Strong demand for family homes sees Edinburgh City’s property market accelerate in 2021

Index 115.7 / House 113.4 / Flat 127.6

2 minutes to read

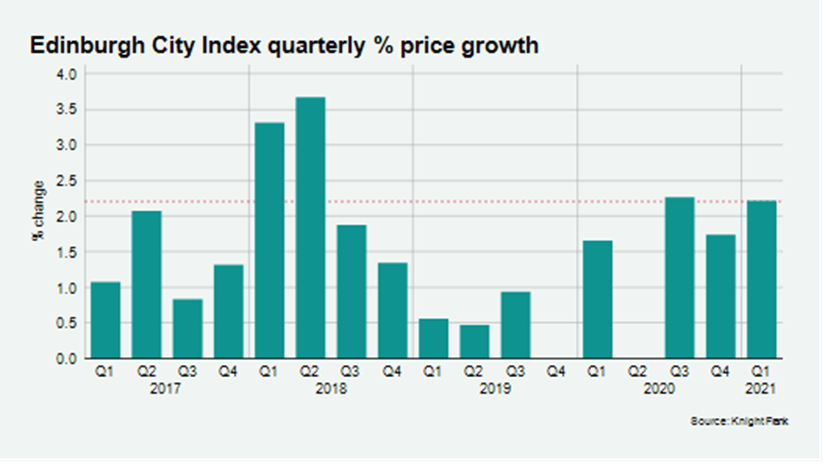

Property prices in Edinburgh recorded their strongest first-quarter performance in three years with an increase of 2.2%, as the Scottish capital experienced high demand and tight supply in the first months of the year.

The pursuit of more space by family buyers in the city pushed the rate of growth to 6.8% in the 12 months to March 2021, compared with an annual growth rate of 5.8% at the end of 2020.

It was enough to see Edinburgh place within the top twenty of cities featured in Knight Frank’s Prime Global Cities Index by annual price growth.

Offers accepted in Edinburgh were up 80% in the first three months of the year versus the five-year average. Transactional activity also remained high, with exchanges up 51% over the same period.

However, following another lockdown in the opening months of the year and with a resumption in full-time schooling having only just take effect, supply remains tight with more buyers chasing fewer houses after sellers held back from listing.

“It’s very much a seller's market at present. We have high demand and low supply, which I expect to continue over the next few months. Family homes with gardens remain the hot ticket. One such property that we sold recently attracted 80 viewings over two weeks and multiple bids,” said Edward Douglas-Home, head of Scottish residential at Knight Frank.

In March 2021, there were 21.4 new prospective buyers for each new sales instruction in Scotland (including Edinburgh). The ratio, which shows strength of demand versus supply, hit a recent peak at 21.9 in February. February’s figure was the highest since December 2019.

The prime suburban market, predominately Victorian-era homes outside the city centre, has continued to benefit from buyers’ appetite for more space and gardens, with last year’s momentum continuing.

Average values in residential south Edinburgh, including the areas of Morningside and Merchiston, rose 2.5% in the three months to March, taking annual price growth to 8.1%. West of the city centre, including the areas of Murrayfield and Barnton, also proved popular with family buyers, and average prices increased 3.2% in the three months to March and 5.6% on an annual basis.

While Scotland’s Land and Buildings Transaction Tax (LBTT) nil rate threshold has returned to £145,000 from £250,000 on 1 April, the removal of the saving, which was up to £2,100 per property, is unlikely to have a material impact on activity in Edinburgh. Supporting this view, offers accepted in March in the city, and therefore not in consideration for the LBTT saving, were up 64% versus the five-year average.

Photo by Bayo Adegunloye on Unsplash