How tighter regulation will impact office markets

Sustainability will be a principal objective for organisations in 2022, with tighter regulations and reporting meaning more measurement, more management and a shift in real estate focus. But what will be the impact on office markets across UK cities?

1 minute to read

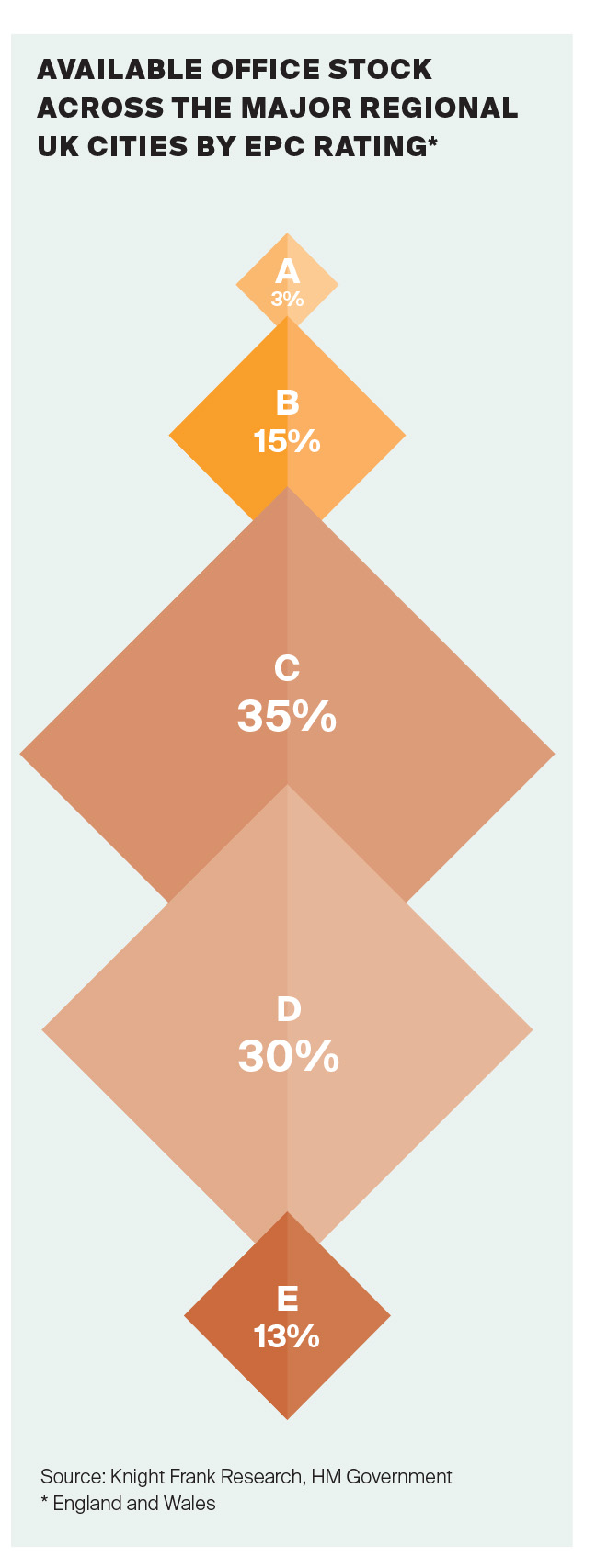

The regulatory framework to decarbonise real estate is tightening across the UK, with a review of buildings Minimum Energy Efficiency Standards (MEES) targeting a minimum EPC rating of B for offices in England and Wales. We investigated how many office buildings across the major regional UK cities would be affected if that minimum requirement was enforced today and outlines the findings in Clean, Healthy and Green.

Unless there is a substantial change in current EPC ratings across office buildings, the market implications of these tighter regulations combined with the growing demand for top-rated office space will be significant. The research found that 82% of office stock being marketed in the major UK regional cities in December 2021 would fail to meet the proposed minimum rating. This means that refurbishment activity is sure to rise in the lead up to 2030, with offices where works are deemed economically unviable, subject to a change in use.

Further analysis also discovered that 80% of office space currently occupied by leading listed UK companies fell short of an EPC listing of A or B. Consequently, a rise in corporate office moves is sure to follow compounding the pressure of supply, as businesses increasingly target the best-rated buildings to fulfill corporate ESG ambitions.

The built environment and cities have a key role in helping achieve net-zero. Cities account for 70% of global emissions and currently, four in every five Britons live within a city region. The rent inflation already seen in London as businesses compete for best-in-class assets looks likely to be mirrored countrywide as the supply of available office space falls and demand increases. Investing in ESG will differentiate landlords’ buildings and offer a more attractive investment proposition.

Download the ESG Report 2022