The ECB limbers up

Making sense of the latest property and economic indicators from across the region

3 minutes to read

1. All eyes are on the ECB

All indicators point towards the European Central Bank (ECB) taking the bold step of initiating interest rate cuts during its forthcoming meeting on June 6th, a move expected to invigorate market sentiment and bolster sales volumes.

Yet, European policymakers must navigate a nuanced landscape, with sticky inflation in the US and UK likely to cause policymakers headaches.

While a pre-emptive rate cut by the ECB may initially elicit positive reactions, the Financial Times articulates three pivotal risks looming over the Eurozone.

Firstly, the potential devaluation of the euro could inadvertently stifle inflationary pressures.

Secondly, such a manoeuvre might signify the ECB's apprehension towards anticipated economic fragility.

Lastly, there exists the peril of compromising the ECB's credibility should inflationary forces emerge in the wake of this decision.

Despite the conceivable repercussions of a weaker euro on import costs, prime residential markets stand to benefit from the potential windfall of larger discounts for foreign buyers in the imminent future.

According to projections by Capital Economics, the USD/EUR exchange rate may undergo a shift from its current 1.08 to 1.06 by year's end.

2. Madrid emerges as Europe’s frontrunner

Prime primes in Madrid rose 7.6% during the twelve months through to March, according to Knight Frank's Prime Global Cities Index, out last week.

Europe witnessed a mere 0.5% uptick on average across its urban landscapes, a stark contrast to the more buoyant figures of 4% for the Americas and 5.7% for Asia.

This subdued performance can be attributed to weak economic growth coupled with the fact that interest rates in the Eurozone now sit at a 23-year high, effectively curbing demand but set against a backdrop of constrained supply prices have remained largely stable.

The pivot in rates, when it comes, will undoubtedly spark stronger transaction volumes and bolster liquidity in key European markets.

3. Choose France

France is firmly back in the global spotlight.

President Macron’s exclusive interview in The Economist coupled with his “Choose France” summit this week at the Palace of Versailles has captured headlines, and all this before the Paris Olympics get under way in July.

The "Choose France" event, which saw 180 CEOs and executives attend the summit, unveiled 56 projects amounting to more than €15 billion ($16.2 billion) of investment, topping last year’s €13 billion.

Microsoft plans to spend €4 billion building cloud and AI infrastructure in France, Morgan Stanley, which has already increased its Paris headcount to about 400 staff from 150 since 2021, will add 100 more employees and Amazon said it would invest €1.2bn ($1.3bn) in the country.

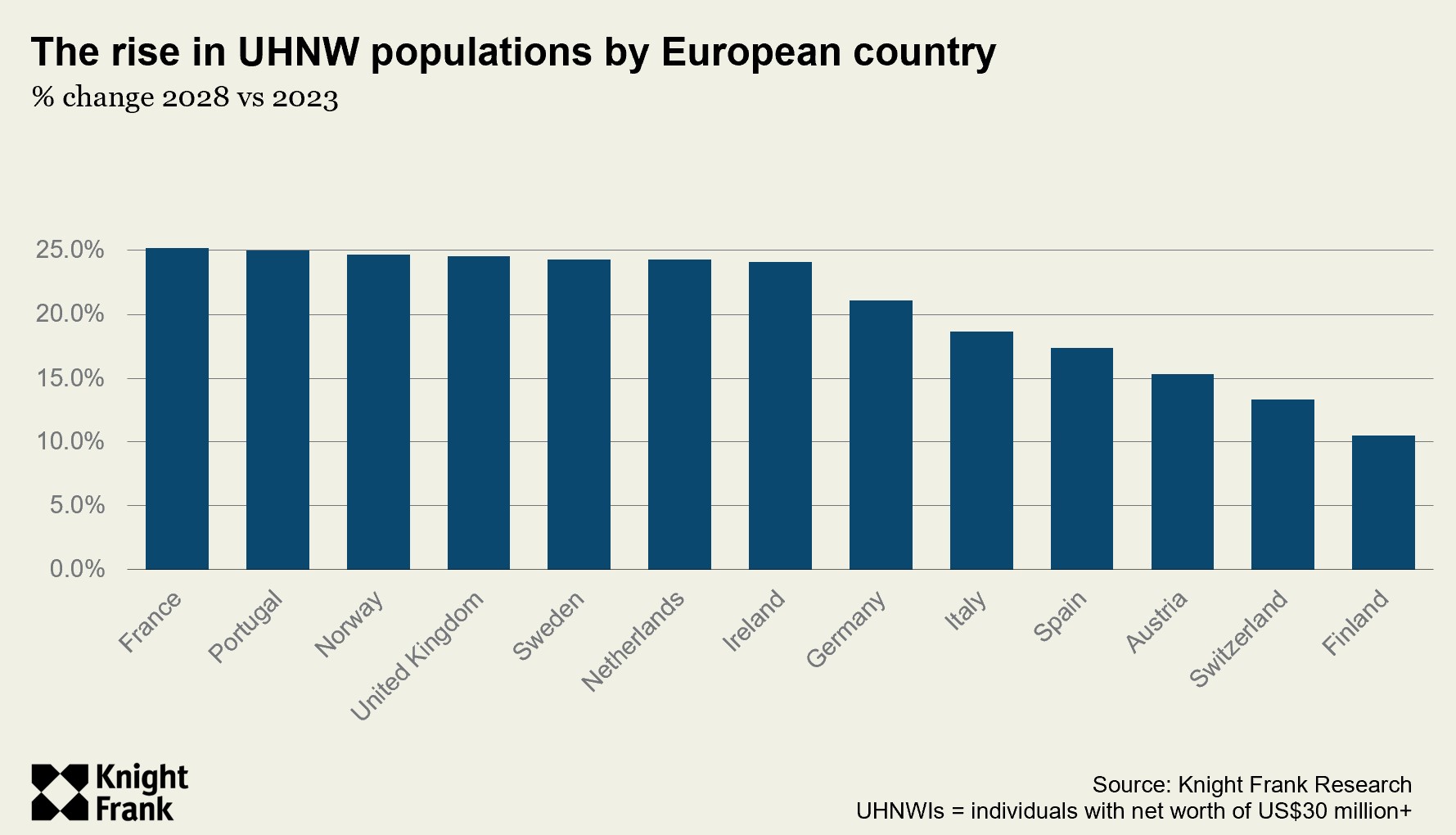

This scale of investment and Macron’s assertion that he has succeeded in making France more competitive on the global stage, reducing corporate taxes and cutting red tape chimes with findings from The Wealth Report 2024 which reveals the number of ultra-high-net-worth individuals calling France home is set to increase by 25.2% over the next five years, above that of Germany and the UK.

In other news...

The Balearic Islands has made changes to its wealth tax and ahead of Europe’s parliamentary elections in June the Greens are calling for an EU-wide tax of up to 3.5% on the top 0.5% of wealthiest individuals (Bloomberg).