Environmental, Social and Governance Factors in Forestry Investment & Management

Considering environmental, social and corporate governance (ESG) issues within the investment process has shifted dramatically over the past decade, from initially being the focus of a relatively limited number of ethical and socially responsible investors to the current widespread integration of ESG criteria into the mainstream investment community.

6 minutes to read

Forestry investors are exposed to a range of ESG factors and with discussions around reducing global carbon emissions in order to limit global warming, and the role forestry can play in mitigating climate change, it is widely expected that there will be an increase in institutional capital into the forestry sector.

Against this backdrop, Edward Holloway from our Rural Asset Management team in Bristol provides an overview of the importance of ESG issues and their integration into the forestry investment process, as well as the emerging products and strategies available to investors.

Introduction – what does ESG mean?

ESG stands for ‘environmental’, ‘social’ and ‘governance’ and refers to the three central factors used to measure the sustainability and ethical impact of an investment, company or business, enabling investors to base their decisions on how big a part these principles will play in a company’s long-term performance.

ESG is a broad concept which covers a variety of factors, the relevance of which largely depends on the sector in question. In terms of the real estate sector, this is likely to mean:

- Environmental factors such as climate change, energy efficiency and water scarcity;

- Social factors such as health and wellbeing of property occupiers and local communities; and;

- Governance factors such as diversity, business ethics, culture and reputation.

The consideration of ESG factors has become critical to the success of businesses across all sectors. Customers, employees, shareholders, lenders, rating agencies and regulators are demanding companies consider how their business impacts the world, their contribution to society and how they conduct themselves, and those not currently giving these factors their due consideration are beginning to lose customers, employees and financing. It is therefore imperative that businesses take note now and respond to these trends, before they become unviable.

Forestry Investment & Management

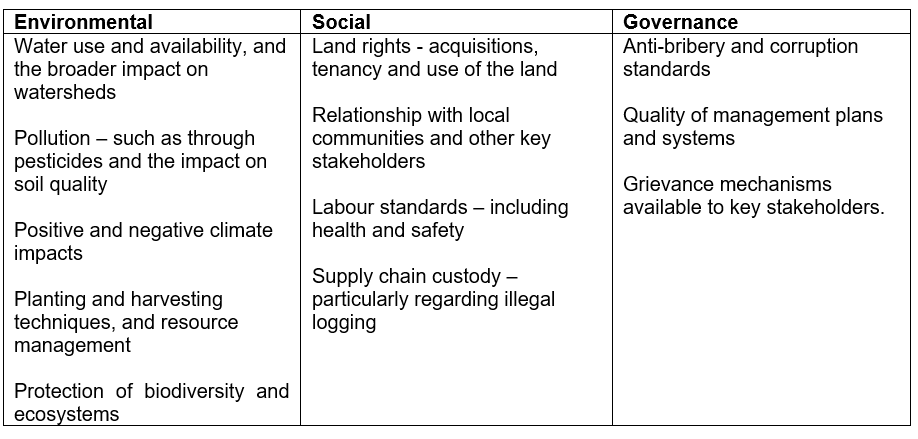

Forestry is a fast growing asset class in which investors are exposed to a wide range of ESG factors, the most prevalent of which are shown in the table below.

How these factors impact investments depends largely on the investor’s responsible investment approach – managed well, these factors manifest themselves as opportunities for value creation, but approached incorrectly or ignored, risks and liabilities arise that are likely to have a negative impact on investments. It is therefore imperative that ESG factors are properly integrated into the forestry investment process.

Integration

Forestry is a long-term investment, and given the different stages in a forestry investment’s lifecycle, ESG factors need to be taken into consideration across the whole as part of a holistic approach in order to be properly integrated.

There are various ways in which this can be achieved, the most tied and tested of which is certification, by which bodies such as the Forestry Stewardship Council (FSC) and the Programme for the Endorsement of Forestry Certification (PEFC) define and audit the operations of industry players to ensure conformity with sustainability standards. Many asset owners demand proof of certification and evidence that assets are management in accordance with standards prior to committing funds, meaning that certification has, in the main, led to better environmental and social practices within the industry.

That said, there are instances in which certification falls short of expectations and it is important to note that governance issues are not covered in-depth by the various certification schemes, resulting in the need for these factors to be assessed independently.

Carbon Sequestration and Offsetting

Forestry is becoming a key element in the discussions around reducing global carbon emissions in order to limit global warming. The 2015 Paris Climate Agreement and subsequent studies on the role that forestry plays in mitigating climate change, as well as the EU’s Actions Plan on sustainable finance, is expected to increase the level of institutional investment into the sector. Closer to home, the UK’s commitment to achieving net-zero emissions by 2050 has significant impacts on the nation’s future land use.

As a result, more forestry investment products and strategies, delivering market returns as well as environmental and social benefits, are likely to become available. A key development area is carbon offsetting.

The amount of carbon released into the atmosphere is a key topic of discussion among responsible investors and carbon sequestration is one of the best tools to combat climate change – forestry and woodland naturally absorbs and stores carbon from the atmosphere as trees grow, representing one of the few methods to store large amounts of carbon in a non-volatile form.

Caron offsetting is a tool by which the owners of forestry and woodland can seek to monetise the carbon being stored in their assets and make it a marketable asset. It works by trading carbon credits to a third party who might be looking to compensate for its own emissions elsewhere, therefore providing an additional income stream for the asset owner and allows the buyer the opportunity to meet net-zero targets and form part of its ESG reporting.

In support of this, the UK government launched the Woodland Carbon Guarantee (WCaG) scheme in England in November 2019. This scheme is aimed at establishing a public marketplace for carbon offsets through woodland creation, allowing farmers and landowners the option to sell Woodland Carbon Units (WCUs) to the government at a fixed price, determined six-monthly auctions. This allows the asset owners to bid the minimum price at which planting becomes a financially viable option to compete with alternative land uses.

Woodlands must be registered with the Woodland Carbon Code (WCC) in order to be eligible. The WCG scheme provides a carbon standard for woodland projects and the amount of carbon sequestered in them and once in the scheme, the asset owner has the ability to decide whether to sell the carbon to the government when the carbon is verified every five or ten years. The alternative is to sell the carbon credits on the open market, although the downside of this is that the prices are not fixed and can be volatile.

Conclusion

Institutional investors have a duty to act in the best long-term interests of their beneficiaries, a fiduciary role which requires an understanding of the environmental, social and governance issues that can affect the performance of investment portfolios.

Given the wide range of ESG factors faced by forestry investors, and the emerging carbon trading market, it is expected that forestry as an asset class will continue to grow as responsible investors seek to ensure they are investing in credible and viable assets. Richard Kelly, Director of Foresight Group, when interviewed for Knight Frank’s Rural Report 2020 stated that “with the increasing importance of ESG considerations, we expect to see substantial institutional appetite for the coming wave of UK afforestation investment opportunities.”