Keeping the housing market moving key to economic recovery

The important contribution that the housing market makes to the UK economy is widely acknowledged, yet assigning a value to that contribution is complex. There is no single source of data providing comprehensive information about the total economic impact of a housing transaction.

2 minutes to read

Our analysis, produced in partnership with the Home Builders Federation (HBF), attempts to quantify that figure. It shows that for every resales housing transaction that takes place the economy benefits by around £9,559 on average. Scaling that figure up means that for every 100,000 housing transactions, there is a net impact of just shy of £1 billion. In addition, more than 11,500 jobs are supported either directly or indirectly by these transactions.

The research is particularly timely given the current backdrop. Activity in the UK property market has been robust since it re-opened in May, due in part to the release of short and longer-term pent-up demand. This trend has been accelerated by the announcement of a stamp duty holiday in July, which will run until the end of March 2021.

That the temporary tax break has been targeted at total activity rather than a specific buyer group is perhaps indicative of the fact that the government recognises the positive contribution a liquid housing market can have on supporting the wider economic recovery. Indeed, in October, the Treasury claimed the move had already helped "protect hundreds of thousands of jobs, benefitting businesses across the housing supply chain and beyond".

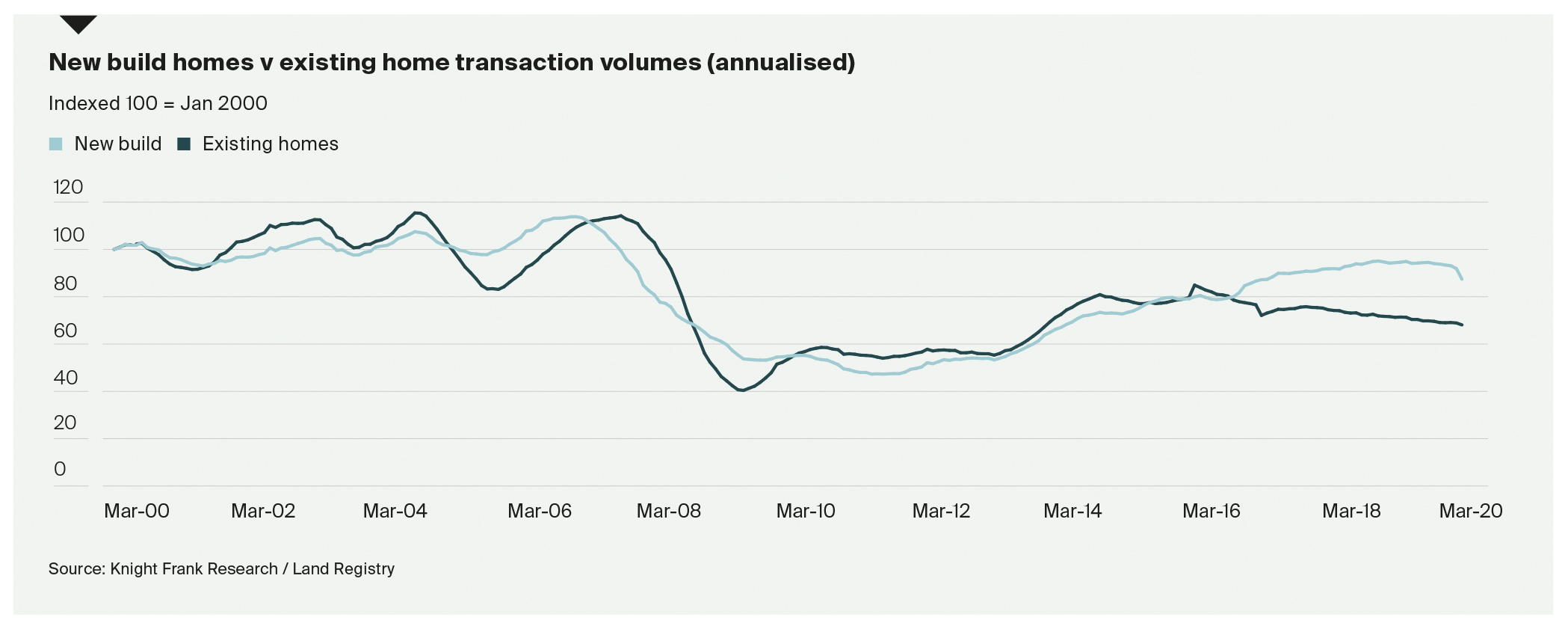

However, the wider economic backdrop is likely to remain subdued as the impact of a second national lockdown becomes clearer. It is also reasonable to assume that the factors which have underpinned the recent rise in activity will not last indefinitely. The economic mood is expected to turn more negative as the government’s furlough scheme is unwound from next year. Meanwhile, the scheduled end of the stamp duty holiday, scaling back of the Help-to-Buy equity loan scheme, as well as with the introduction of higher taxes for overseas purchasers, could weigh on activity levels post-March.

"Stewart Baseley, executive chairman, HBF, said: “With Help to Buy scheduled for full withdrawal in two years, now is the time for a proper discussion about the importance of freeing up the home mover market. Doing so will allow for more housing opportunities for all households, unlock greater labour mobility and provide the economy with a boost when it is most needed.

“The housing market and the new build sector in particular bounced back very strongly in spring after lockdown. Protocols are in place that have allowed high build levels and sales rates to be safely maintained, enabling thousands of households to buy the home of their dreams. Looking forward, house building and the wide range of jobs that the housing market supports, as well as the huge economic benefits that transactions generate can all play a major part in building and sustaining an economic recovery.”

What happens with Covid-19 will, of course, be the deciding factor, but given the clear multiplier effect moving house can have on the economy, keeping the housing market moving could play an important role in supporting any economic recovery.