UK residential market: prime property markets resilient in face of higher interest rates

With the impact of the mini-Budget fading, ironically it is the strength of the UK jobs market that is acting as the main drag on the UK housing market.

3 minutes to read

The increase in core inflation, which is largely driven by wage growth, from 6.8% to 7.1%, resulted in a worried Bank of England opting for a half point rise that took the base rate to 5% in June.

This is the highest level since 2008 and will continue to feed into higher borrowing costs, with many 2-year fixed-rate mortgages above 6%.

For the 1.4 million re-mortgaging this year according to the government, it means a significant increase in monthly repayments, which will squeeze strained household spending further.

Monthly mortgage approvals are a quarter lower than before the pandemic as buyers adapt to higher rates in a volatile market.

It means UK house prices will come under growing pressure given how much higher rates are compared to 18 months ago and we expect a 10% decline in UK prices by the end of 2024.

However, when stability returns, we think demand will prove more resilient than expected given the cushioning effect of strong wage growth, record levels of housing equity, amassed lockdown savings, and the availability of longer mortgage terms.

Prime London

That said, the prime London market is proving resilient.

The economic mood has darkened, but the market is far from grinding to a halt. The number of new prospective buyers in London over the most recent four-week period was 24% above the five-year average.

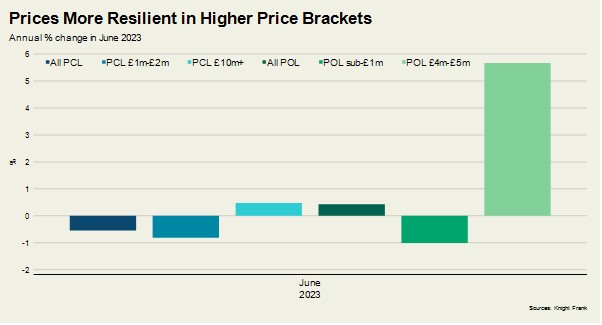

The resilience is perhaps no surprise given that around half of sales inside zone 1 are typically in cash. Higher price-brackets have certainly proven more robust as activity tends to be less reliant on mortgage debt, as the chart shows.

London Lettings

Uncertainty in the sales market means the story of low supply in the prime London lettings market appears to be coming to an end.

It means more owners are letting out their property after failing to achieve their asking price.

The number of new prospective tenants registering was 31% above the five-year average in May, underlining the strength of demand from students and businesses.

On the supply side, the combined number of lettings listings in PCL and (Prime Outer London) POL was the second highest level since September 2021, Rightmove data shows.

As a result of the imbalance between supply and demand becoming less pronounced, annual rental value growth in PCL fell to 14.4% in June, the lowest level since October 2021. In prime outer London, a figure of 12% was the lowest over the same time-period.

Prime regional markets

Transactional activity remains subdued outside of London, having not fully recovered from the mini-Budget.

Prospective buyers are still active in the market but are understandably hesitant against the backdrop of the higher interest rates. The fading ‘escape to the country’ trend, which fuelled the property boom outside of London after the first pandemic lockdown, is another factor moderating demand.

Offers made were down by almost 20% in May versus the five-year average (excluding 2020) despite supply levels recovering from pandemic lows. New sales instructions remained ahead of the five-year average in May as they have done since February, suggesting further downwards pressure on prices this year.

Read more or get in contact: Tom Bill, head of UK residential research

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here