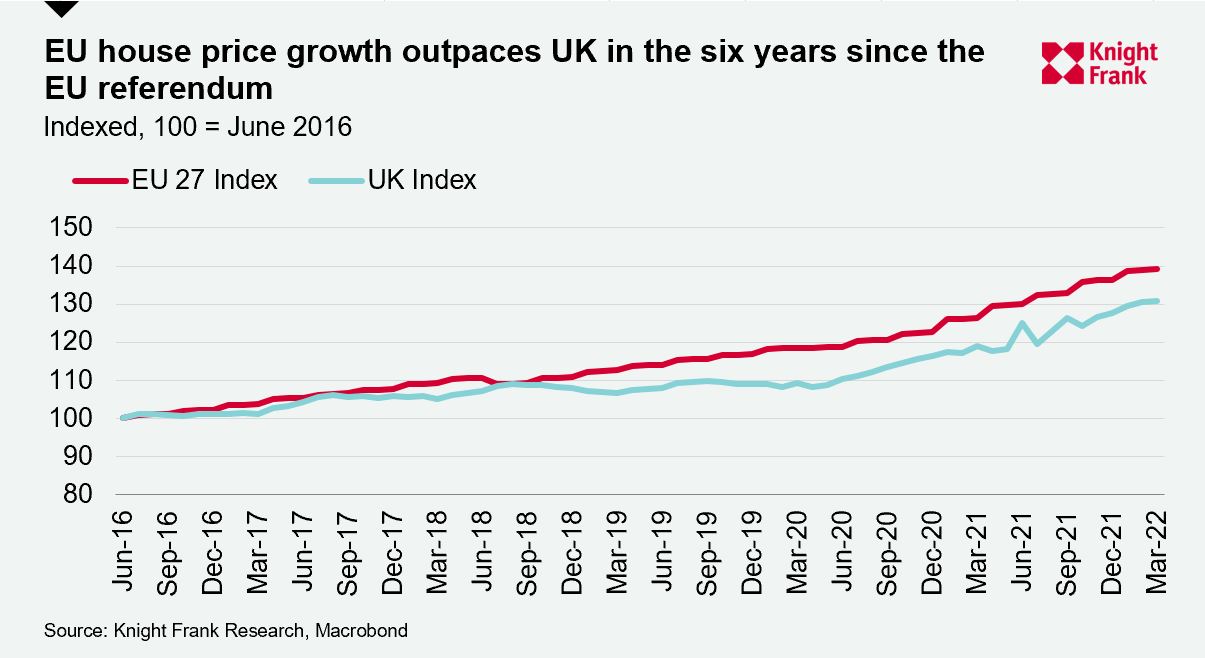

Brexit

Tomorrow marks the sixth anniversary of the Brexit referendum. Kate Everett-Allen tallies the data to see how the UK and Europe’s housing markets have fared in the intervening period.

In other news...

Spanish hotel investment bounces back.

Elsewhere - UK pay deals hold at 4% as inflation steams ahead (Reuters), Singaporean fund GIC strikes €2.1bn deal with The Student Hotel (FT), and finally, Goldman Sachs on the likelihood of a US recession (Bloomberg).