Daily Economics Dashboard - 15 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 15 February 2021 2020.

Equities: In Europe, stocks are higher this morning, with gains recorded by the FTSE 250 (+1.3%), CAC 40 (+1.2%), STOXX 600 (+0.9%) and DAX (+0.4%). In Asia, most markets remain closed due to the Lunar New Year holiday, however, the Nikkei 225 added (+1.9%) on close and surpassed 30,000 points for the first time since 1990, following news that Japan’s economy increased +3% over the quarter to Q4 2020. The TOPIX (+1.0%) and S&P / ASX 200 (+0.9%) were also up on close. In the US, markets are closed today for Presidents’ Day Holiday.

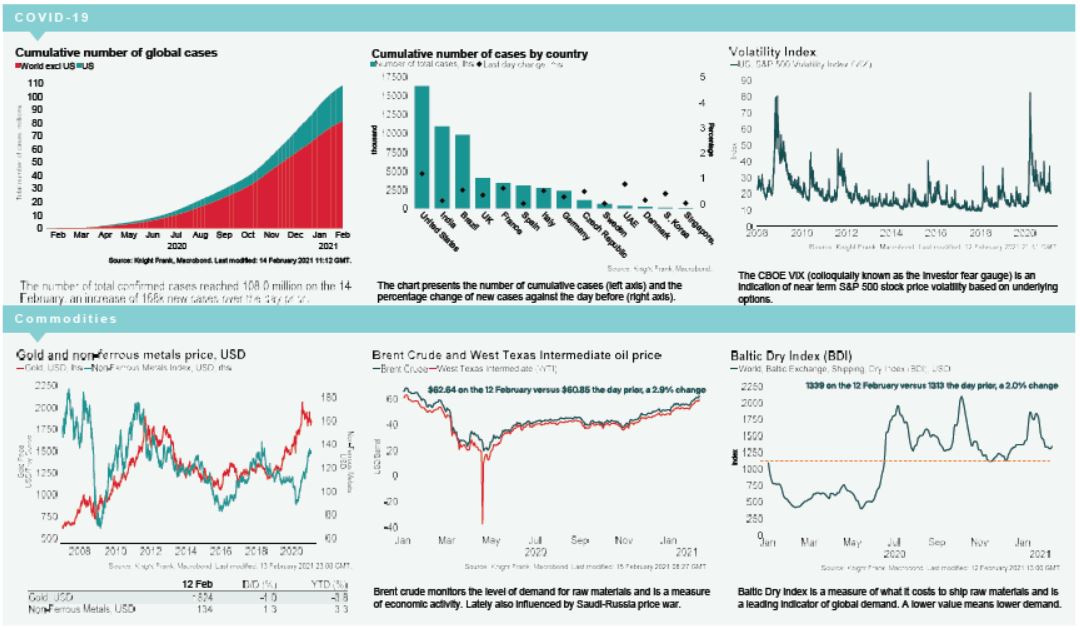

VIX: The CBOE market volatility index declined -6.0% over Friday to 20.0, its lowest level since April 2020 and just above its long term average (LTA) of 19.9. This morning, the Euro Stoxx 50 volatility index is higher, up +2.1% to 20.5, remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield has softened +6bps to 0.58%, while the German 10-year bund yield has added +5bps to -0.38% and the Italian 10-year bond yield is up +3bps to 0.51%. The UK gilt yield is the highest it has been since March 2020.

Currency: Sterling has appreciated to $1.39 and the euro is currently $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.47% and 1.38% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the second consecutive session on Friday, up +2.0% to 1339, its first weekly rise in three weeks and the index’s highest daily increase in 17 sessions. The index is currently -28% below the four-month high seen in mid January 2021. Prices have been pushed upwards by panamax rates, which have increased +17% over the week, its best weekly performance since 8th January 2021.

Oil: Both Brent Crude and the WTI are above $60 per barrel for the first time since December 2019, following increases this morning of +1.4% and +2.0% to $63.30 and $60.63, respectively.

Lockdown: On Sunday, the city of Auckland in New Zealand entered into a three day lockdown. Australia has since suspended its quarantine-free travel arrangement with New Zealand. Germany has closed its borders with the Czech Republic and Austria’s Tyrol region. Meanwhile, South Africa is re-opening 20 of its land border crossings today.