Slowing global growth, Amazon’s physical store exit and the housing market's supply problem

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Growth

The outlook for global growth looks highly uncertain amid the escalating conflict in Ukraine, however in recent days a handful of institutions have made forward looking statements that are worth sharing.

Firstly, the IMF on Saturday said the global economic implications of the war and subsequent sanctions would be severe. It noted the "complex policy trade-offs" faced by central bankers deciding whether to hike rates to rein in inflation or hold them low to support economies. The fund urged policymakers to step in to offset the damage to household finances caused by the rising prices of energy and food. Both the war and sanctions may knock a percentage point off global growth while adding a percentage point to inflation, according to JPMorgan research cited by Bloomberg.

Meanwhile, China’s top legislature, the National People’s Congress (NPC), started its annual meeting on Saturday. Though there was no mention of the conflict, the government said "the "external environment" is "increasingly volatile, grave and uncertain". It set its 2022 growth target at 5.5%. Though that's much more modest than last year's growth of 8.1%, it's markedly more than the IMF's current forecast of 4.8%.

A brighter outlook in China will be felt globally. Growth 5.5% instead of 5%, for example, would add about 0.1 percentage points to global growth, according to Bloomberg Economics.

Housing supply

Spring and autumn are traditionally the two most active times of the year for buyers and sellers in the UK property market, but the former still outnumber the latter by a wide margin.

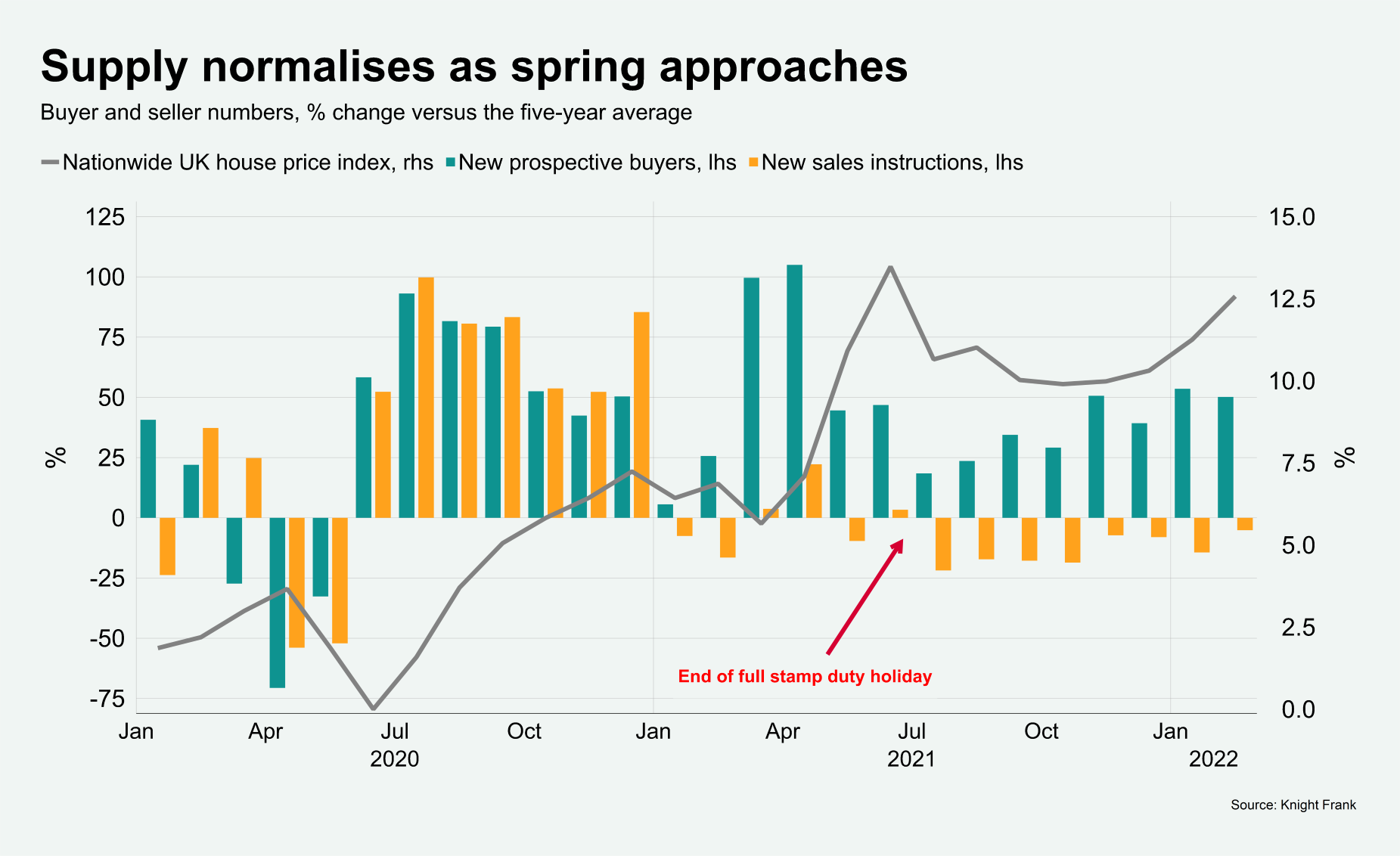

The chart below shows the percentage change in new sales instructions relative to the long run average, a leading indicator of future supply (yellow bars), and the percentage change in new prospective buyers relative to the long run average, a good barometer for demand (green bars). It reveals that, while the number of new prospective buyers was 50% higher than the five-year average in February, sales instructions were down by 5%. The gap is narrowing, albeit extremely slowly.

The result is double-digit house price growth. Are we likely to see the pressure ease? Here's Tom Bill:

At some point this year that demand will begin to relent. Mortgage rates are on the rise, as we explore here in more detail. Meanwhile, the cost-of-living squeeze will start to be felt more acutely, accelerated by events in Ukraine.

As we move beyond the pandemic and revert to more familiar constraints and uncertainties, spring could mark the return of more recognisable and predictable conditions in the UK housing market.

Amazon

Amazon last week announced it would close all 68 of its brick-and-mortar bookstores, pop-ups and shops carrying toys and home goods in the United States and United Kingdom. These were experimental ventures and the financial impact on Amazon will be negligible, but are there lessons to be taken about the ability of online pure-play operators to move into store-based retailing?

Amazon will still have other store-based operations in the shape of its food business and it’s soon-to-be-launched Amazon Style fashion concept. Stephen Springham gives his take:-

There are still question marks over these formats too. How has Amazon in any way changed or improved Whole Foods since it acquired the business back in 2017? Despite accelerated roll-out of Amazon Go and Amazon Fresh, does it wholly convince as a format? Cashier-less stores - a triumph of technology or a solution to a problem that didn’t really exist in the first place?

The return to workplaces

The re-occupancy of offices continues to gather momentum. February's Bank of England survey of 2,699 chief financial officers put the percentage of workers on business premises at 72%, up from 64% in January.

Recruitment consultants are reporting a surge in demand for childminders and polling of more than 750 managers and HR professionals conducted by Ipsos for workplace management firm GoodShape reveals more than a third expect remote working policies to be rolled back in the months ahead.

These are all blunt readings of a complex issue, however optimism in office markets is undoubtedly building. Take up in London hit 3.24m square feet in Q4 2021, according to the latest spotlight from Knight Frank's Shabab Qadar. You can see his take on how the re-occupancy is likely to progress over the course of 2022 here.

In other news...

Pandemic redraws US airline route maps as business travel falters (FT), Australia’s Aware Super joins megafund rush into Europe (FT), Hammerson confident of a bright future for UK shopping centres (FT) and finally, Putin’s war on Ukraine exposes ESG (Sunday Times).