Daily Economics Dashboard - 8 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 8 January 2021 2020.

COVID-19 Vaccine: The Moderna vaccine is the third to be approved for rollout in the UK.

Equities: Globally, stocks are up. In Europe, gains have been recorded this morning by the FTSE 250 (+0.8%), DAX (+0.7%), STOXX 600 (+0.5%) and CAC 40 (+0.3%). In Asia, the Kospi has recorded year to date gains of +10% after closing +4.0% yesterday. The Topix (+1.6%), Hang Seng (+1.2%) and S&P / ASX 200 (+0.7%) also closed higher. However, the CSI 300 was down -0.3% on close. In the US, S&P 500 futures are +0.2%.

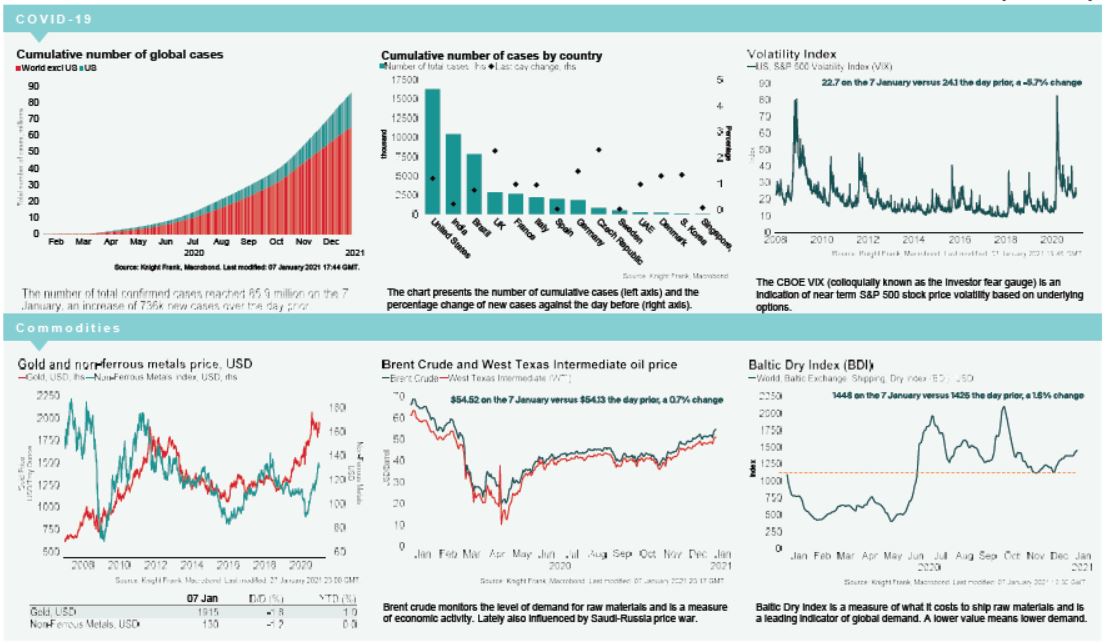

VIX: Following a -5.7% decline over yesterday, the CBOE market volatility index has increased +0.5% this morning to 22.5, which remains above the long term average (LTA) of 19.5. However, the Euro Stoxx 50 volatility index has declined this morning, down -1.0% to 20.8, below its LTA of 23.9.

Bonds: The German 10-year bund yield has softened +2bps to -0.53%, while the UK 10-year gilt yield compressed -1bp to 0.28%. The US 10-year treasury yield has held flat at 1.08%, the highest it has been since 19th March 2020.

Currency: The euro has depreciated to $1.22, while sterling is currently $1.36. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.62% and 1.40% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have increased +0.8% and +0.7% to $54.83 and $51.16 per barrel, respectively. The latest Baker Hughes rig count found there were 351 active oil rigs in the US as at 30th December 2020, compared to 796 one year ago. Internationally, the number of active oil rigs in November stood at 669, compared to 656 one month prior.

Baltic Dry: The Baltic Dry increased for the seventh consecutive session on Thursday, up +1.6% to 1,448, the highest it has been since 19th October. The main driver of this growth were panamax rates, which increased +2.8% to their highest level in four months and capesize rates which added +1.7% yesterday. Over the first week of the year, the Baltic Dry index has gained +6%.

US Unemployment: There were 787k new unemployment applications in the week to 2nd January, below market expectations of 880k and lower than the previous week’s reading of 790k.