Prime London Lettings Report: April 2021

Prime central London sales index: 139.5Prime outer London sales index: 150.3

2 minutes to read

Annual rental value declines in prime London property markets bottomed out in April.

The fall in prime central London was 13.3% over the 12-month period, which compared to 14.3% in March. In prime outer London, the annual decline was 9.4% in April versus 11.5% in March.

The improvement, which follows 12 months of widening declines, was expected following a monthly drop of 2.2% in April 2020 as the property market closed during the first national lockdown.

While the causes of the decline haven’t disappeared, a gap is opening up between different parts of the lettings market.

Demand has been curtailed due to international travel restrictions and supply driven higher by the transfer of short-term rental properties onto the long-let market.

However, exceptionally strong demand in the sales market for houses with outdoor space has reduced supply and put upwards pressure on rental values for this type of property.

A looming supply shortage for prime houses in London and the Home Counties means some executives relocating to the UK this summer may struggle to find the right type of property to rent, as we analysed here.

The number of houses listed for rent between £2,000 and £4,000 per week in prime central London fell by 83% between March 2020 and April 2021, OnTheMarket data shows.

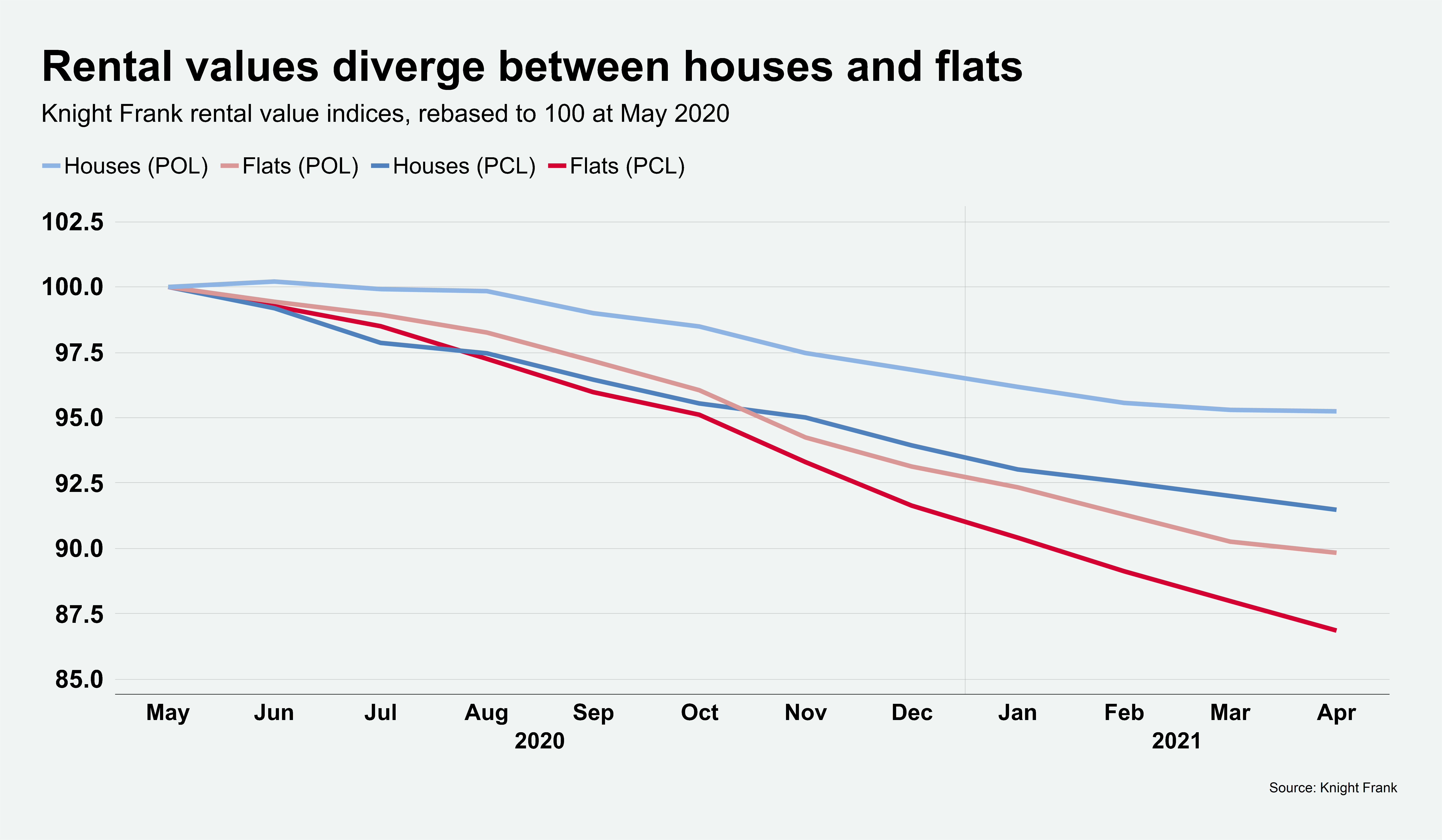

The shortage is having an impact on rental values, as the chart below shows. Average rents for houses in prime central London fell 9.7% in the year to April compared to 14.8% for flats. In prime outer London, average house rents fell by 5.9% in the year to April compared to a decline of 11.9% for flats.

The same divergence exists between different price bands. Rental values for properties valued above £2,000 per week fell by 7.8% in the year to April in prime central London and by -3.7% in prime outer London. Both figures are below the wider average.

“The strong sales market means there are some parts of the lettings market in prime central London that are almost bereft of options for tenants, for example houses in Notting Hill and Chelsea,” said David Mumby, head of prime central London lettings at Knight Frank. “The best properties are not even being openly marketed. It means is that we may see a very rapid recovery in rents in some prime London markets.”