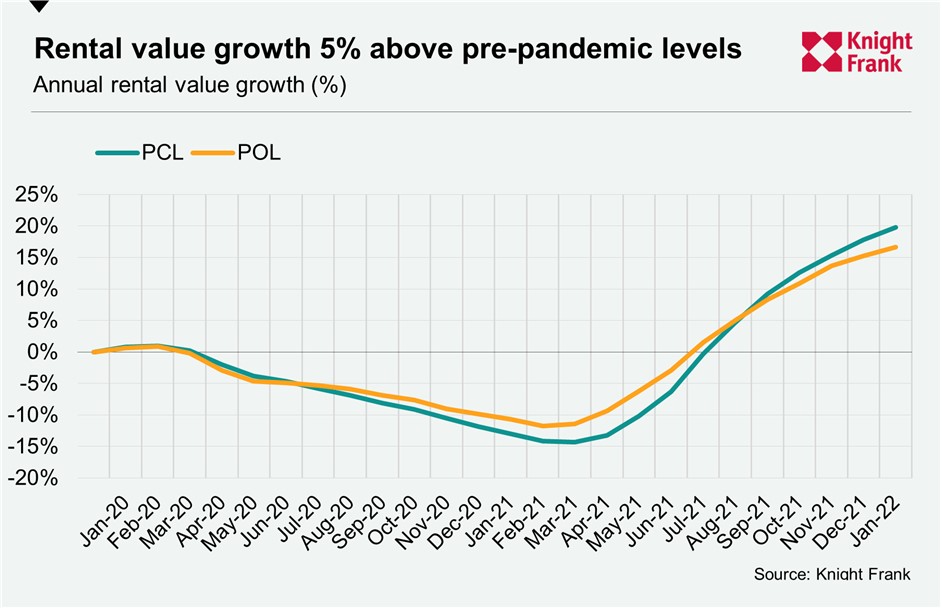

Rental values are 5% up on pre-pandemic level

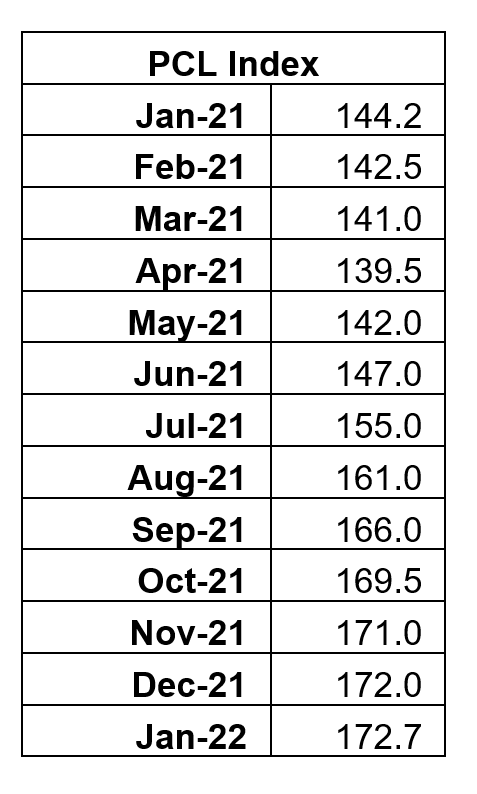

January 2022 PCL lettings index: 172.7

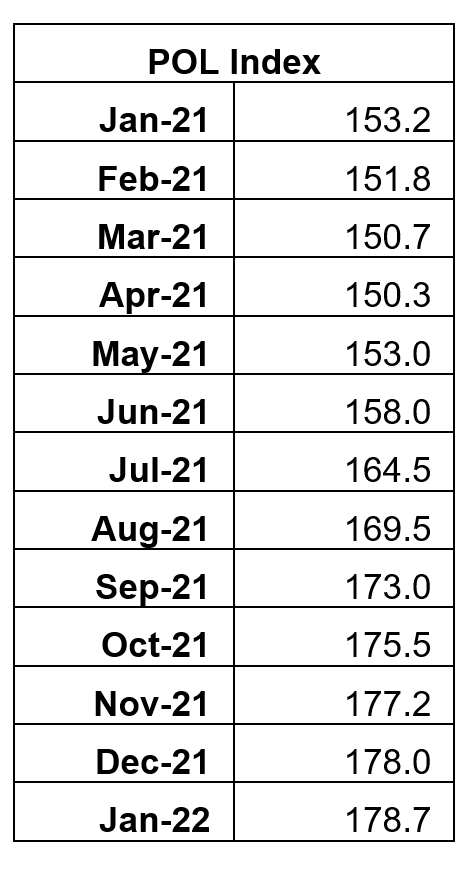

January 2022 POL lettings index: 178.1

2 minutes to read

Rental values in London and the Home Counties have climbed to 5% above their pre-pandemic level in March 2020.

The annual change in prime central London reached 19.8% in January, which was the largest jump since the index began in 1995. In prime outer London, the change was 16.6%, the largest increase over the same period.

The increases are the result of a readjustment to both indices to reflect the steep nature of the rises that took place last year.

Rental values in PCL fell 14.3% in the year to March 2021 as a flood of short-let properties hit the market and demand dried up. The situation reversed as lockdown restrictions were relaxed, producing the dramatic reversal – see revised chart below and tables (bottom).

“The unprecedented backdrop of the pandemic led to exceptional rental value growth last year,” said Tom Bill, head of UK residential research at Knight Frank. “It has tailed off in recent months as the supply and demand imbalance corrects itself but that process still has some way left to run, which will keep upwards pressure on rents this year.”

“It’s a tough time to be a tenant at the moment,” said Gary Hall, head of lettings at Knight Frank. “Rents are rising and the availability of stock is low, which means transaction volumes are lower. That said, we believe stock levels should start to improve later this year.”

In an indication of how strong demand remains, the number of new prospective buyers in London and the Home Counties in January was 62% above the five-year average.

Furthermore, the number of enquiries from corporate relocation companies in January this year was the highest it has been since January 2020.

In recent weeks, there have been signs that supply is gradually picking up, in part as a result of sellers failing to achieve asking prices, a trend more noticeable in prime central London.