House prices swelled by the revival in city living

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Cities

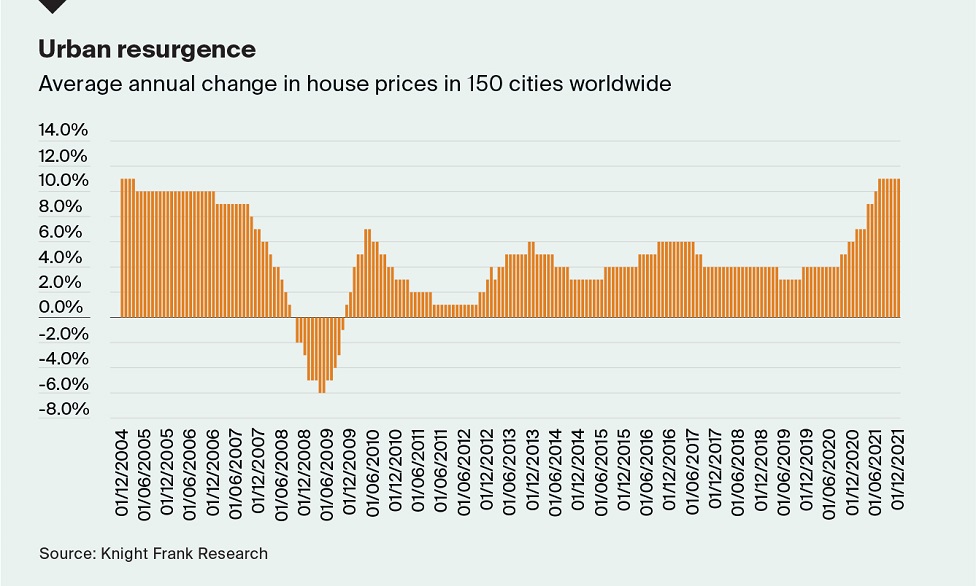

City house prices are rising at their fastest rate in almost 18 years.

Of the 150 cities tracked by our index worldwide, 140 saw prices increase in 2021, up from 122 in 2020. Overall, the index grew by 11% in 2021.

Cities in the Americas registered the strongest jump averaging 15% annual growth compared to 11% in the EMEA region and 9% across Asia-Pacific. US households not only accrued significant savings during successive lockdowns but the equity in their homes expanded significantly too. In some cases, this wealth has been used to upgrade existing homes or purchase a second property.

We talked last week about the mounting evidence indicating that the housing boom is on borrowed time and city markets are by no means insulated by the range of factors likely to drag on growth over the course of the year. However cities are benefitting from the post-pandemic resurgence of urban life - see the expansion of the services sector below. That's likely to act as a buttress for growth as suburban markets feel the more immediate squeeze of tightening monetary policy.

The value of farmland

The value of UK farmland is climbing at the fastest pace since 2014 as investors looking for a hedge against inflation join a growing pool of rollover and conservation-motivated buyers - see Monday's note.

Global food prices are already 20% higher than they were a year ago, according to the UN, and the Russian invasion in Ukraine, China's zero-Covid policy and some of the worst conditions for crops in the US since the 80s are set to fuel more growth. The FT has some interesting numbers on growing institutional interest:

In the Midwestern state of Iowa, which restricts corporate ownership of farms, the buyer pool last month consisted of 35 per cent investors and 65 per cent farmers, according to the Realtors Land Institute, compared with 18 per cent investors in 2019. The price of Iowa farmland rose by a third between March 2021 and March 2022, the institute said.

Only gold has outperformed UK farmland values during the past twelve months when compared to a basket of assets that includes the FTSE 100 and UK house prices, according to our latest farmland index. Competition between farmers and institutional investors is only going to grow.

Green homes

Last month we covered research from the Home Builders Federation revealing the scale of savings that energy efficient homes can offer.

Owners of new houses and flats, for example, will save an average of £435 a year on their energy bills, rising to £555 for new build houses alone. The running costs for all new build homes issued with an EPC in the 12 months to September 2021 came to approximately £116 million. If these homes had been built to the same standards as the existing properties in the sample, running costs would have been around £228 million.

It is too early to gauge the full impact of rising energy costs on the housing market but it's worth noting that Knight Frank new homes applicant volumes rose 50% in Q1 2022 vs the five-year average, according to data we shared with the Telegraph yesterday.

Of course new homes can only ever be a small slice of the solution and we've talked at length in these notes about the policy vacuum that exists when it comes to dealing with carbon emissions from existing homes. It's a hugely complicated task and there's no policy that can be pulled off the shelf at short notice now energy bills have risen by 54%. That's causing angst in Whitehall - see yesterday's Telegraph on the Treasury blocking an expansion of the scheme set up to pay for home energy efficiency improvements for the poorest households.

London's cultural hotspots

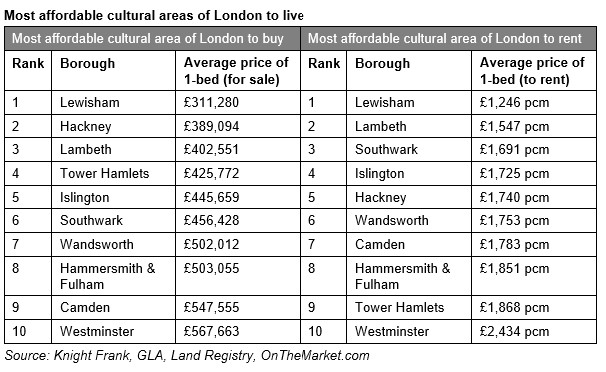

More than half of respondents to our recent UK buyer sentiment survey said easy access to amenities including pubs and entertainment was more important now than it was at the outset of the pandemic.

Anna Ward analyses Greater London Authority data to find areas with the highest concentration of cultural venues and cross checks it with affordability data to rank London's most affordable cultural hotspots.

Lewisham tops the list. The borough – which has 229 culture spaces including over 100 social venues - has also been recognised by the Mayor of London as the capital’s borough for culture in 2022. The win saw it secure £1.35m of GLA funding to deliver a year-long programme of cultural events and initiatives. See the piece for more.

Consumer spending

The UK services sector continues to buck economic headwinds. From this morning's Times:

The purchasing managers’ index (PMI) for the services sector, compiled by S&P Global and the Chartered Institute of Procurement and Supply, rose for the third consecutive month to reach 62.6, up from 60.5 in February. The figure is higher than flash estimates and far exceeds the 50 mark that separates growth from contraction.

Consumers' desire to get on with normal life after two years of hardship is clearly strong. Stephen Springham's report from November tackled the outlook for retail and leisure, including the place of the battle-weary consumer within it:

Freed from the shackles of lockdown, the UK consumer’s response has been to go out and spend, rather than retreat into their shell. As it proved in previous recessions and times of economic / social hardship, spending is actually the best antidote to wider malaise.

Leisure spend is forecast to climb 36% to hit £98bn this year.

In other news...

The impact of severe weather on the Australian residential market.

Dubai Ultra-Prime home sales hit a new record.

Elsewhere - about 70% of all meetings keep employees from working and completing all their tasks (Harvard Business Review), and finally, UK homebuilders sign pledges on fire safety measures (Reuters).