The Davos downgrade, rate hikes, and globalisation

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

The Davos downgrade

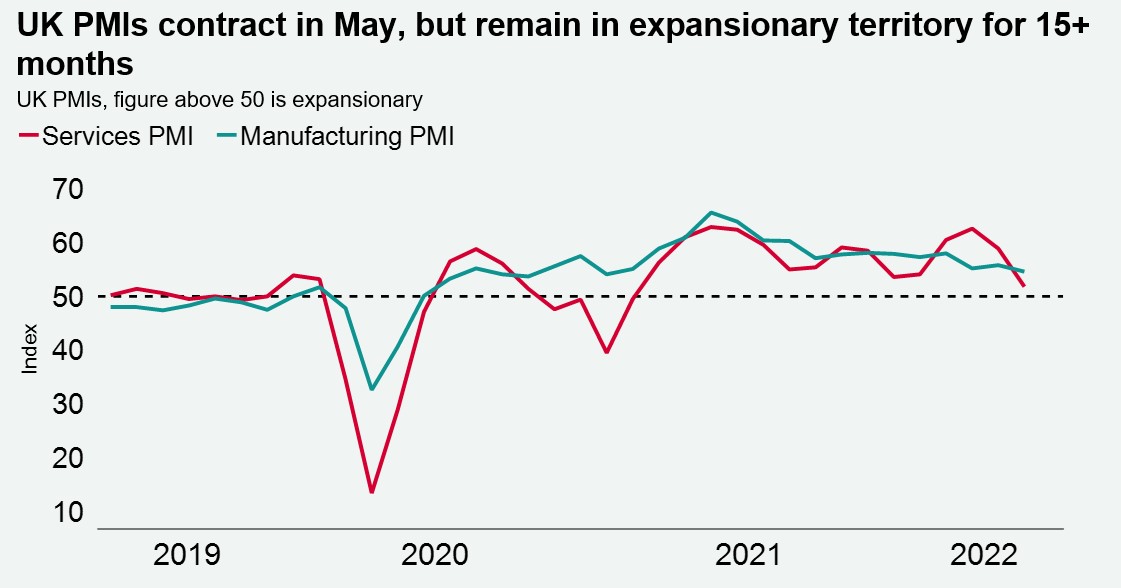

The IMF has used this week’s summit of global leaders to highlight further ‘incremental changes’ to its recent downgrade of global GDP growth forecasts. It cites the tightening of financial conditions, the rise in the value of the dollar and a ‘slowdown in China’. Despite this, the fund has stated that it does not expect a global recession. The latest consensus forecasts for the UK paint a similar picture, but with its recent strong labour market performance, robust retail sales figures and continued expansion in services and manufacturing, the outlook is also for a slowdown, rather than recession, this year.

More rate hikes ahead?

The US Federal Reserve is widely expected to hike rates by 50bps at both of its next meetings in June and July. Meanwhile, the European Central Bank has stated that it will increase rates by Q3 2022, a far cry from its earlier position which ruled out rate rises in 2022. The potential for further interest rate rises in the UK has been well-documented. What do rising interest rates mean for commercial real estate? Our analysis indicates a significantly lagged impact on property yields, with swap rate increases taking up to three years to fully affect asset prices, dependent on the sector in question.

The end of globalisation?

Well, not for real estate. Deglobalisation, another Davos theme, draws on recent supply chain disruptions, ‘on-shoring’, ‘near-shoring’ and even more recently the ‘friend-shoring’ movement. It is a complex and nuanced topic but for commercial real estate at least investors continue to allocate capital overseas. $72bn has been invested in overseas commercial real estate since the start of the year, a 2% increase on the same months in 2020 and 2021. Cross border investment into the UK has totalled over £10bn YTD, which equates to a 5% increase over the same period last year and an 11% increase on the first five months in 2019 and 2018, with a week still left in the month.

Download the latest dashboard