The global housing boom slows

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

The slowing global boom

Australia's central bank yesterday raised its key interest rate by 25 basis points to 0.35%, its first hike in a decade. Officials flagged there would be more to come and futures markets quickly priced a move to 0.75% in June and a string of hikes to 3.5% by the middle of 2023, according to Reuters.

House prices across the country are up 17% year-on-year but both price growth and sales rates are slowing across most major cities, according to this analysis from Michelle Ciesielski. The average clearance rate at auction dropped to 69% during the first four months of the year, down from 79% a year earlier.

There is a high degree of symmetry among the world's major housing markets as central banks clamour to get a grip on inflation. US house prices are up 15% in the most recent twelve months, but existing home sales have now slowed for two consecutive months, according to the National Association of Realtors.

We are witnessing what will be a slow and drawn out end to the pandemic-era housing boom, one that has generated an incredible $6 trillion in housing wealth for American homeowners, according to the Federal Reserve. The Fed is expected to raise the key interest rate by an eye watering 50 basis points later today.

Inflation

Whether or not the Bank of England will follow suit on Thursday is the talk of the City. A hike looks like a sure thing, so much so that Halifax jumped the gun with its announcement on how its customers would be affected yesterday.

Six of the nine members of the Times's Shadow MPC would vote for a 50 bps hike to 1.25% if they were in the hot seat, and economic indicators published during the most recent 48 hours will do little to calm speculation that the Bank is poised to take a more aggressive approach.

More than 60% of UK manufacturers raised prices in April amid the soaring costs of energy and raw materials, the highest reading on record, according to the S&P Global/CIPS manufacturing Purchasing Managers’ Index. Meanwhile British Retail Consortium data reveals that retailers raised prices by the most in a decade last month.

Retail

Inflation is a major headwind for retailers in terms of higher operating costs and rising input prices, and a number of the major operators have already warned on profits for the coming year. However, the mood is one of cautious optimism, writes Stephen Springham.

Inflation is far better for the retail sector than deflation and could actually prove a force for good if it prompts a return to more ‘honest’ pricing as opposed to relentless promotions and discounts, he argues.

Retail real estate hit the bottom during the pandemic and is now on an upward cycle, albeit a very gradual one. Growth in capital values accelerated over the quarter (January +0.6%, February +0.9%, March +2.9%). All retail asset classes are now in positive growth territory, including shopping centres for the first time since January 2016.

Rental growth hit 0.2% in March, predominantly led by growth in retail warehousing (+0.4%) but there are also encouraging signs of stabilisation on both high streets and shopping centres.

Jobs

Last month's payroll data from the ONS revealed that average pay increased 6% in March compared to a year earlier. Wages are now 11% higher than at the outset of the pandemic.

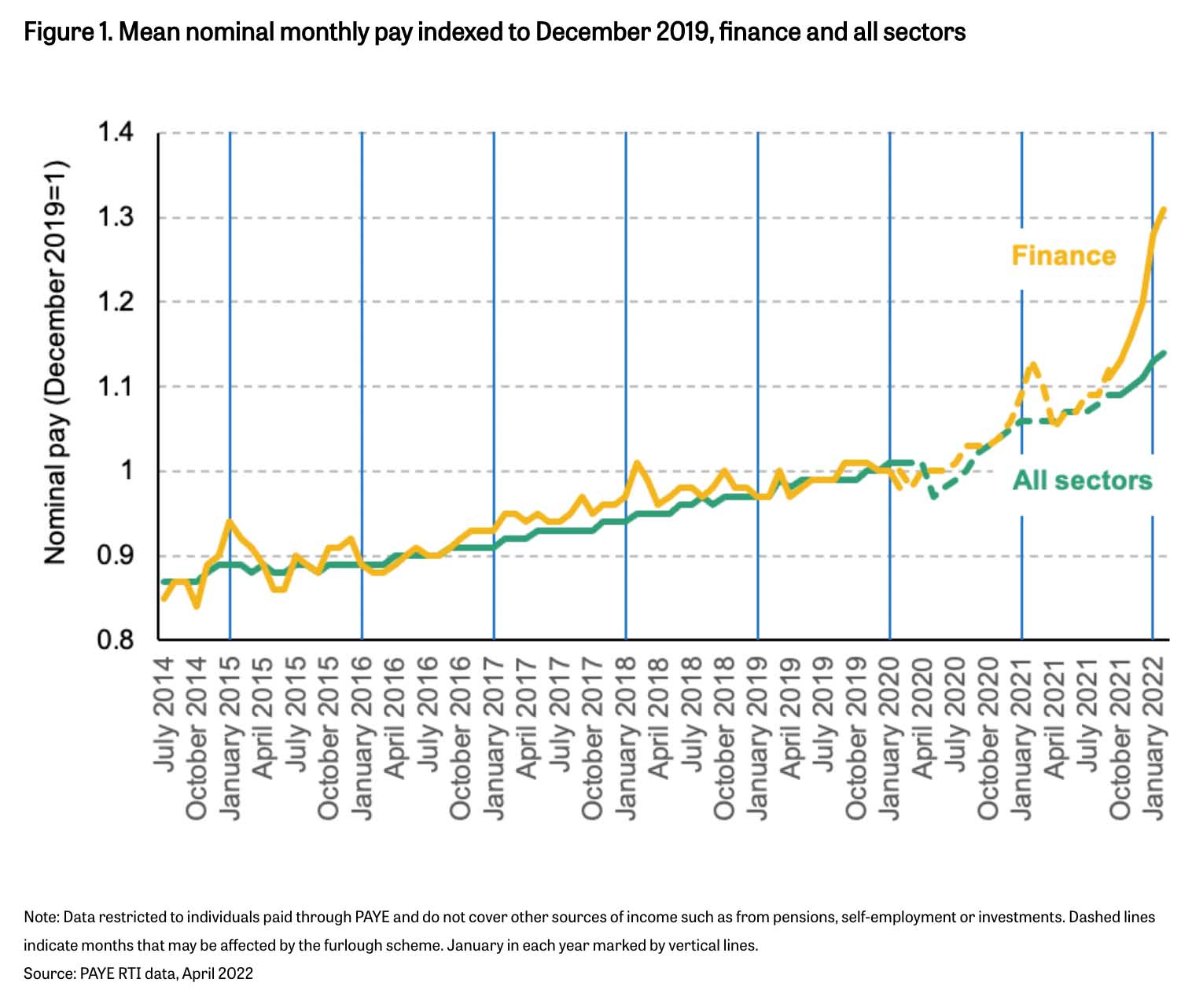

There have been inklings that growth was particularly strong in the finance sector - see the run on champagne during bonus season - but new analysis of the ONS figures by the Institute for Fiscal Studies confirms that financial services sector wages are pulling away from the rest of the economy - particular among the highest earners.

By February 2022, average pay in finance was 31% higher than in December 2019 in cash terms, whilst average pay across all sectors was just 14% higher. That implies a real increase of 23% and 7% respectively. It's worth noting that bonuses are paid during January and February, so the measure may ease a little in the months ahead.

In other news...

Why Venice’s property market is ticking the boxes of international buyers once more.

A new Rural Update from Andrew Shirley on wine, hens and EU border checks.

Elsewhere - Hong Kong loosens Covid rules after sharp economic contraction (FT), and finally, Landsec shifts focus out of London in face of stiff competition on deals (FT).