Australian outlook: top five residential property market trends

Michele Ciesielski, head of residential research, Knight Frank Australia, takes the pulse of the Australian residential property market in five charts.

4 minutes to read

Australians will be going to the polling booths on May 21st, 2022, for the upcoming federal election. Inherently, many investors hesitate making major decisions in the lead up to an election, including the trading of residential property.

Traditionally, these cooler months of the year create a lull for real estate transactions across the country, but the timing of this election has also coincided with a decline in activity across the Australian residential property market following 18 months of exceptional double-digit price growth.

Over this time, accumulated investor savings were injected into a housing market with historically low interest rates, government stimulus and a diminishing delivery of newly constructed homes.

The following five charts take the pulse of key indicators across the Australian residential market.

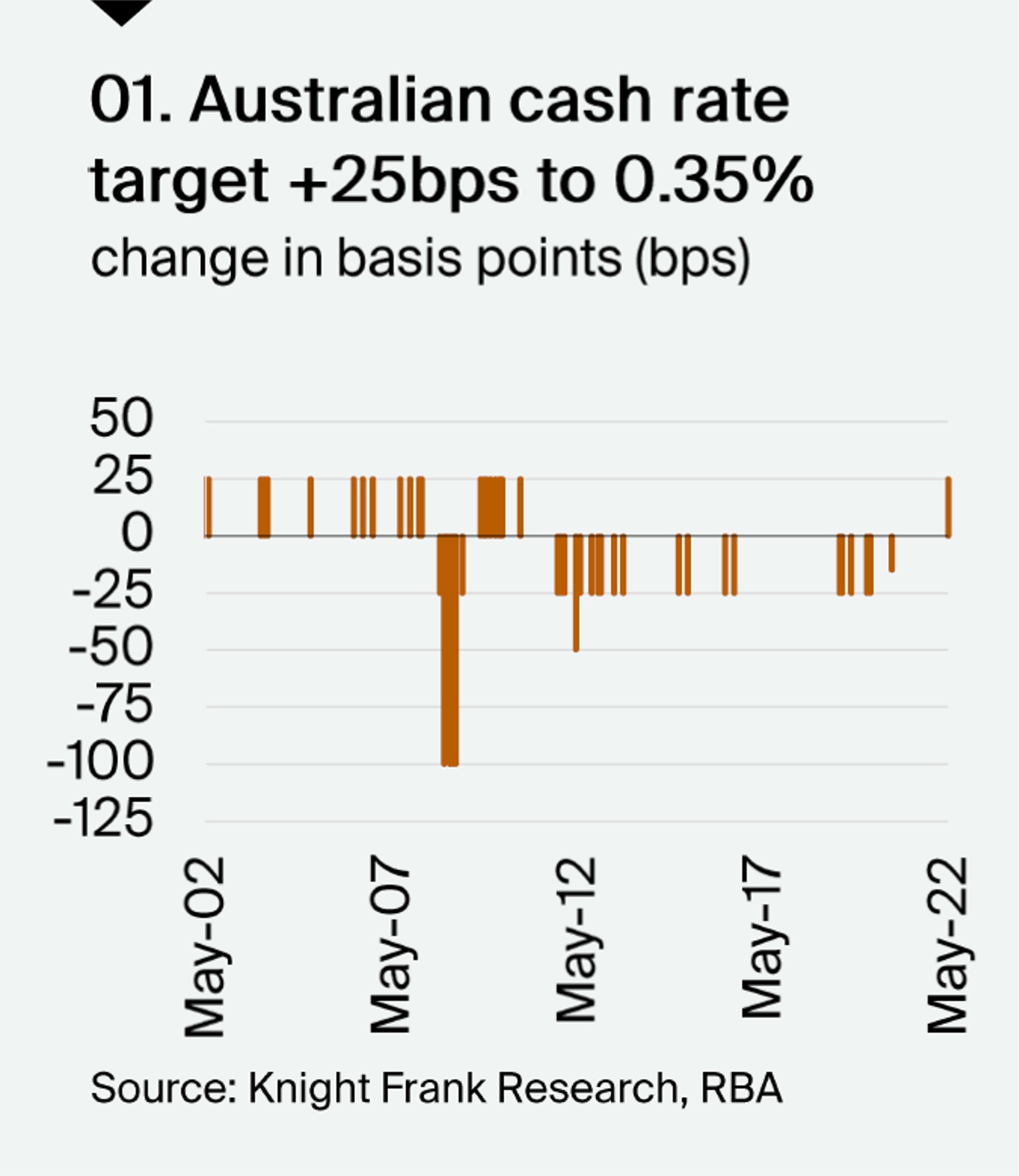

Australian cash rate target raised 25bps to 0.35%

To combat recent higher than anticipated inflation figures, the Reserve Bank of Australia on May 3rd 2022 ‘judged it was the right time’ to lift the official cash rate by 25 basis points, to 0.35%, to be the first rate rise since November 2010.

Many financial institutions over the past year had already commenced lifting mortgage lending rates and have been adhering to a more responsible lending environment as domestic investors returned.

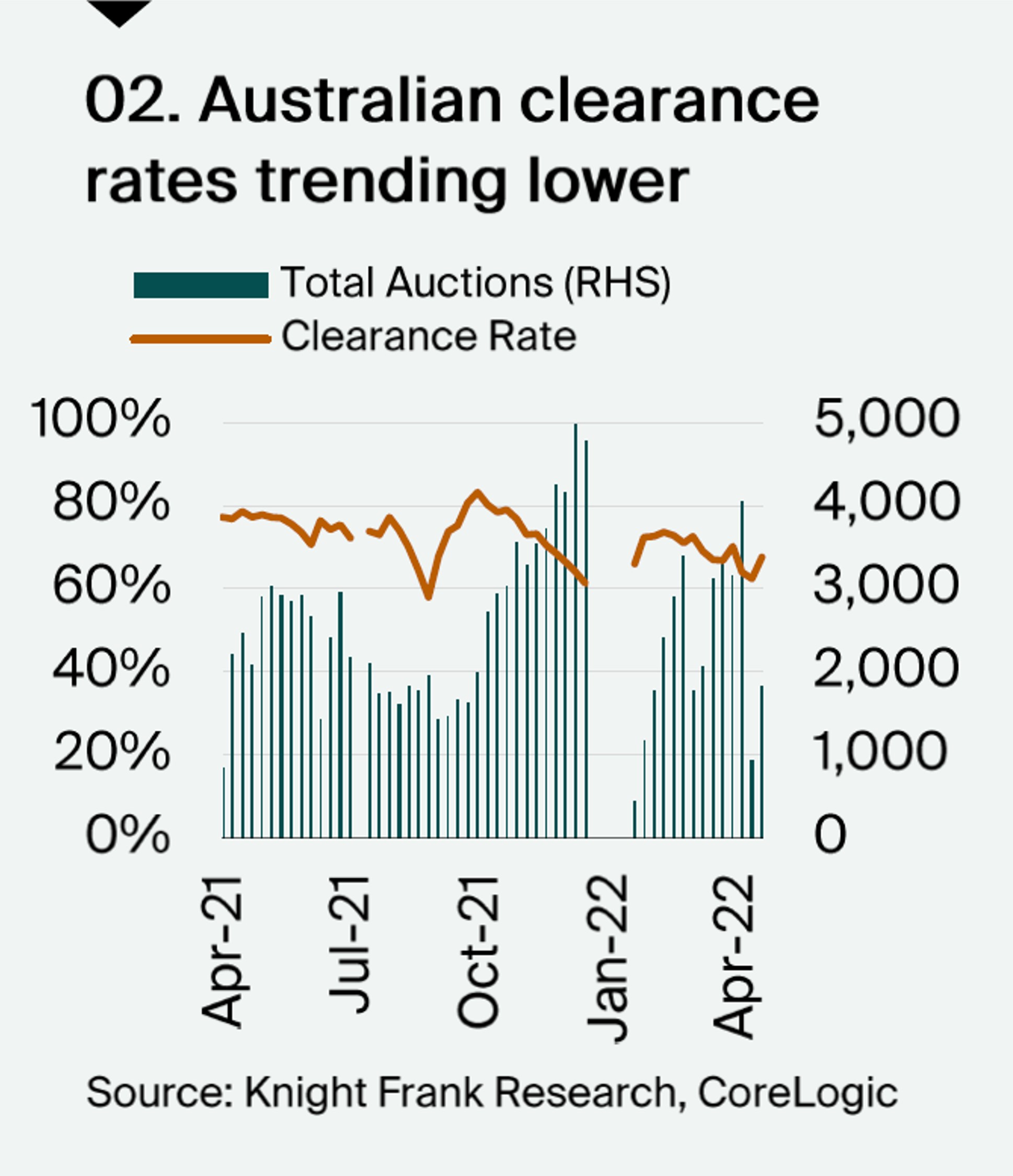

Clearance rates trending lower across Australia

The clearance rate of weekly auctions tends to be a good first indicator for the general direction of sales activity about to happen, and then consequently, capital values.

The first four months of 2022 has recorded a slowdown in auction activity across most of the major cities, with an average clearance rate of 69.1% from a total 32,306 auctions—skirting the aspirational 70% mark.

By comparison, this was trending below the 79.1% achieved in the first four months in 2021 (25,336 auctions), and the 73.2% in the last four months of 2021 (from 49,092 auctions).

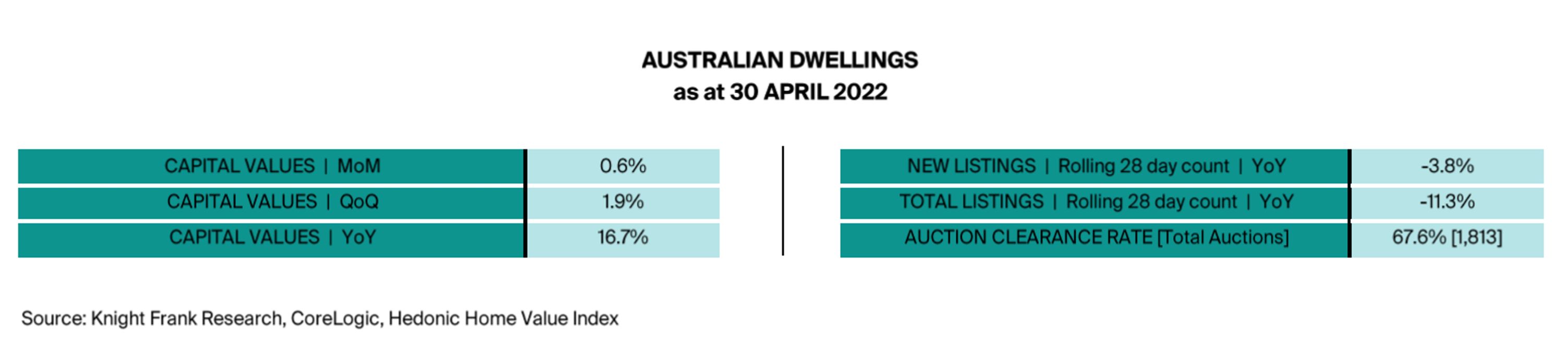

Following 0.7% growth in the month of March 2022, Australia’s dwelling price growth has also reduced speed. CoreLogic recorded 0.6% growth in the month of April 2022, although overall, the market is still 16.7% higher than one year ago.

Australia’s share of first home buyers shrinks

First home buyers (FHB) saw a narrow window of opportunity in the middle of 2020 to buy their first property as values subsided across Australia.

In the months that followed, many FHB were encouraged by HomeBuilder, a government initiative intended to support confidence in the residential construction sector within the COVID-19 stimulus package. At this entry level of the market, investors then returned and once again, FHB became priced out.

By the end of 2021, we saw the share of first home (owner-occupier) buyers shrink to 29% of all Australian owner-occupier new loan commitments, after rising to 36% in 2020, to now be below the end of 2019 marker of 31%.

To address the housing affordability conundrum, last month we saw the Budget extend the First Home Guarantee Scheme, in addition to, a new Regional Home Guarantee Scheme and the extension of the Family Home Guarantee, then subsequently increase the house price caps by $100,000 in major cities and substantial ‘Rest of State’ state cap increased around the country.

In response, the opposition government have said if they were to form government, a Help to Buy shared equity scheme (capped at 10,000 places) would be introduced.

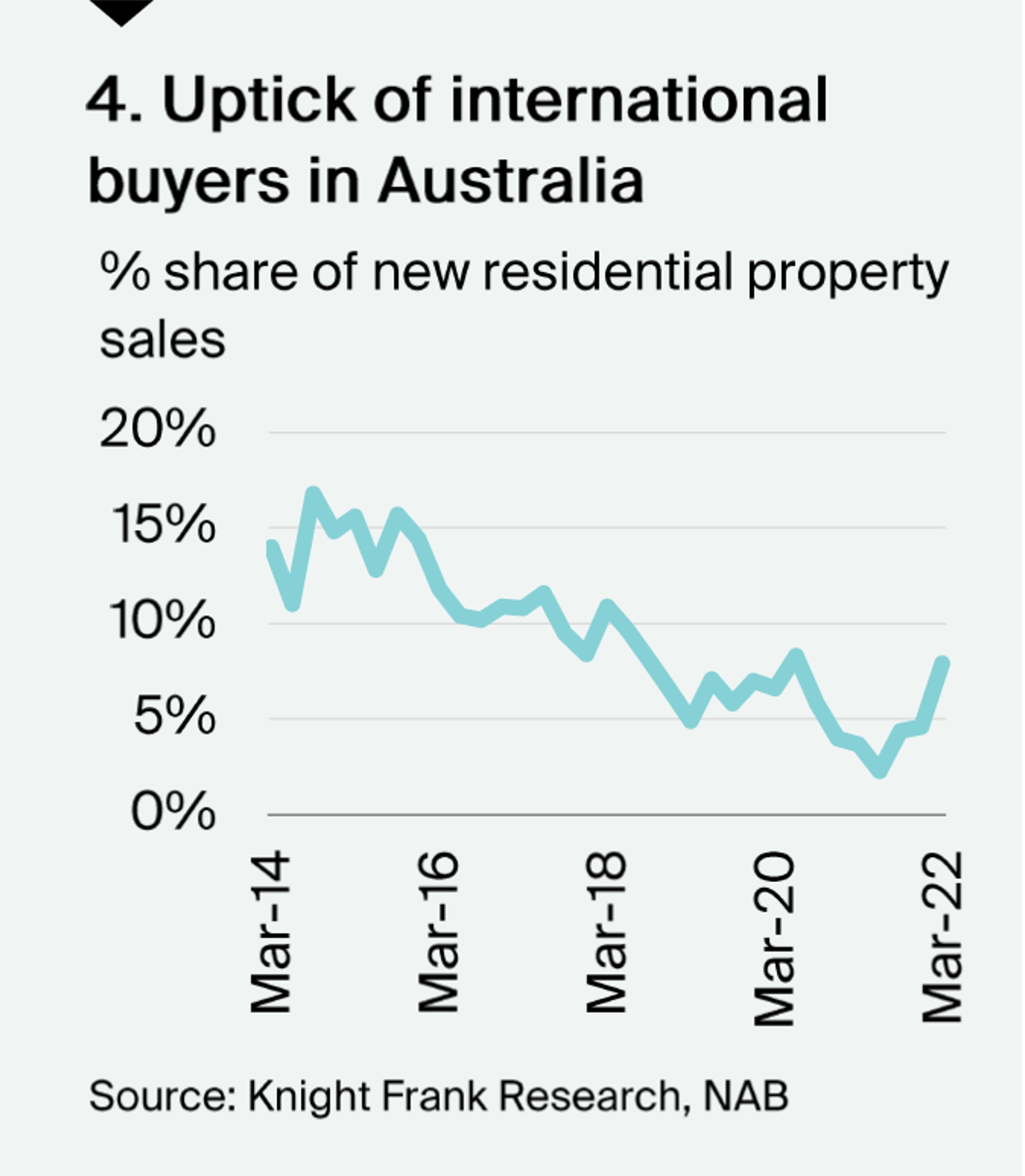

Uptick of international buyers in Australia

The Australian government continues to encourage foreign investment into the residential property market and haven't proposed any changes to the Foreign Investment Review Board application process framework.

The opposition government on the other hand, in order to pay for their proposed housing affordability policies, plan to double foreign investment application fees and financial penalties from July 2022.

This is aptly timed given the return of international buyers with their share of new residential property rising to 7.9% in March 2022, following the reopening of borders in late 2021. One year ago, this was a share of 3.7%.

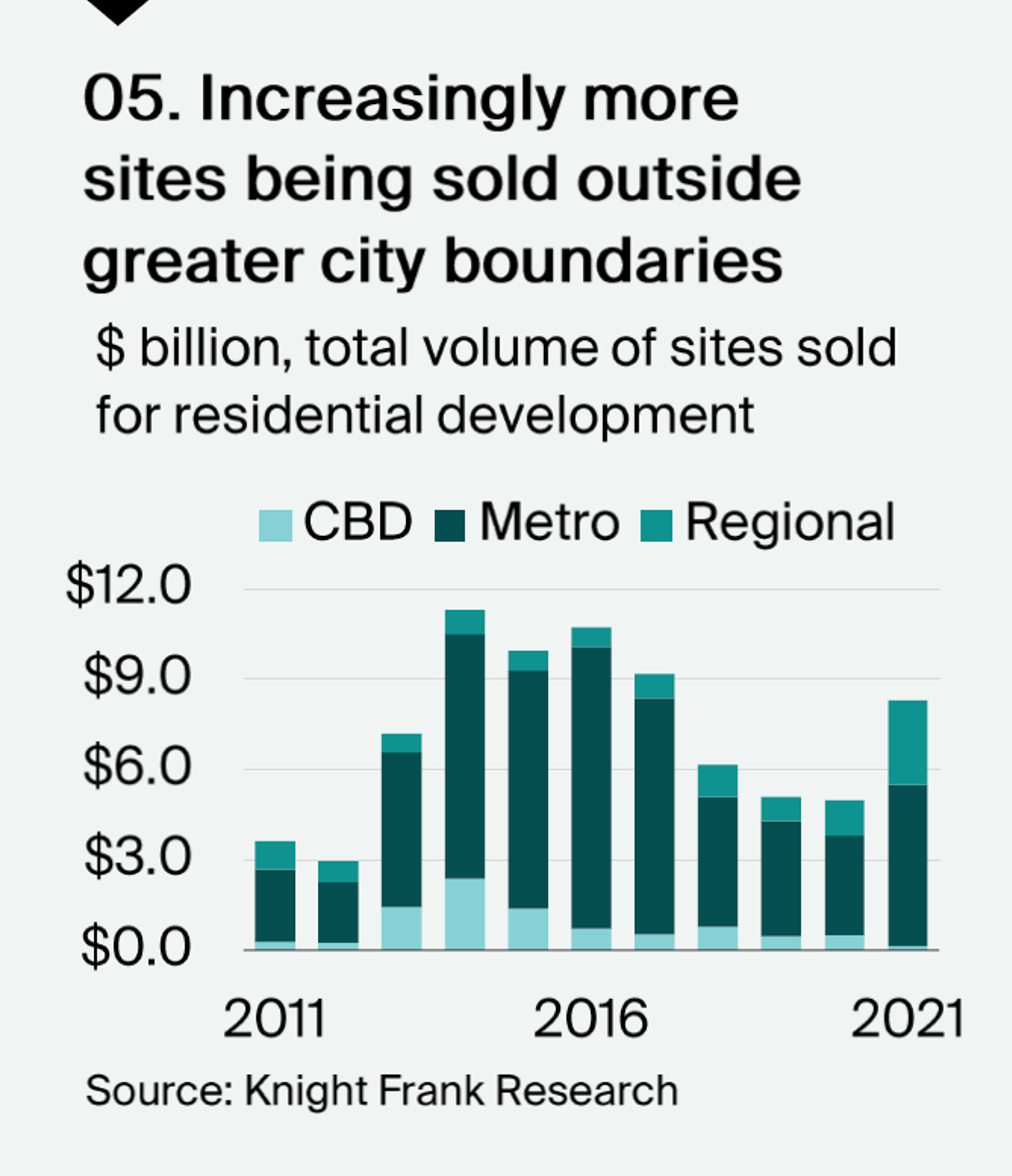

Increasingly more sites being sold outside greater city boundaries

Australia’s housing supply is forecast by NHFIC to decline markedly in coming years with 163,400 homes short of demand between 2025 and 2032.

This follows several years of declining new residential sites being purchased by developers, although in the past year, increasingly more low-density sites have been sold on the outskirts of the greater city boundaries, anticipating the creation of more affordable options for homebuyers.

Although there are pricing challenges ahead for developers and buyers alike, with ongoing escalation in construction costs impacting project delivery and extended weather events further delay construction days on site.

Outlook

With the cash rate expected to rise multiple times over the coming year to combat higher inflation, it’s not yet known how much rising mortgage lending rates will impact consumer sentiment after being a low risk factor for more than a decade.

As sales activity slows, it’s inevitable we will continue to see price growth respond accordingly. Although this is likely to be a short-lived correction as the supply of new home delivery is expected to diminish considerably over the coming years across most of Australia.

Sign up to receive regular international content