UK Property Market Outlook: Week Beginning 28 September

The prime minister has warned of a difficult six months ahead due to Covid-19. Below are six key issues for the UK property market as winter approaches.

4 minutes to read

Images of empty toilet roll shelves last week show how the national mood has become more jittery in recent weeks.

Localised cases of panic-buying followed the government’s warning of a difficult six months ahead as it attempts to contain the Covid-19 pandemic.

For the UK property market, it is reasonable to assume the unadulterated positivity of the last four months won’t be replicated between now and January.

Events are too fluid to draw any firmer conclusions but here are six key considerations for the UK property market this winter.

First and foremost, sentiment will remain crucial.

We learned last week that a summer surge in consumer spending tailed off in September. A range of other indicators, including cinema bookings and pub footfall, also point to an autumn slowdown. Furthermore, business activity fell in September, underlining how a slowdown had begun even before Boris Johnson announced tighter restrictions last week.

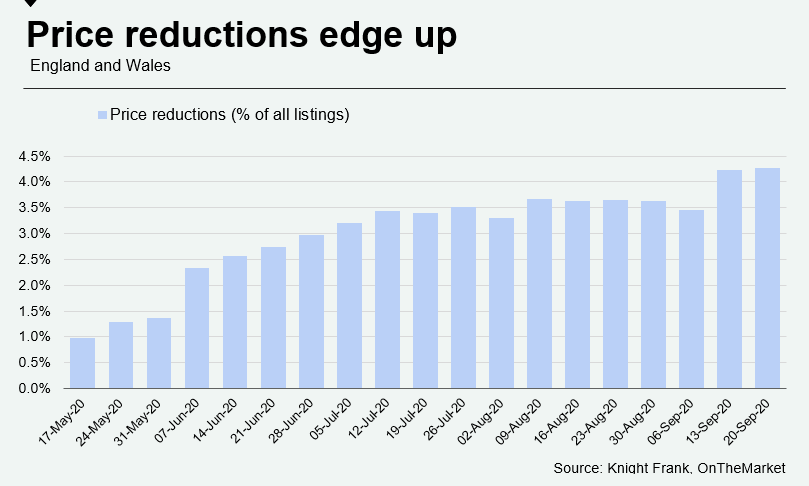

It has been a similar trend in UK property markets. The number of price reductions as a percentage of all listed properties rose above 4% in September, as the chart below shows. It wasn’t a significant increase but it demonstrates how there is a flicker of nervousness in the property market as summer turns into autumn.

Lenders have been feeling the same edginess for a while. The average rate on a two-year fixed-rate mortgage at a 95% loan-to-value rose to 3.9% in August from 2.7% in July. By September, deals at such high loan-to-value ratios had become scarce as lenders focussed on lower-risk lending.

Buyers in higher price brackets typically face fewer mortgage constraints and respond more quickly to external events. If lending criteria tighten, prime markets may benefit. A relaxation of international travel restrictions would only amplify this effect.

The Chancellor’s support package for employers announced last week will help cushion the impact as the furlough scheme ends, but the national mood is clearly turning more sober due to the possibility of a worsening economic backdrop.

The second consideration for anyone attempting to anticipate the trajectory of the property market is that more buyers and sellers are accelerating plans due to the potential for tighter Covid restrictions as well as weaker economic news. This could eventually produce a natural tail-off in activity even if the market remains open. There is evidence Covid clauses are again being inserted into contracts more frequently, demonstrating how the urgency is being matched by caution.

Third, although the ebullience of the summer may be fading, there is still huge momentum in the property market. Inherently long lead times for buying property will sustain this momentum, as will the stamp duty holiday.

The number of offers accepted across the UK in the week ending 19 September was 154% ahead of the five-year average, underlining how activity won’t come to a sudden halt should the market remain open.

Fourth, the chances of positive news around a vaccine or treatment are rising as trials get closer to completion. There have been predictions of a run on concert tickets and restaurant bookings should the scientific news improve. While this can’t be relied upon, an acknowledgment that sentiment could change quickly may help inform the decision-making process for buyers and sellers.

Fifth is Brexit. Four years from the vote, the concern for financial markets and the property market remains the same; the no-deal cliff-edge. This year has mirrored 2019 in many ways though Brexit remains lower down the news agenda due to the pandemic. Its significance will spike around key dates in the calendar, including the end of the transition period in December. The combination of a no-deal Brexit and a pandemic may deter some buyers and sellers. Some economists argue that this combination is precisely why some form of pragmatic solution will emerge, even if it is one that merely avoids a cliff-edge.

Finally, it is worth remembering the strength of the fundamentals. Price growth has been modest for much of the country in recent years and prices in many prime markets have fallen in excess of 10%. Interest rates will remain ultra-low and the cheap cost of debt is driving a significant amount of activity. It is one of the reasons we don’t believe double-digit price declines will occur, as set out in our latest five-year forecast here.