Record job vacancies (again), higher construction costs, and London's bounce

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more

UK labour market continues to tighten:

Unemployment fell to 3.8% in the three months to February 2022, as job vacancies hit a new record high of 1.29 million, with four in every 100 jobs left unfulfilled. The tight labour market comes at a time when economic growth is slowing, with UK output expanding just 0.1% m-m in February.

Construction costs set to accelerate further:

Construction output in the UK increased 6.1% y-y in February, but while the construction outlook remains robust, there will be no respite from sharp cost inflation, with tender prices forecast to increase 4.4% this year. Ultimately, this will dampen development activity and curtail future supply – a topic covered in more detail in our recent Logistics Outlook.

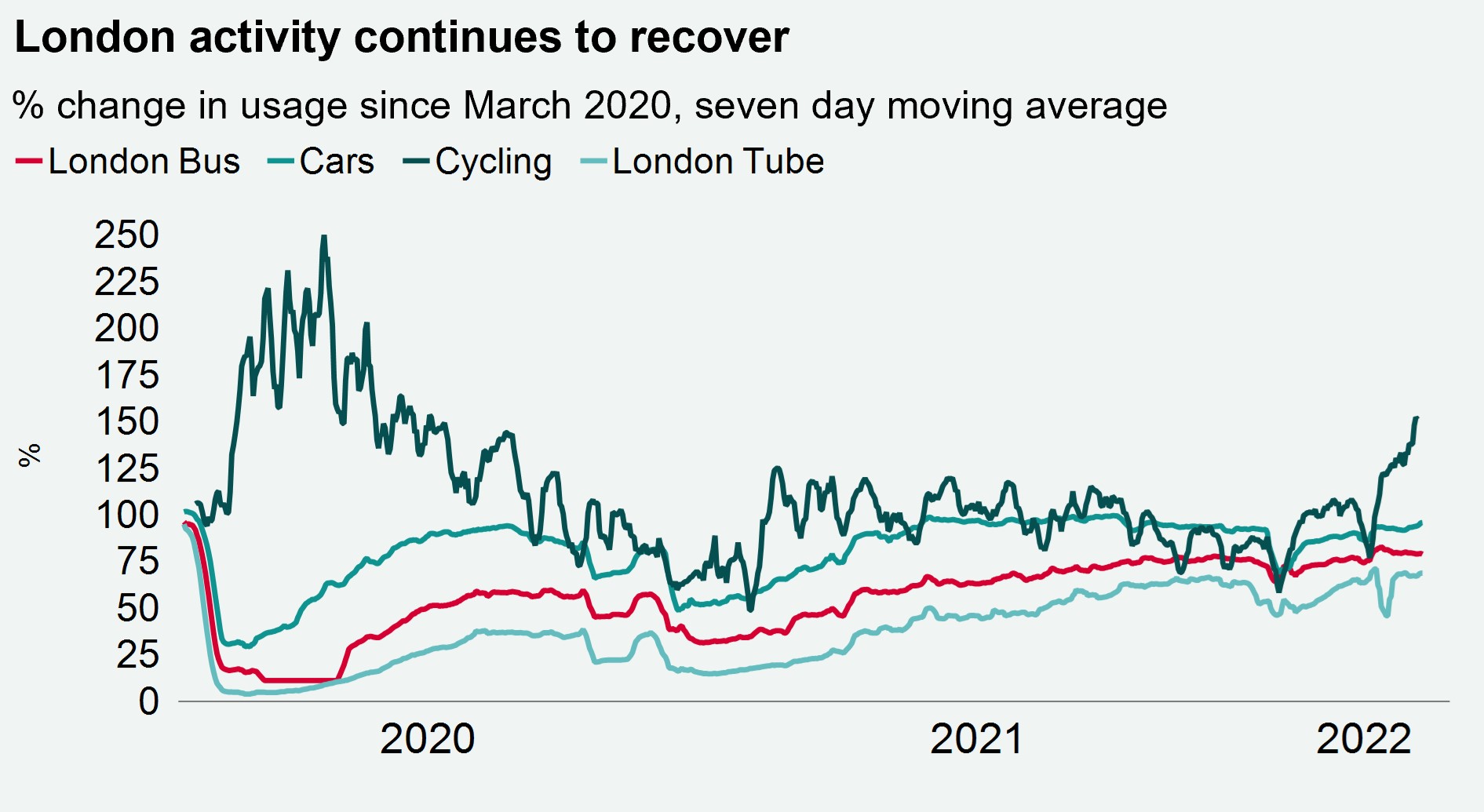

London Calling

The capital is seeing a resurgence in passenger numbers, with car and bicycle journeys surpassing their pre-pandemic levels, and tube and bus journeys at 78% and 82% of their pre-pandemic activity. Meanwhile, in March, London Heathrow reported its highest passenger numbers since the pandemic began. We are seeing this increased level of activity coincide with robust occupational demand for office product - take-up reached 2.65 million sq ft in Q1 2022, a 119% increase compared to Q1 2021.

Download the latest dashboard