UK residential property market finely poised as new year starts

Arrival of Omicron muddies the waters, but indicators suggest a re-balancing is underway

4 minutes to read

Normal is certainly not the adjective that immediately springs to mind with house prices in 2021, and December didn’t deviate from the narrative of robust growth.

Halifax reported a sixth consecutive monthly increase (1.1%) in December and a quarterly growth rate of 3.5%, which was the strongest performance since 2006. It took the average price of a UK property to £276,091, and the annual price change in the 12 months to December to 9.8%.

Nationwide reported that annual house price growth was 10.4% in December, which was the strongest calendar-year performance since 2006.

In the short-term, the mismatch between solid demand and dwindling supply continues to support pricing and restrict sales activity. RICS UK Residential Survey found a net increase of +9 respondents reporting an increase in buyer demand in December. While modest, it was the fourth successive positive reading despite the end of the stamp duty holiday in September.

However, even this was enough to outstrip the flow of new instructions coming into the sale market, which had a reading of -14 in December. This is the ninth consecutive month of negative readings for this measure according to RICS.

Despite this, both Halifax and Nationwide reiterated their belief that the record-breaking price run cannot last forever. While 2022 should still be a good year for the UK property sector, the lenders believe the impact of sales having been brought forward to meet the stamp duty deadline, an expected series of interest rate rises, and more supply coming online will see price growth moderate this year.

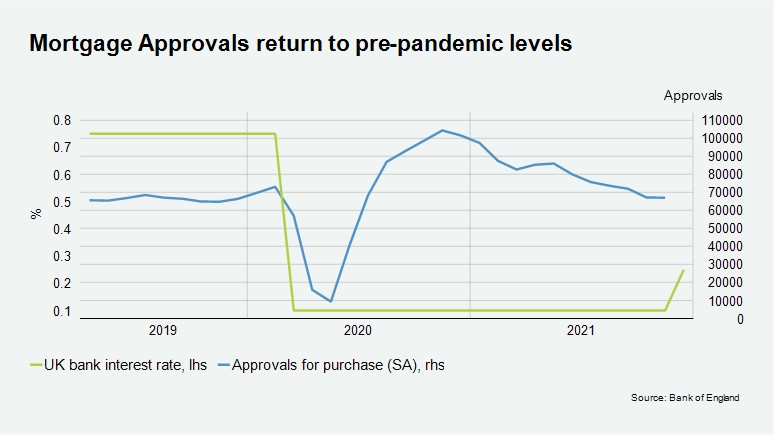

Official mortgage and transaction data published last month suggest this is underway, although the figures coincide with the hangover period following the stamp duty holiday.

Mortgage approvals for house purchase were 66,964 in November, which was the lowest since June 2020 (40,500), and close to the 12-month pre-pandemic average of 66,700 (see chart).

UK residential property transaction data from HMRC showed a similar trend. While seasonally adjusted transactions of 96,290 in November were 24.3% higher than October’s total, this was 16.4% lower than November 2020.

We have explored the four key factors that will shape the fortunes of the UK residential property market in 2022 separately, but sentiment remains the other key ingredient in the face of Omicron uncertainty.

The December edition of the Markit Household Sentiment tracker showed only a slight dip compared to November, remaining in positive territory. A score of 50 in the tracker equals no change, while above and below indicates expected growth or falls. Current price expectations slipped to 56.8 in December (November 58.9), and future price expectations dropped to 64.5 (65.9). Both scores remain above February 2020, the month before pandemic restrictions were introduced in the UK.

Prime London Sales

Average prices in prime central London increased 1.3% in the year to December, reflecting the static market conditions seen over the last nine months. It compared to a decline of 4.3% recorded in December 2020.

Meanwhile, in prime outer London, average prices rose 3.2%, which was the strongest annual rate of growth since February 2016 and reflected the robustness of demand for space and greenery during the pandemic. The increase compared to a decline -3.2% recorded in the year to December 2020.

We expect prices to rise further across London next year, with a more notable upswing in PCL when international travel resumes.

Prime London Sales Report: December

Prime London Lettings

Nine months ago, few would have predicted that rents would end the year in positive territory in the prime London lettings market. Thanks to a sharp retreat in supply and the physical re-opening of offices and Universities, that is precisely what happened.

This precipitous drop in supply drove rents higher, with average rental values climbing 2.9% in the year to December in prime central London (PCL). In prime outer London (POL), there was a 3.7% rise.

The six-month increase of 8.2% in PCL in December is the highest recorded over an equivalent period since December 2010. A corresponding rise of 7.1% in POL was last exceeded in September 2007.

Prime London Lettings Report: December

Country Market

High-value properties were the top-performers in the country house market in 2021, as buyers continued to seek space and greenery.

The £5m+ country house market has been the top performing value band in five out of the seven quarters since the market reopened on 13 May 2020.

In December, the average price of a property valued at £5m+ in the Prime Country House Index was 19.8% higher than it was twelve months ago.

High-value country houses take top spot in vintage year for the market