International residential property: soft or hard landing?

As global housing markets feel the pinch of higher interest rates, we assess which markets are experiencing the biggest slowdown.

3 minutes to read

Global housing markets are entering a new cycle as interest rates in some advanced economies reach levels not seen for 15 years.

House price slowdown

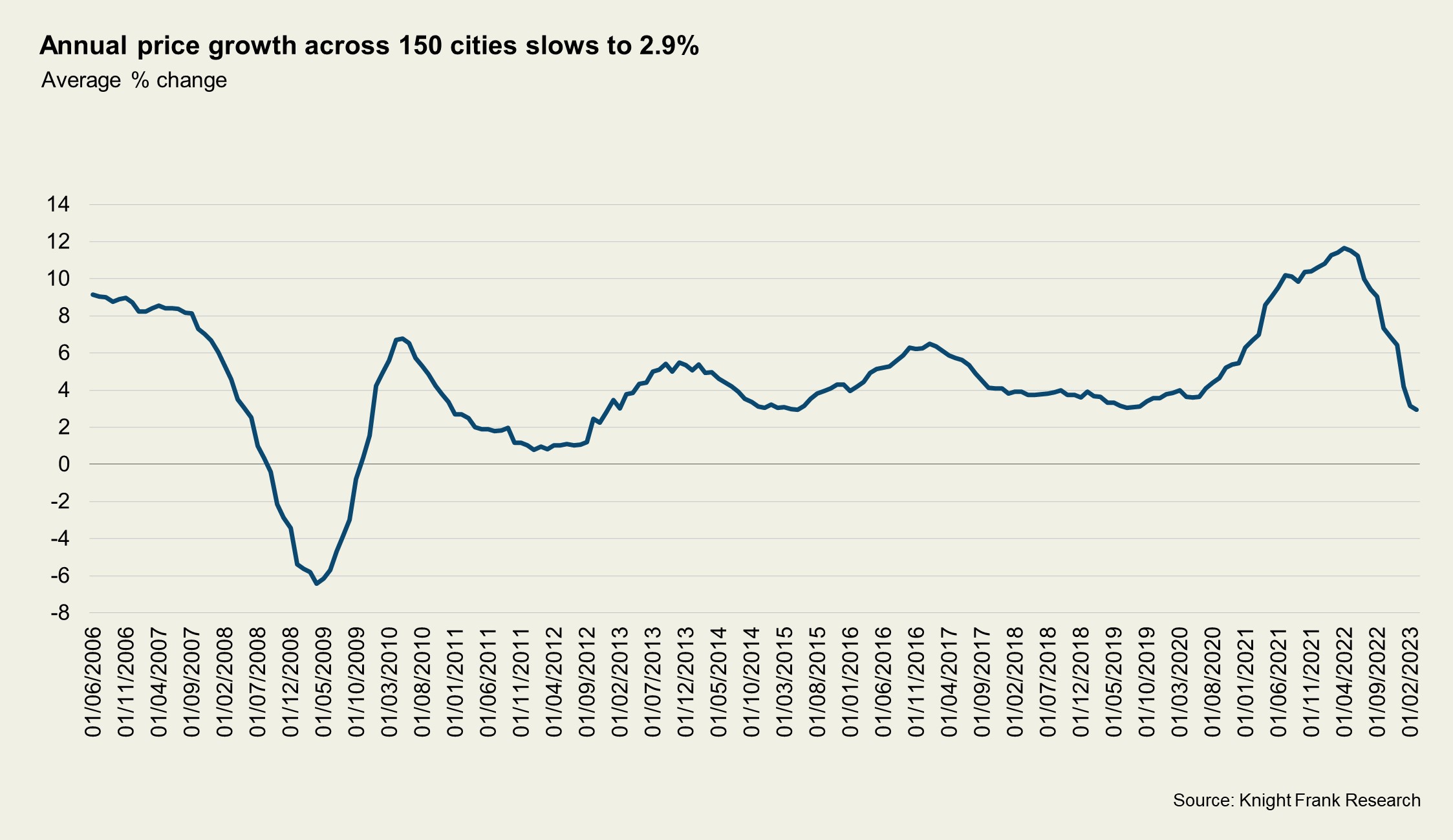

Prices are now declining on an annual basis in 36 of the 150 cities we track in our Global Residential Cities Index and average annual price growth has dipped from a high of 11.6% in March 2022 to 2.9% in March 2023.

The prime segment is displaying greater resilience. Our latest Prime Global Cities Index sees 33 of the 45 cities tracked registering a decline in 2022.

Talk of rate cuts in 2023 looks premature, as the latest inflation figures in advanced economies remain stubbornly high.

South Korea, Hong Kong SAR, New Zealand, Australia, Finland, and Sweden are currently seeing the biggest price corrections due to a range of factors, amongst them consecutive rate rises, a lack of affordability and a high proportion of households on variable rate mortgages.

Some markets are displaying greater resilience, however, as labour markets remain strong, a lack of supply and improving consumer sentiment cushion prices.

Prime central London and New York missed out on the double-digit annual rates of growth most other global cities saw during the pandemic. But like in 2008 their safe haven credentials are coming to the fore.

For New York, a resurgent safe haven play due to economic headwinds, a strong rental market and a desire amongst overseas investors to have greater exposure to the dollar is seeing prime price growth remain in positive territory.

Plus, currency shifts due to aggressive tightening in markets like the US will present cross-border opportunities for some.

In London, supply levels are slowly ticking upwards from the tight conditions witnessed during the pandemic which is helping to generate some traction in the market. Meanwhile, sterling’s weakness , mainly due to strength of dollar and cost of living crisis which is leading to weaker consumption, and the high proportion of cash buyers is supporting demand.

Global mobility

The wealthy are increasingly on the move. Locked down for years during the pandemic, there is a growing appetite to travel or relocate on a semi-permanent basis.

The Wealth Report reveals that 13% of the wealthy are looking to obtain a second passport or citizenship in 2023, a figure that rises to 16% amongst Asian ultra-high-net-worth individuals.

But this is happening at a time when some policymakers are pulling up the drawbridge.

The world is increasingly polarised with some countries looking to attract investment and overseas buyers via visa, family office initiatives or flat tax initiatives (Dubai, Singapore, Italy), while others are looking to deter such inflows by ending Golden Visa programmes and introducing foreign buyer bans (Portugal, Ireland, Canada).

This means it will be a more complex landscape for the wealthy and their advisors to navigate. Changes announced to date in 2023 have come with little warning.

Unlike in 2008, new visa initiatives are not linked to property acquisitions, instead the focus is on job creation, innovation or capital investments as governments come under increasing pressure to tackle housing affordability and plug pandemic-induced deficits.

Digital nomad visas that popped up during the pandemic as tourist-deprived markets looked to stimulate their local economies with a new intake of untethered freelancers, tech and creative types are gathering pace with Spain recently launching its own version, offering non-EU residents a means of circumnavigating the post-Brexit 90/180-day rule.

How will global house prices perform in 2023?

International housing markets are facing their most significant headwinds since the financial crisis.

But the volatility in alternative asset classes, be they stock markets or crypto, is reaffirming the credentials of bricks and mortar.

We’ll be revisiting our prime price forecast in June but for now we’re expecting prime prices across the 25 cities we track to record a 2% uplift.

Dubai and Miami lead the rankings, but European Cities are also expected to surprise on the upside as their relative value comes into focus.

Read the full forecast.

Read more from Kate or get in contact: Kate Everett-Allen, head of international residential research

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here