Housing policy takes centre stage

Signs of resilience for new homes as new housing supply falls.

4 minutes to read

All signs point to housing being a central issue in the next general election. Over the past month, housing policy has jumped up the political agenda.

Reinstating housebuilding targets, opening up (or protecting) the green belt to more development, and reviving Help to Buy are all options which have been mooted by the two main political parties in recent weeks. Other proposals include higher stamp duty for overseas buyers and limits on international sales for new UK developments.

A renewed focus on the sector and a recognition of the role supply-side reforms and demand initiatives can play in supporting economic growth is no bad thing, particularly given the current policy vacuum and uncertainty that exists.

However, the limit to what the government can do to support a sector that is largely demand-led is explored here.

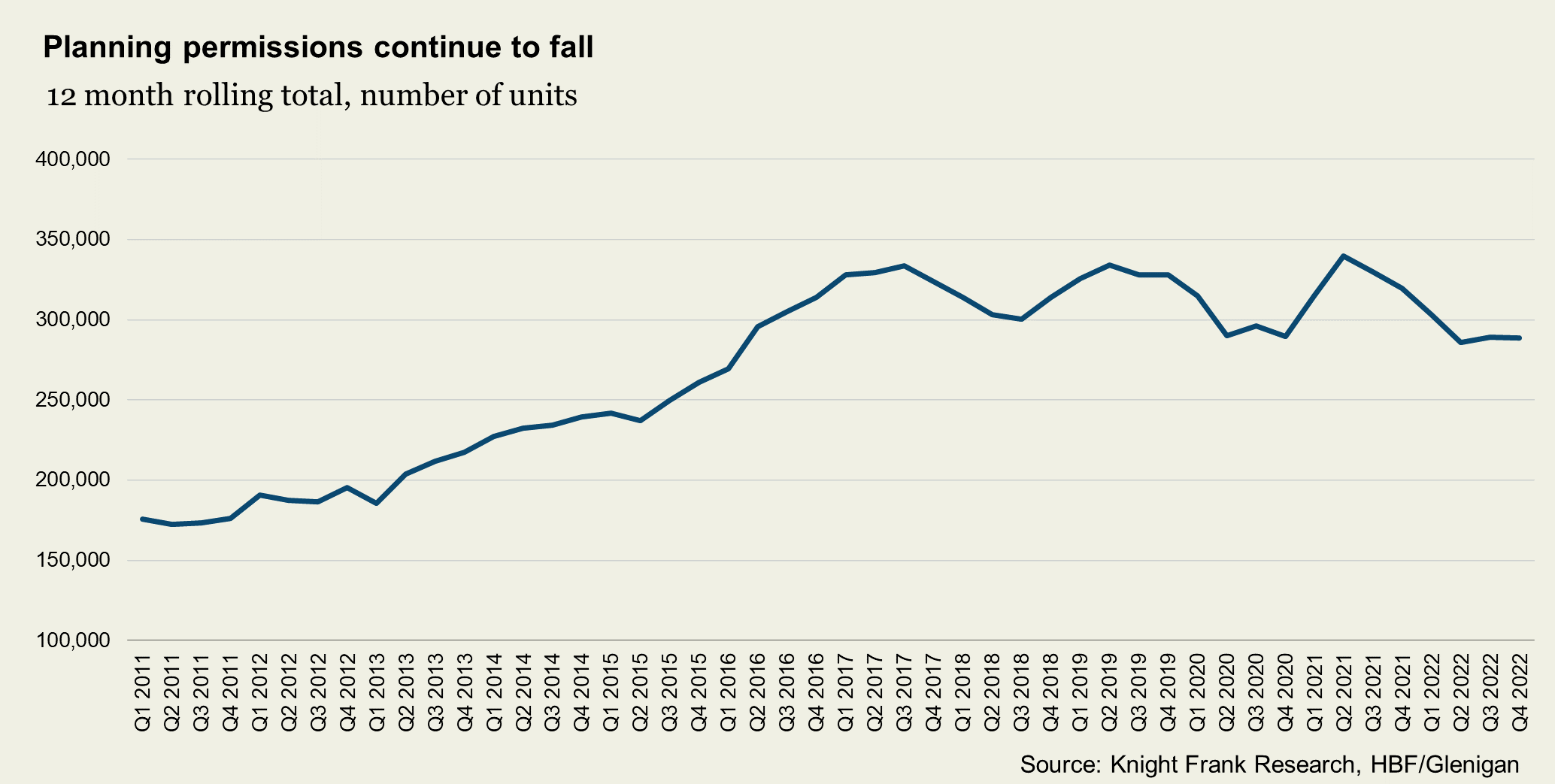

Figures from Glenigan and the HBF show that in Q4 the number of housing projects granted a planning permission fell below 3,000 for the first time since the data set was started in 2006. On an annual basis, the total number of homes granted full planning permission fell to 288,440, a 10% decline on the previous year. The impact of the mini-Budget on the sector is clear.

Uncertainty over proposed reforms to the planning system, water and nutrient neutrality delays and the scrapping of mandatory housing targets are all causing considerable disruption, including to the willingness of some local authorities to progress their local plans. This is holding up development as it has slowed down the number of allocated land sites coming forward, creating more competition amongst housebuilders.

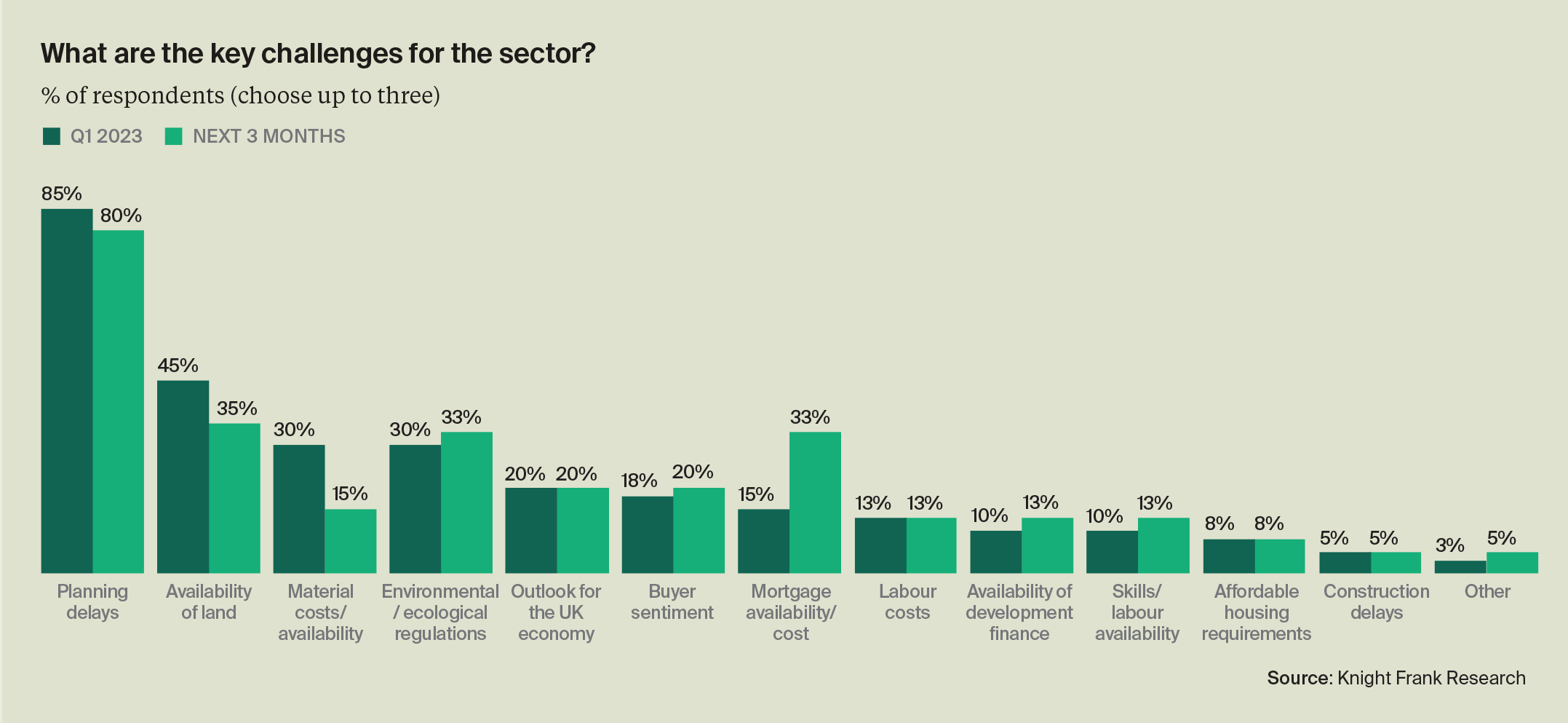

Some 85% of respondents to our Q1 survey of volume and SME housebuilders cited planning delays as the greatest challenge for their business in Q1, up from 73% in Q4.

Clarity and more supportive planning policy will help support an increase in much needed planning permissions which, in turn, will pave the way for more homes to be delivered. However, it will need to be matched by sufficient end-user demand. That depends on the state of the economy and the mortgage market. The outlook for both is one reason why some large housebuilders have recently scaled back plans.

Indeed, a third of respondents to our survey said mortgage availability and cost will be a key challenge for the sector in the coming months. Lenders approved 52,011 mortgages for house purchases in March, up from a low in January, but still below pre-pandemic averages.

The net result is that the latest supply-side indicators make for dire reading. Energy Performance Certificate (EPC) data suggests just 54,575 new homes were completed in Q1 2023, a 20% decline on the previous quarter. In London, completions were 25% down year-on-year, while new starts dropped 43%, according to Molior. Data from Glenigan points to a 44% fall in starts on site during the three months to the end of April compared with a year ago.

As we’ve discussed previously, a combination of higher interest and mortgage rates, still elevated build costs and the ending of Help to Buy all represent significant headwinds to both supply and demand.

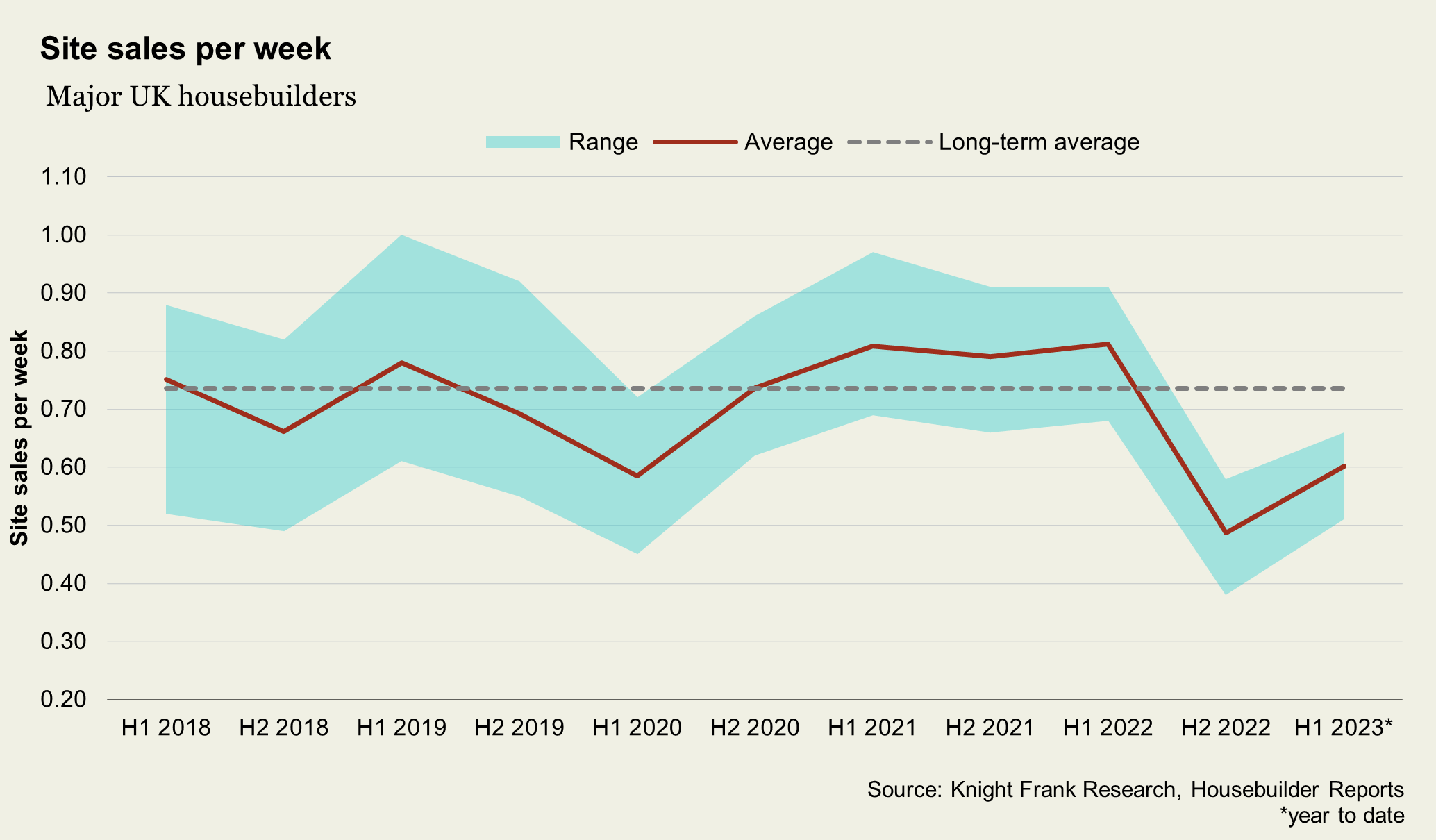

Despite this, there are signs the new homes market is proving resilient. Trading updates from the major listed housebuilders all point to sales rates picking up so far this year, with little evidence of price cuts (albeit there are a higher number of incentives on offer for buyers).

It is early days, but it suggests the new homes market will fare better than the scenarios set out in our wider housing market forecasts.

Unlocking opportunities in the Living Sectors

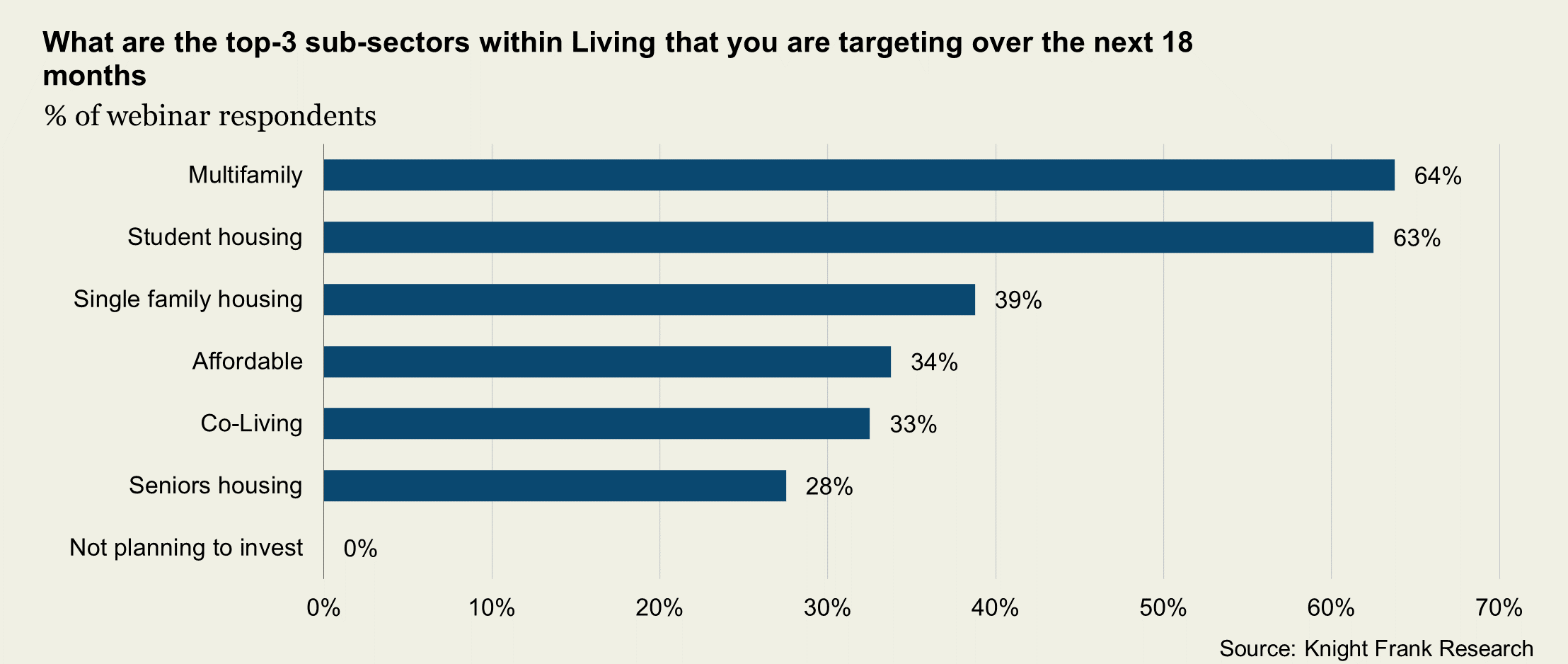

The Living Sectors, encompassing residential for rent, purpose-built student housing and age targeted seniors housing, continue to take an even greater share of overall commercial real estate investment globally. Increasing global capital flows have been fundamental to this growth, with cross-border investment into Living Sectors having risen 223% globally from 2012 to 2022.

With such an unprecedented pace of change, our latest Active Capital webinar examined the Living Sectors in more detail. We asked attendees which sub-sectors within Living they were targeting over the next 18 months, with Multifamily and Student markets coming out top. You can watch the full webinar on-demand.

Photo by James Feaver on Unsplash