Housebuilders back in the market for land, planning delays and gauging student sentiment

Residential development update.

3 minutes to read

Delayed payments

UK housebuilders are back in the market for land after a hiatus in the aftermath of the mini budget. However, they are navigating more challenging circumstances as house prices are easing, while build and labour costs remain high.

That’s the message from our Development Land Index, due for release next week (sign up to receive a copy here). The report also features the results of our quarterly survey of volume and SME housebuilders across the UK. In total, 73% said they are looking to defer payments for land, mostly over a one-to-three-year time period.

Cost pressures

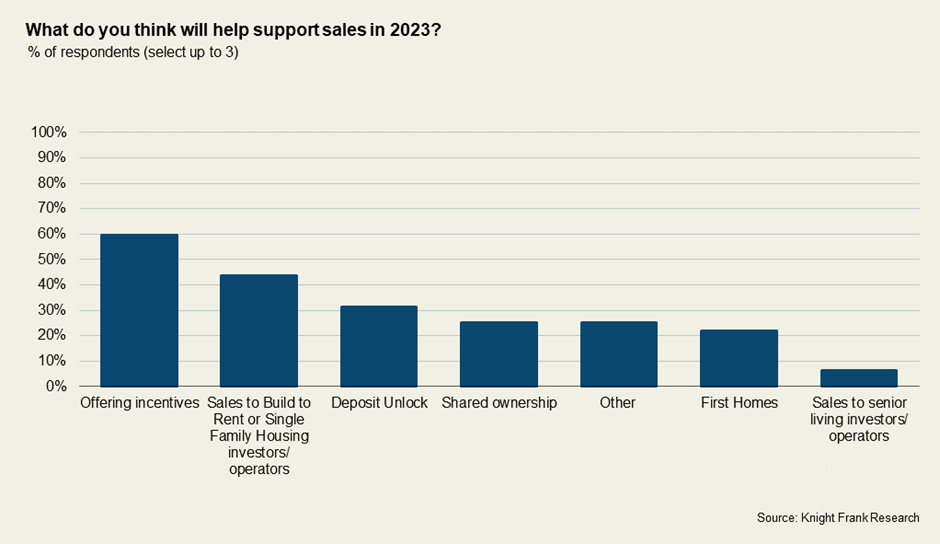

In the absence of sales supports such as Help to Buy, which officially closed to new applications in October, just under 60% of survey respondents said they expected offering incentives would help support sales volumes in 2023. A third said they were seeking partnerships or bulk sales deals with institutional investors in the Build to Rent sector this year.

While the larger players are being highly selective, SMEs are cutting profit margins to compete for land. Indeed, more than half of SME respondents, those building up to 100 units in their region, said they had cut their profit margins when bidding for plots of land in Q1, whereas 60% of those building upwards of 100 units said they either increased their profit margins or made no change to them.

Our survey found that build costs had a ‘significant’ impact on 48% of respondents’ businesses in Q1, down from nearly 60% in Q4. Build costs are expected to stabilise as construction supply shortages are easing. Overall, the Build Cost Information Service (BCIS) is forecasting build costs to increase 4.2% this year, down from a jump of 11.6% in 2022.

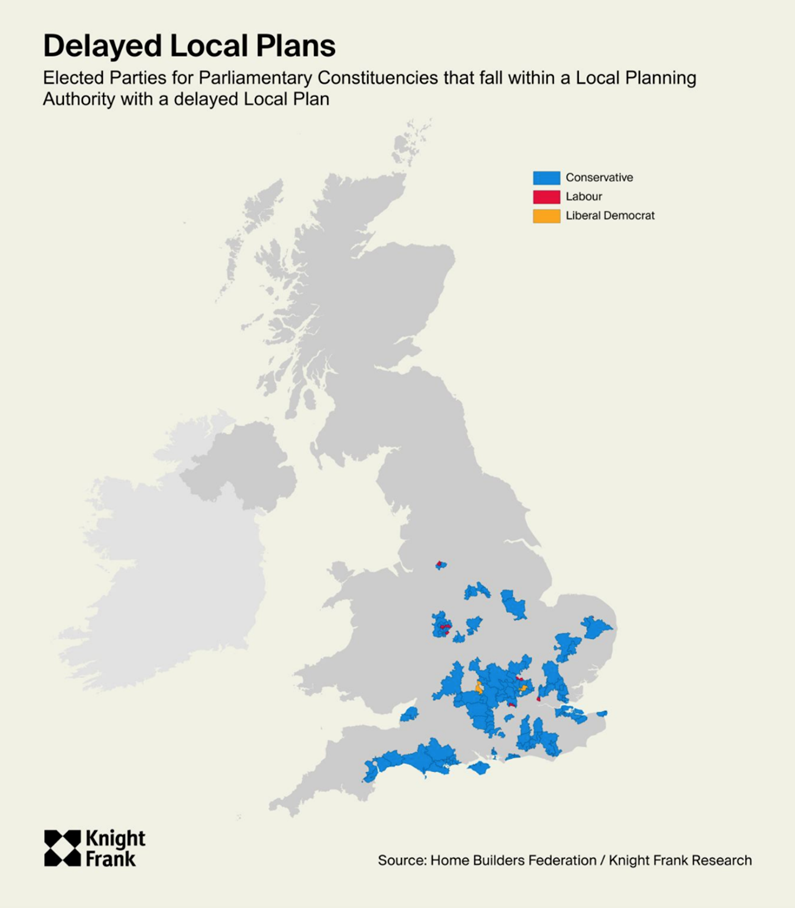

Local plans shelved

Local authorities are facing considerable disruption in progressing their local plans. This is holding up development as it has slowed down the number of allocated land sites coming forward, creating more competition amongst housebuilders.

There are a number of factors contributing to the delays, but the main issues include the government’s numerous proposed reforms to the planning system, water and nutrient neutrality delays and Michael Gove’s move last year to scrap mandatory housing targets. So far, 55 local authorities have withdrawn or paused their housing delivery plans, including 17 since Gove’s intervention in December, according to the House Builders Federation (HBF).

Our Knight Frank geospatial projects lead Cameron McDonald has worked with the HBF to track the geographic spread of the authorities affected. The analysis, covered in detail by the Telegraph, includes an overview of how those authorities intersect with local political control.

From a development perspective, it’s clear that the removal of firm housing targets and the uncertainty around planning reforms has given local politicians in some areas the perfect excuses to postpone, delay and revisit Development Plans. It’s a short termist approach to plan making that is going to have significant longer-term implications, particularly given the geographic spread clearly sits in areas where housing demand and affordability are most stretched.

Student sentiment

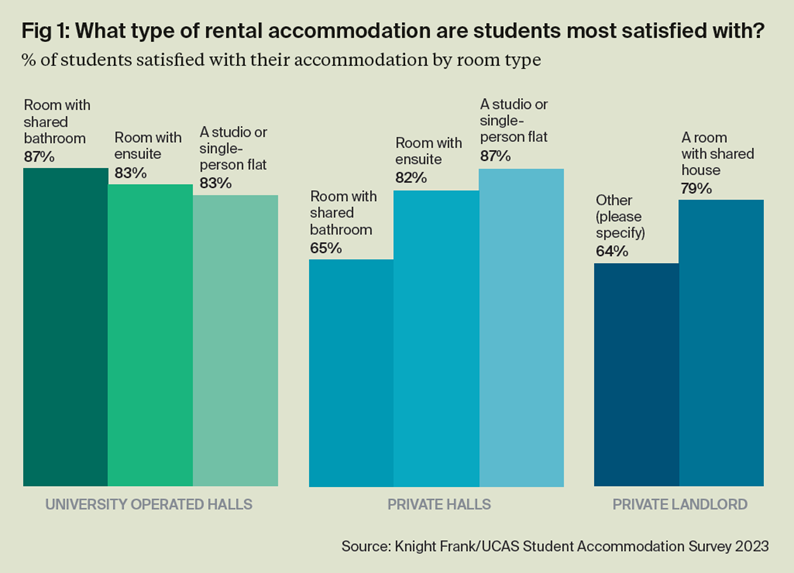

We’ve talked before about how, in turbulent times, investors are finding confidence in the counter-cyclical nature of the student sector, and the structural deficit of purpose-built accommodation in most UK cities. It’s timely, then, that today sees the launch of our fourth Student Accommodation Survey, undertaken in partnership with UCAS.

This year we received more than 20,000 responses from both current and new students across the UK giving a unique insight into the preferences and concerns they have when it comes to their housing requirements. The results points to affordability being the number one issue facing students when it comes to accommodation, with ‘cost’ identified as the most important factor influencing decisions on where to live, overtaking ‘value’ in last year’s survey.

Even so, the majority of students continue to report that they are satisfied with their accommodation, with those living in purpose-built accommodation the most satisfied. You can read the full report here.