Daily Economics Dashboard - 4 March 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 4 March 2021.

Equities: Globally, stocks are lower. In Europe, declines have been recorded this morning by the STOXX 600 (-0.6%), FTSE 250 (-0.8%), DAX (-0.7%) and CAC 40 (-0.4%). In Asia, the CSI 300 (-3.1%), Hang Seng (-2.2%), KOSPI (-1.3%), TOPIX (-1.0%) and S&P / ASX 200 (-0.8%) were all down on close. In the US, futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are -0.6% and -0.3%, respectively.

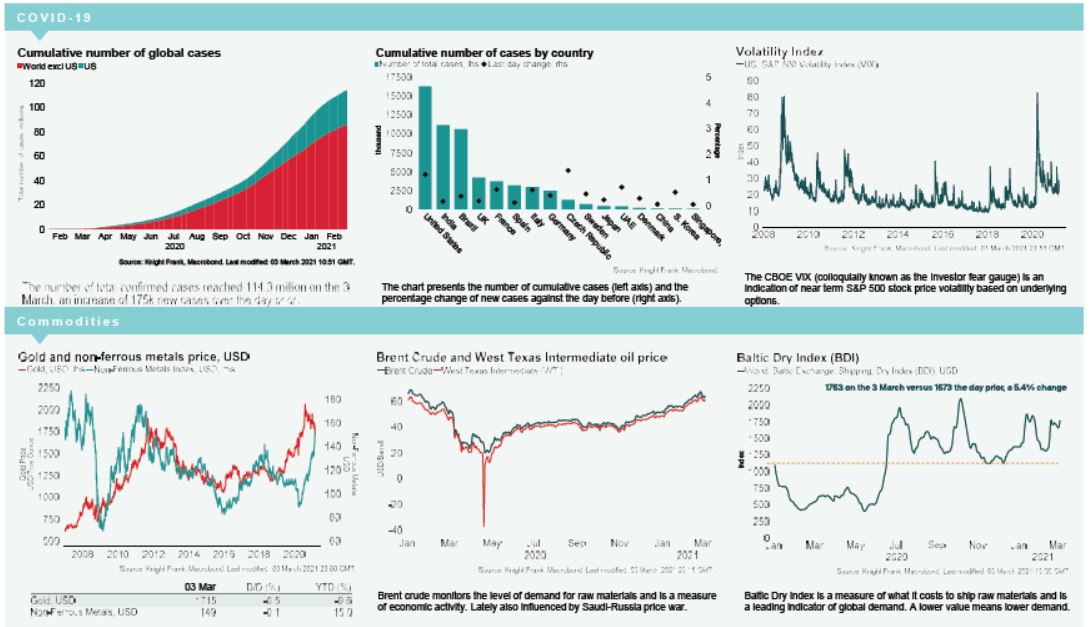

VIX: After increasing +11% over Wednesday, the CBOE market volatility index is up a further +3.6% this morning to 27.6, remaining elevated compared to its long term average (LTA) of 19.9. The Euro Stoxx 50 volatility index is also higher this morning, up +8.4% to 23.5, albeit remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield has compressed -2bps to 0.76%, while the US 10-year treasury yield is down -1bp to 1.47 and the German 10-year bund yield has held steady at -0.30%.

Currency: Sterling and the euro have depreciated to $1.39 and $1.20, respectively. Hedging benefits for US dollar denominated investors into the Eurozone have increased to 1.59% per annum on a five-year basis, up from 1.51% last week and 1.37% one month ago. Meanwhile, hedging benefits into the UK on a five-year basis are currently 0.51%, higher than 0.47% one week ago but lower than 0.57% last month

Baltic Dry: The Baltic Dry increased for the second consecutive session Wednesday, up +5.4% to 1763, its highest daily increase in over two weeks. The index is now -5% below the four-month high seen in January 2021.

UK Economy: The OBR forecasts the UK economy to grow +4% in 2021 and to return to pre pandemic levels by mid 2022, with growth of 7.3% next year, falling to 1.7% growth by 2023, then 1.6% and 1.7% growth for the two years after. Unemployment is expected to peak in 2022 at 6.5%, lower than the 11.9% previously forecast. The UK will borrow £355bn this financial year, a new peacetime record, with steadily reduced levels of new borrowing subsequent years. The Chancellor reaffirmed the principle that over the medium term debt should not increase and announced future increases of Corporation Tax (CT) for large corporates (defined based on profitability) to 25% from 2023. While an increase, this remains the lowest CT rate in the G7. Eight freeports with low tax zones will also be created across England.