Overseas buyers and tenants gear up for UK return

UK Property Market Outlook: 6 September 2021

3 minutes to read

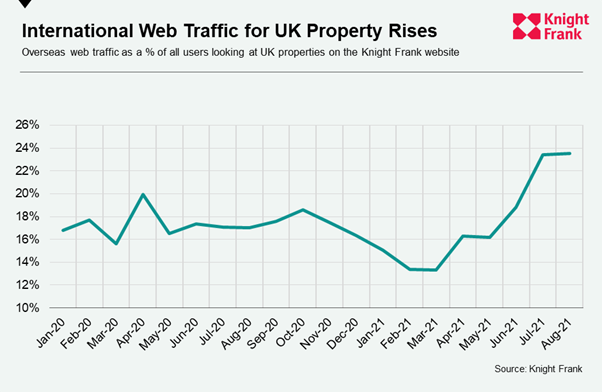

The number of international buyers and tenants searching for UK property has reached its highest level since before the pandemic.

Almost a quarter (24%) of all web users looking at sales and lettings properties were based overseas in August, the highest figure since January 2020, Knight Frank web traffic data shows. The average figure in the 18 months to June was 17%.

Furthermore, the number of international web users looking at lettings properties in August exceeded those based in the UK for the first time since the start of 2020. Demand has been driven by overseas students acting before the start of the academic year and returning corporate tenants as offices re-open.

As overseas demand recovers from the depths of the pandemic, upwards pressure on prices and rents will increase.

“It’s more web traffic than air traffic at the moment but international demand is undoubtedly building,” said Tom Bill, head of UK residential research at Knight Frank. “As the feeling grows that the worst of the pandemic is behind us, normal service will resume in the UK property market and I expect overseas buyers and tenants to make their presence felt in the final quarter of this year.”

Despite growing international demand, uncertainty over the relaxation of travel rules means the precise timing of the return is uncertain.

Air traffic has been severely curtailed during the pandemic due to international travel restrictions that mean many visitors to the UK have needed to quarantine on arrival or their return. While the number of arrivals at Heathrow in July was the highest since the start of the pandemic, it was still more than 80% below the figure for the same month in 2019.

The international buyer landscape in prime central London changed as a result of the restrictions, meaning French nationals were the largest group of buyers in prime central London in 2020, with a number of those already based in the UK.

In the lettings market, some overseas students have arrived in the UK ahead of the academic year while others are waiting for more clarity around face-to-face learning, meaning tenant demand should be more evenly spread throughout the year than normal.

That said, overseas prospective tenant numbers are high in areas like Aldgate and the Southbank. “In some London branches, we have in excess of 80% of rental applicants searching for properties who are not based in the UK,” said Gary Hall, head of lettings at Knight Frank.

In the sales market, the presence of overseas buyers is patchier but numbers are expected to pick up from this month.

“We are getting more enquiries from overseas buyers who are keener to come over,” said James Cleland, head of Knight Frank’s country business. “The tide is definitely turning.”

As the impact on prices begins to filter through, it will be most pronounced in prime central London. While average prices in PCL increased by 0.8% in the year to July, Nationwide recorded 7.2% growth in the year to June in Greater London, underlining the impact of the travel restrictions.

We expect prices in PCL to end the year 2% higher but to increase by 7% next year as overseas demand kicks in.