Will inflation eat itself?

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Fighting inflation with inflation

The US Federal Reserve took a big 0.75%-sized swing at inflation on Wednesday, prompting plenty of speculation the Bank of England might follow suit.

It wasn't to be. The Monetary Policy Committee (MPC) yesterday voted for another incremental 0.25% hike to 1.25%, despite the fact that it believes inflation is likely to surpass 11% in October. Three members of the committee voted to hike by 0.5%, so there is clearly more to come.

Quite how much remains a point of contention. The BoE still takes the view that inflation is now so bad that it will eat itself, which strikes at the core of the differing approach to the Fed. Economic growth will continue to weaken, the unemployment rate will tick up to 5.5% in three years' time and energy prices will fall back, all of which means inflation will drop back to a little above the 2% target in two years’ time before dropping "well below" it in three years' time. That's according to MPC projections published last month.

Since then consumer confidence has weakened further and GDP has come in below expectations. The Bank now expects the economy to contract 0.3% in Q2, hence the continued incremental approach to rate increases.

Cooling

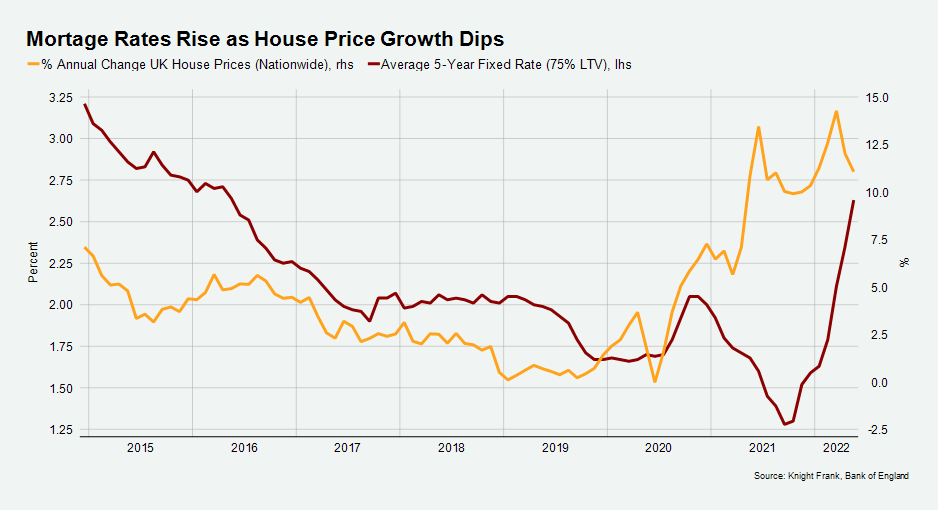

We can expect mortgage rates to continue rising in the near term (see chart 1). Here is Simon Gammon of Knight Frank Finance speaking to the Evening Standard: -

“Lenders are repricing their product lines rapidly, often as much as twice a week. All are swamped with applications to remortgage, so are repricing both because interest rates are rising and because nobody wants to be the cheapest on the high street for fear of being overwhelmed."

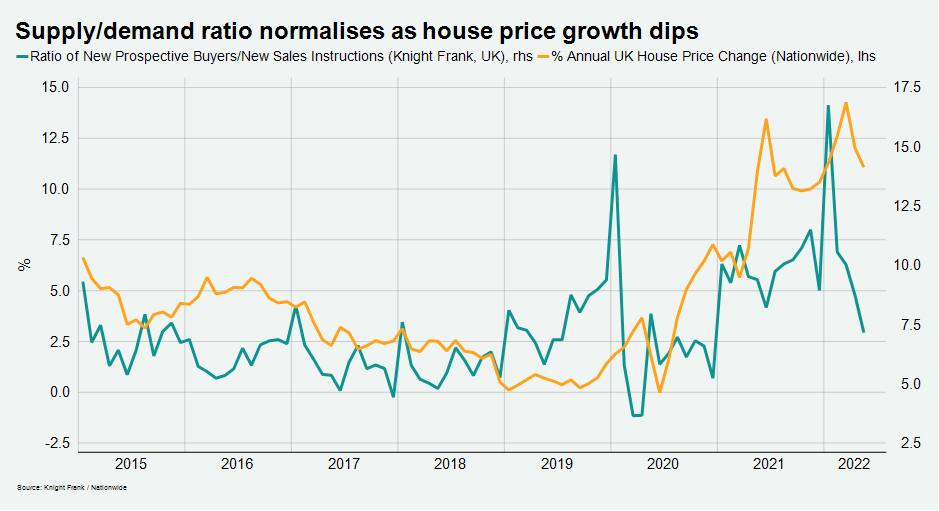

May's increase in the base rate prompted more sellers to come forward, which to some extent eased the chronic shortage that has been the market's dominant theme during the past twelve months (see chart 2). We can expect more of the same this month - see this detailed analysis from Tom Bill. Here is Tom:

“The latest interest rate rise will accelerate the process of normalisation taking place in the UK housing market. Unlike other parts of the economy, we don’t expect decades-old records to be broken in the property market and prices will continue to drift back down to earth after the distortions of the pandemic.”

US mortgage rates

The Fed's aggressive approach had an immediate impact on US mortgage rates, which this week rose the most since 1987. The latest from Freddie Mac has the average 30-year rate at 5.78%, up more than half a percentage point compared to a week ago.

Projections published by the Fed on Wednesday suggest that interest rates could hit 3.4% by the end of the year before peaking at 3.8% at the end of next year.

Most indicators show the housing market cooling. Mortgage applications for new home purchases fell 5% in May compared to a year ago, according to Mortgage Bankers Association data out yesterday. Existing home sales contracted 2.4% in April, the third consecutive fall, according to the National Association of Realtors. Pending home sales have fallen for six consecutive months.

Rents

Landlords are to be prevented from evicting tenants in England without giving a reason, under proposals published in a government White Paper. The Renters Reform Bill will also end blanket bans on benefit claimants or families with children - and landlords must consider requests to allow pets.

The government has also promised tenants stronger powers to challenge poor practice and unjustified rent increases and the Decent Homes Standard will also be extended to the private sector.

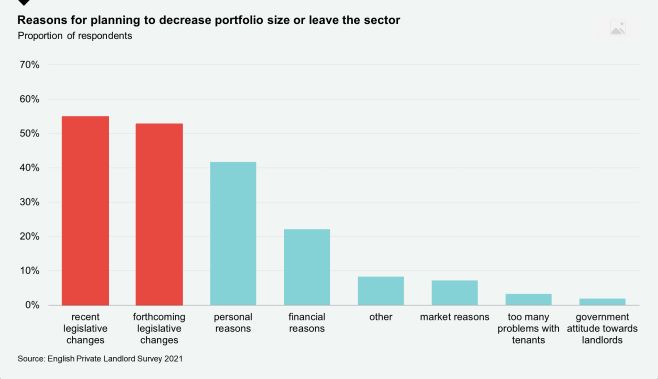

This is all sensible, but setting aside the merits or otherwise it is clear that regular legislative changes and increased regulation are contributing to a shrinking of the sector. The English Private Landlords Survey published last month, found that, among those considering leaving the sector or rationalising their portfolios, recent and forthcoming legislative changes were the most cited reason for doing so (see chart).

Demand is strong among renters and stock is shrinking, which is one of the many reasons we are bullish on the outlook for Build to Rent. We expect that residential investment volumes, which includes the student housing, BTR and seniors housing sectors, will top a record £16.5 billion in 2022, a notable increase from the £10.2 billion spent in 2021.

The Great Resignation

Large numbers of older workers (those aged 50-69 years) opted to leave the workforce during the pandemic. There were an extra 270,000 economically inactive 50-69 year olds during the six months to March compared to the same period two years earlier, according to new research from the Institute for Fiscal Studies.

The group doesn't put that down to poor health or demand, rather people have en masse opted for retirement as a lifestyle choice. That presents a particular problem - retired people are less likely to return to work than people (of the same ages) in other forms of inactivity. Indeed, they are unlikely to ever return to employment – previous research has found that only 5–10% of retired people ever return to paid work.

The construction sector, like many others, has been acutely impacted by the trend and the looming skills shortage looks set to be a drag on activity over the coming years. New figures from the Construction Skills Network suggest that more than a quarter of a million extra construction workers may be needed by 2026 if demand is to be met. Private housing, infrastructure and repair and maintenance are likely to be the worst affected sectors.

In other news...

Law firms snap up London’s prime office space.

Spain's rental accommodation growth is amongst the fastest in Europe.

Film & TV Studios - a spotlight on the M4 Corridor.

Our latest monthly housing market update.

Elsewhere - real estate billionaire says recession will draw people back to the office (Bloomberg), and finally, London landlords agree merger for £5bn West End properties (Times).