Walkability: quantifying the 15-minute city

The idea of the 15-minute city has generated a huge buzz across property and politics amid a wider rethink of how we build and manage cities post-pandemic

1 minute to read

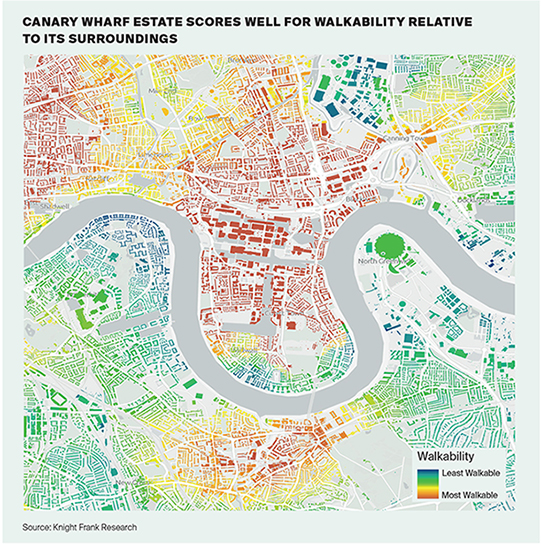

We developed an Urban Walkability Tool, allowing different markets or buildings to be benchmarked and scored based on their existing access to amenities. For real estate investors, the value of this research lies in gaining a better understanding of what people want from their surroundings in order to develop desirable offices and homes of the future.

We discussed the growing popularity of the 15-minute city in our London Report 2022 applying the Walkability tool to seven central London sub-markets. By analysing more than 140,000 Ordinance Survey AddressBase points, and identifying 9,000 amenities of interest for walkability, ranging from culture to education and retail space, the research concluded that those markets with a good balance of office, retail and residential space also drive value-adding weight to the argument that successful places of the future will be mixed-use, mixed-income, walkable places that create strong communities.

Indeed, the two Central Business Districts (CBDs) with a good mix of office and residential properties that score well for walkability, South Bank and Kings Cross/Euston, have registered office rental growth at twice the average of the overall London market. Both markets also maintain below-average levels of availability, with substantial gains in property values.

Additionally, walkable neighbourhoods promote healthy and sociable lifestyles, build communities and can help developers and investors meet their ESG targets, an increasingly urgent criteria as the UK faces up to a decarbonised future.

Download the ESG Report 2022