Daily Economics Dashboard - 28 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 28 January 2021 2020.

Equities: In Europe, the STOXX 600, FTSE 250 and DAX are all down -1.9%, followed by the CAC 40 (-1.6%). In Asia, the CSI 300 (-2.7%), Hang Seng (-2.5%), S&P / ASX 200 (-1.9%), KOSPI (-1.7%) and the TOPIX (-1.1%) all closed lower. In the US, following the one of the steepest selloffs of the S&P500 since October 2020, declining -2.6%, futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are currently -0.7% and -0.5% lower.

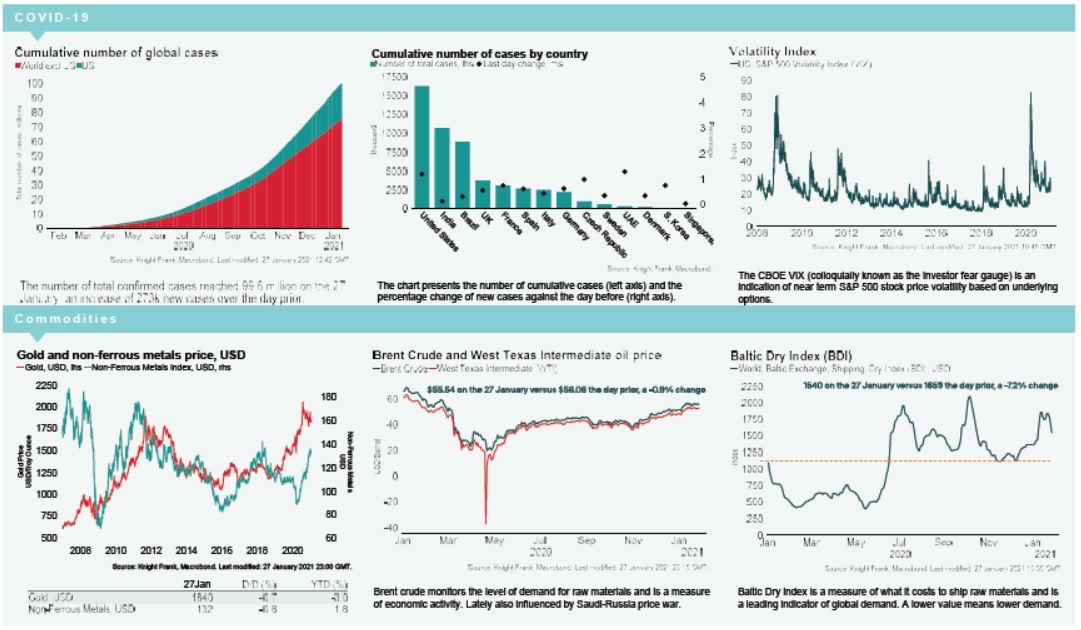

VIX: The ‘investor fear gauge’, the CBOE market volatility index, spiked +62% yesterday on close and is currently trading at 33.39, the highest level since early November 2020. The Euro Stoxx 50 volatility index is also up by +18.8% to 31.8. Both indices are above their long term averages. A combination of retail trading in the US, the Federal Reserve announcement that interest rate and asset purchase policy is to remain unchanged, as well as possible vaccine delays in Europe have contributed to the rise.

Bonds: The UK 10-year gilt yield compressed by -2bps to 0.25% while the German 10-year bund yield and the US 10-year treasury yield compressed by -1bp to -0.55% and 1.0% respectively.

Currency: Sterling and Euro are currently $1.36 and $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.57% and 1.35% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased for the forth successive session yesterday, declining by -7.2% to 1,540, a level which is -17.0% lower than the four-month high seen last week.

Oil: Brent Crude and the West Texas Intermediate (WTI) are down by -1.3% and -0.9% to $55.06 and $52.34 per barrel, respectively.

US Unemployment: There were 847k new unemployment applications in the week to 23rd January 2021, below market expectations of 875k and smaller than the previous week’s reading of 914k.