Why Madrid is Europe's best kept secret

A robust economy, positive outlook for house price growth and low purchase costs point to Madrid being one of Europe’s best-kept secrets.

3 minutes to read

On a recent visit to Madrid to launch The Wealth Report 2023 I was struck by two things: its vibrancy and greenness.

Returning to my desk and digging into the data it seems my impression was spot on.

The city is investing heavily in its green infrastructure and its economy is proving highly resilient.

Roof terraces abound, in part a response to pandemic-driven lockdowns, and plane trees now line many central streets.

But the city has even more ambitious plans. A new 46-mile (75-km) forest perimeter comprised of almost half a million trees is set to be planted, absorbing around 175,000 tonnes of carbon dioxide each year to help improve the city’s air quality.

In terms of the city’s economics, Oxford Economics (OE) neatly sums it up, “The prospect of a technical recession was very much a possibility for the Spanish capital at the onset of 2023. However, these concerns have eased considerably through H1 2023, with Madrid's economy displaying a great deal of resilience amid a very challenging European economic backdrop.”

Madrid’s GDP is set to rise by 2.2% in 2023 according to OE, that compares to 0.8% for London and 1.1% for Paris.

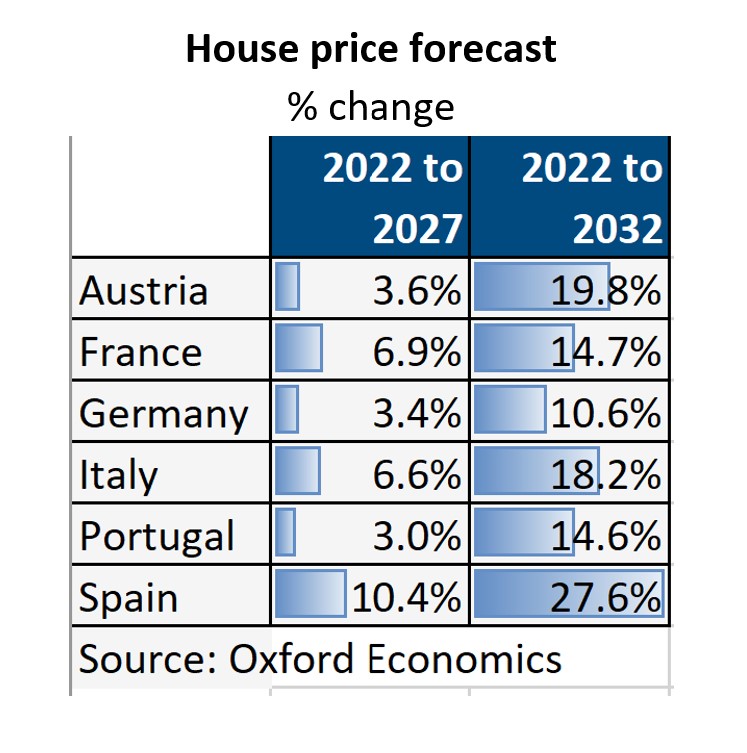

This resilience is also mirrored in the country’s house prices. Average prices across Spain will rise by 10.4% by 2027 and by 27.6% ahead of 2032, outpacing many of its European counterparts, according to OE.

The prime segment is also set to outperform. A sneak preview of our prime price forecast, set to be released in early August, reveals Madrid’s predicted performance puts it in joint fourth place out of 26 cities in both 2023 and 2024.

Under the radar

Based on the city’s lifestyle, large-scale investment in sustainable living, relative low cost of living and economic resilience, I’m non-plussed by the city’s low profile amongst European buyers.

I put this to Mark Harvey, Knight Frank’s Head of International, “I think Madrid is one of Europe’s best-kept secrets. The Latin Americans have the city firmly in their sights, but it seems to have passed some Europeans by, most notably UK purchasers, that they have a jewel on their doorstep.”

Value

Madrid is highly competitive on price. For a foothold in one of the city’s top districts of Salamanca, Chamberí, Jerónimos, Almagro or El Viso, a buyer would expect to pay circa €8,000 per sq m, this compares to €21,000 in central Paris or €13,000 in Berlin.

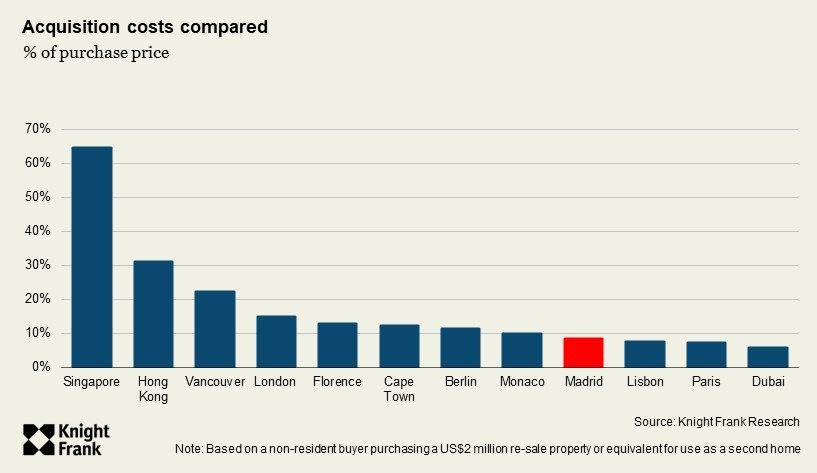

At around 9% of the purchase price, buyer costs are relatively low for non-residents compared to the global average, with no additional stamp duties or annual charges for foreign buyers.

Overseas demand

One in four prime homebuyers in Madrid originate from overseas according to Knight Frank data.

Carlos Zamora, Knight Frank’s Head of Residential in Madrid, explains: “In 2022, Madrid saw 8,000 sales above €3 million, an increase of 55% compared to the previous year, that equates to 2,000 sales to overseas buyers.”

Carlos adds, “Mexicans, Colombians, Peruvians, Chileans, Argentines, French, British and even North Americans are the most active.”

The dollar/euro exchange rate has driven stronger demand from US and US-dollar denominated buyers since the pandemic.

The city ticks numerous boxes for foreign buyers, from culture and language to climate, accessibility, lifestyle and increasingly, Madrid’s superior build quality.

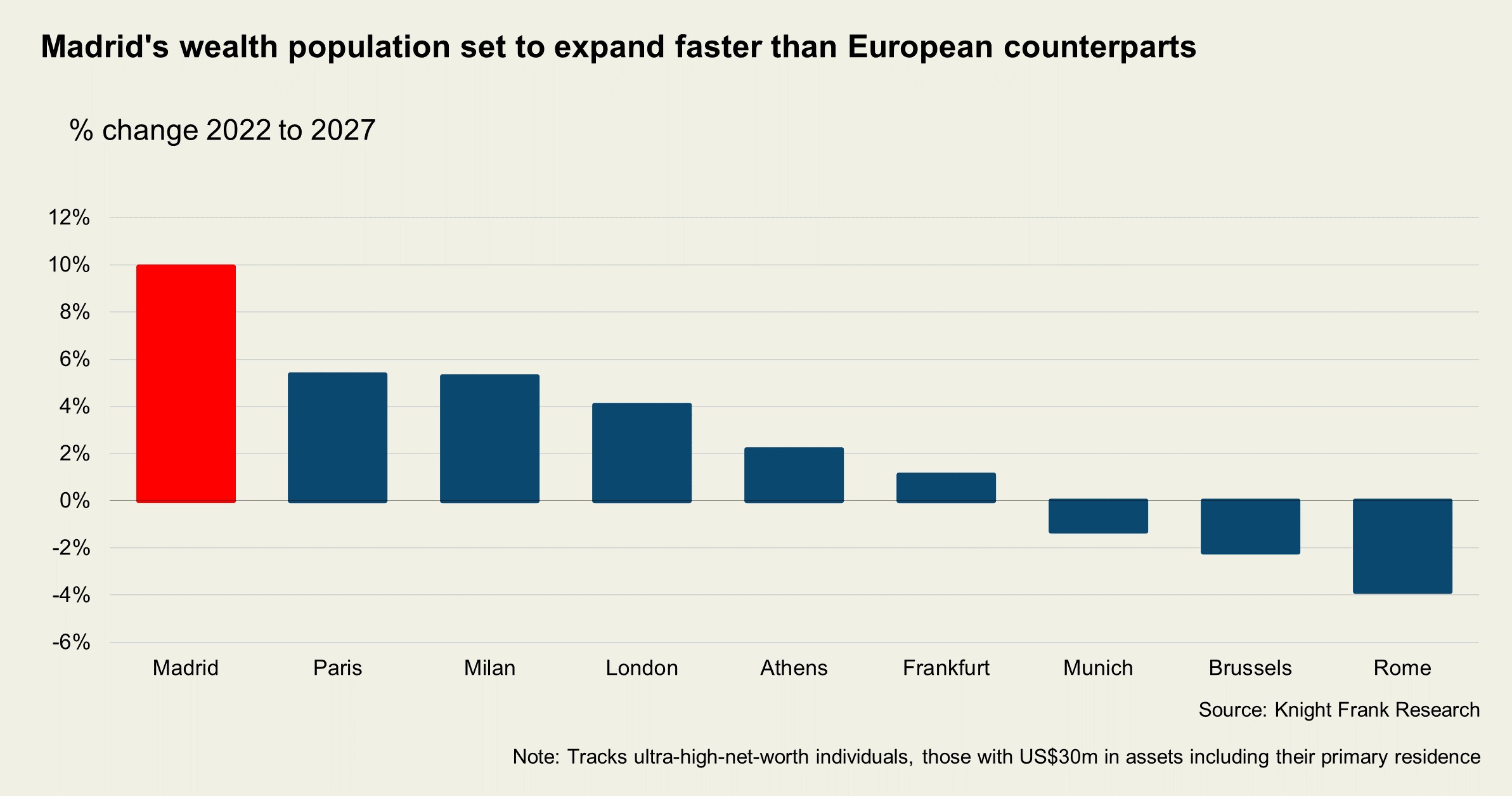

This influx of wealth is backed up by Knight Frank’s wealth forecasts that reveal the number of ultra-high-net-worth individuals (UHNWIs) in Madrid is set to rise by 10% between 2022 and 2027, this compares to 5% in Paris and 4% in London.

To discuss the Madrid market in more detail contact Mark Harvey or sign up to Knight Frank’s Spanish research and our monthly Overseas Property Newsletter.

Photo by antonio filigno