Prime London Lettings Report: May 2021

Prime central London lettings index: 138.8Prime outer London lettings index: 149.7

2 minutes to read

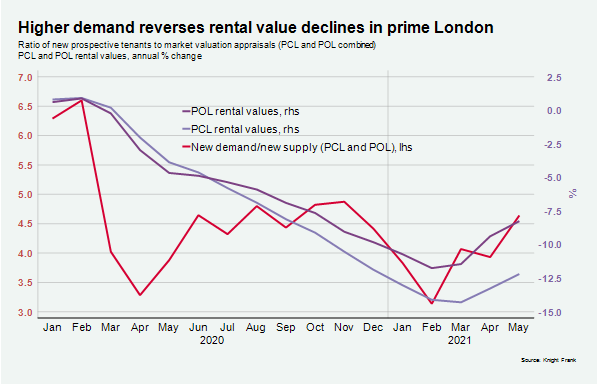

Stronger demand is helping to reverse the rental value declines that have taken place in prime London property markets over the course of the pandemic.

Underlining the extent of the increase, the number of new prospective tenants in the three months to May was 76% higher than the first three months of 2020.

As a result, average rental values declined 12.2% in prime central London in the year to May, which compared to a fall of 14.3% in March. In prime outer London, the figure was -8.2%, compared to a decline that bottomed out at -11.7% in February.

Tenants are taking advantage of falling rents and moving to properties that enable them to shorten their commute or gain extra home-working space against the positive backdrop of the UK’s economic recovery.

The number of properties that rented in locations surrounding London’s two main financial districts increased by 21% in April this year compared to March 2020, as this analysis showed.

In prime markets in London and the Home Counties, the number of tenancies started is also on the rise. In the three months to May, the figure was 24% higher than the same period in 2019, Knight Frank data shows.

In addition to domestic tenants returning to work, demand from international students is building. This may drive activity levels higher and increase upwards pressure on rental values in coming months. However, it will be dependent on how quickly travel restrictions are relaxed whether cases of Covid-19 remain under control.

Applications for January deadline courses from non-EU students increased by 17.1% this year, which included a 22% rise from China a 26% increase from India.

If restrictions are lifted as planned and any third wave of Covid-19 remains under control, demand could escalate quickly due to the combined effect of new students looking for accommodation in addition to those who registered last year but have been studying remotely.

Supply levels remain high due to the fact a large number of short-let properties transferred to the long-let market during the pandemic. However, there are signs more balance is returning, which is putting upwards pressure on rental values, as the chart below shows.

The ratio of new prospective tenants to market valuation appraisals is an indicator of the relationship between demand and supply. The figure was 4.6 in May, which is the highest it has been in six months although it is not yet back to where it was before the pandemic.

Furthermore, the number of new listings in prime central and prime outer London and the Home Counties has come down since peaking last summer, OnTheMarket data shows. The figure was 12,480 in May this year, down 47% from 23,647 last July.