Supply squeeze in rental market to tighten in spring

Supply will remain low in London and the Home Counties while demand surges, keeping strong upwards pressure on rents

2 minutes to read

Last week, we explained how the UK sales market was on the road to normality, with supply, mortgage rates and overseas buyer numbers likely to rise in coming months.

The journey back to normality for the lettings market in London and the Home Counties will take longer.

Students and corporate tenants account for a large part of demand, which has got stronger over the last 12 months as offices and Universities have re-opened.

Supply has been more erratic over the same period. It surged at the start of last year as properties that would otherwise be used for short-lets and staycations moved onto the long-let market.

As lockdown restrictions were relaxed, they switched back, meaning prospective tenants were involved in a so-called sprint for stock.

The stamp duty holiday exacerbated the situation, with many would-be landlords deciding to capitalise on the tax break by opting to sell.

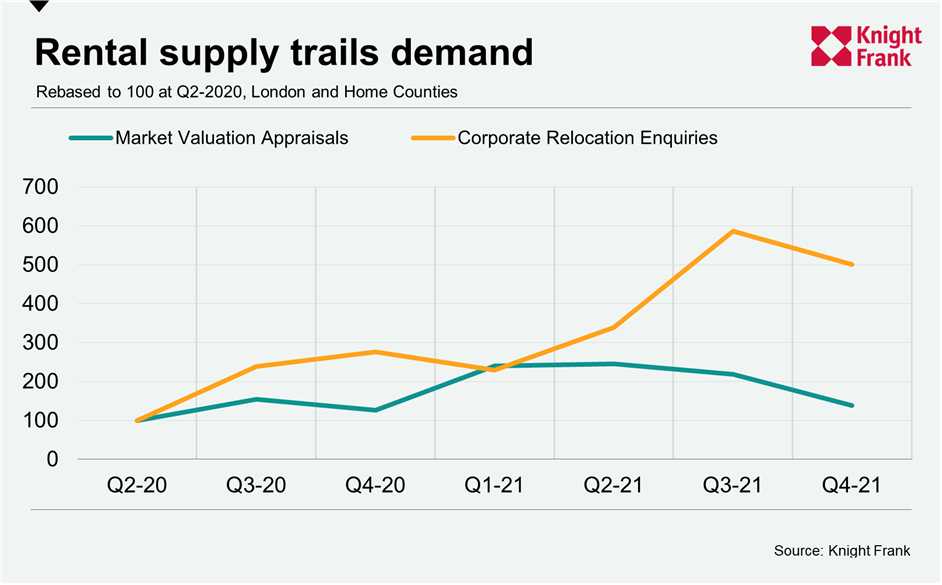

After some jitters before Christmas when the Omicron variant first appeared, students and companies are now activating their plans. Their problem is that supply remains tight, as the chart below shows.

The numbers of corporate relocation enquiries was five times higher in the final quarter of last year than it was in Q2 2020. The enquiries come from companies of all sizes looking to relocate staff to the UK across a range of sectors including finance, tech and energy.

Meanwhile, the number of market valuation appraisals was only 38% higher. Appraisals take place when a prospective landlord values their property for the rental market and act as a leading indicator of supply.

There will be a steadier flow of students looking for rental properties in the early months of 2022 than previous years, which will accentuate this imbalance.

The first reason is that Universities have staggered the return of face to face learning. Second, many of those who were unsuccessful in finding a property in time for September moved into temporary accommodation, which means they are still looking.

Meanwhile, demand from corporate tenants will rise as spring approaches. Companies that are activating or re-activating plans may find they are doing so at the same time as their peers.

“Everything points towards a scramble for stock this spring,” said Tom Bill, head of UK residential research at Knight Frank. “Any re-balancing between supply and demand in the lettings market will only come later this year at the earliest.”

Rents are likely to keep rising strongly as a result. Average rents rose 2.9% in prime central London last year and we forecast higher growth in 2022. In prime outer London, rents increased by 3.7% in 2021.

Strong rental value growth may tempt some landlords back into the market, which would help redress the balance.

Furthermore, while we expect sales values to increase this year, rising mortgage rates could see demand being to fray. Together with rising supply, this is likely to put downwards pressure on prices, which means rental returns may start to look more attractive.