House price forecasts revised up after Budget

Expectations for mainstream property markets have turned more positive following the Budget last week. However, travel restrictions mean the recovery in prime central London may take longer

3 minutes to read

Although the stamp duty holiday and the furlough scheme were both extended in last week’s Budget, the rationale behind the decisions was unconnected.

The sixth extension of the furlough scheme underlines the government’s strategy of safeguarding jobs, which has become more targeted as the vaccine programme rolls out.

By contrast, prolonging the stamp duty holiday was an attempt to unwind a policy that in some ways was the victim of its own success.

Whatever the basis for each initiative, the Budget has changed the landscape for the housing market in 2021 and we have revised our forecasts as a result.

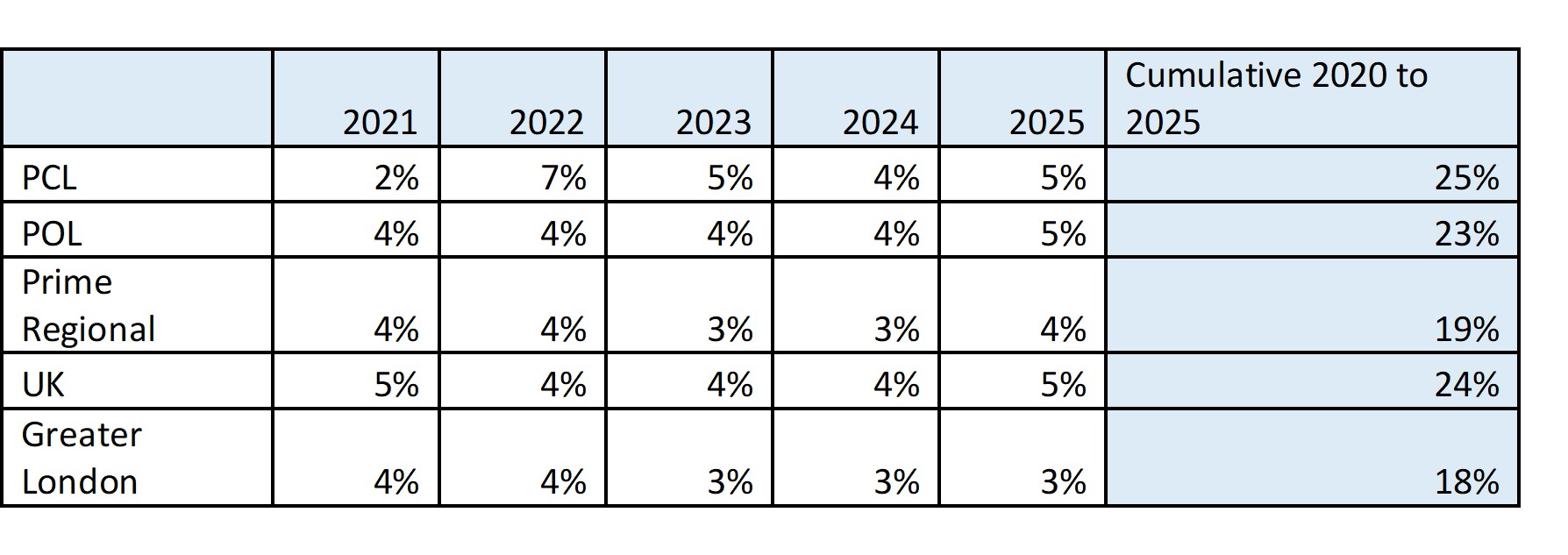

We expect UK house prices to increase by 5% in 2021, rising from a forecast of zero at the start of this year. The strength of key market indicators in the first two months of the year, as analysed here, meant that an upwards revision was likely even without the measures announced in the Budget.

Our forecast for Greater London has risen to 4% from 1% in January. We now expect price growth in the UK to outperform the capital as the impact of the tapered stamp duty holiday extension drives demand in lower-value markets more consistently through to the end of September.

Our forecasts for Prime Outer London and Prime Regional markets have remained largely unchanged as both areas continue to benefit from a drive for more space and greenery.

However, continued uncertainty around the relaxation of international travel restrictions means we have revised our 2021 forecast for prime central London (PCL) down to 2% from 3%.

Average prices in PCL have been flat over the last six months as international demand has fallen, as discussed here. By contrast, prices have risen by 1.3% in prime outer London and 4% in Greater London.

Furthermore, when international buyers return, possibly late in Q2 this year, there are two further considerations.

First, a 2% stamp duty surcharge for overseas buyers will come into effect from April.

With no price growth due to the absence of international buyers in recent months, the surcharge has effectively been priced in before its introduction.

However, overseas buyers may factor the charge into price negotiations. This may lead to a short-term hiatus in activity during a period of price discovery.

The second consideration is that demand from international buyers may initially be more skewed towards properties with outdoor space than it was before the pandemic. This could make any recovery in prime central London prices more inconsistent across different property types.

Meanwhile, we have revised our forecast for PCL in 2022 to 7% from 6% as more of the pent-up demand currently building is displaced into next year.

A sense of finality will be of overriding importance for the property market this year, in relation to the stamp duty holiday, lockdown measures and international travel restrictions.

As the stamp duty holiday elapses, normal seasonal patterns of activity in will begin to return to the property market. If the vaccine rollout proves successful and the prospect of further lockdown measures recedes, we would also expect a requirement for outdoor space to ultimately become less prevalent in the property market.