UK Inflation to peak at 7%, office yields to compress and EV sales on the rise

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Hawkish BoE unsettles markets

While we expected the Bank of England (BoE) to raise rates by 25bps at last week’s Monetary Policy Committee meeting, four of the nine MPC members voting to raise rates to 0.75% was not necessarily on the cards. In response, UK gilts softened, reaching 1.37%, the highest level in three years. Markets are now pricing in rates to increase to at least 1.0% by May and to 1.5% by November. Even so, this does not automatically equate to higher property yields – for example, our latest London Report indicates that Office yields are set to compress this year.

UK inflation to peak at 7%

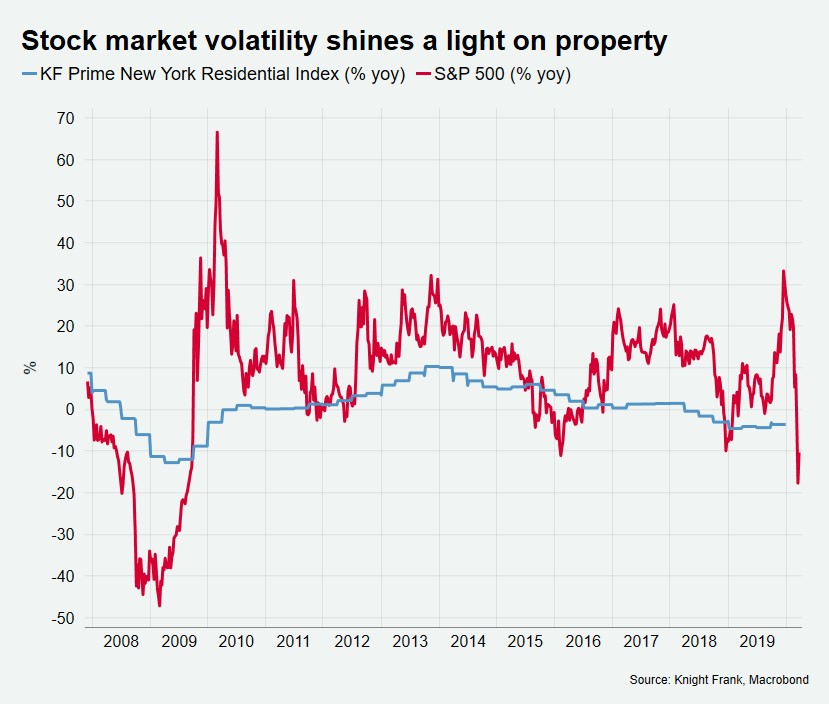

The BoE is expecting UK inflation to peak in Q2 2022 at 7.0% before dropping back below the 2.0% target by Q2 2024. This news, combined with the ECB diverging from its previous commitment to hold interest rates, has caused some uncertainty. Last week, the VIX volatility index increased to its highest level since January 2021. However, the key question remains whether central banks can really do very much to tame inflation, given that energy prices are responsible for so much of the current inflationary pressure.

Electric vehicles take the driving seat

New car sales in the UK have increased by 28% year on year, the fastest rise in the last six months. This acceleration has been largely driven by electric vehicles, with one in five new registrations now fully electric or hybrid. UK car sales in January outpaced sales in Germany and France, although overall UK sales remain 23% slower than the pre-pandemic average, partly due to semi-conductor shortages.

Download the latest dashboard