Hybrid work evolves to accommodate growth in Asia-Pacific

Set against a cyclical high in new supply delivery of close to 6 million sqm so far in 2023, office market demand has continued to hold up.

2 minutes to read

Vacancy rates in Asia-Pacific’s office markets have been rising since the middle of 2022, hitting 14.4% in the third quarter of 2023, sustaining a trend which has seen the metric continually breach record highs for a fourth consecutive quarter.

Despite hybrid workstyles being prevalent in most markets, year-to-date net absorption through September is still up over a tenth from 2022 levels. Financial and professional services firms, as well as flexible space operators, have remained active while a flight-to-quality trend supported demand for new completions. Barring the uncertainties in the medium term, we see a healthy appetite for office space to remain sustained with a stronger return-to-office trend in the region.

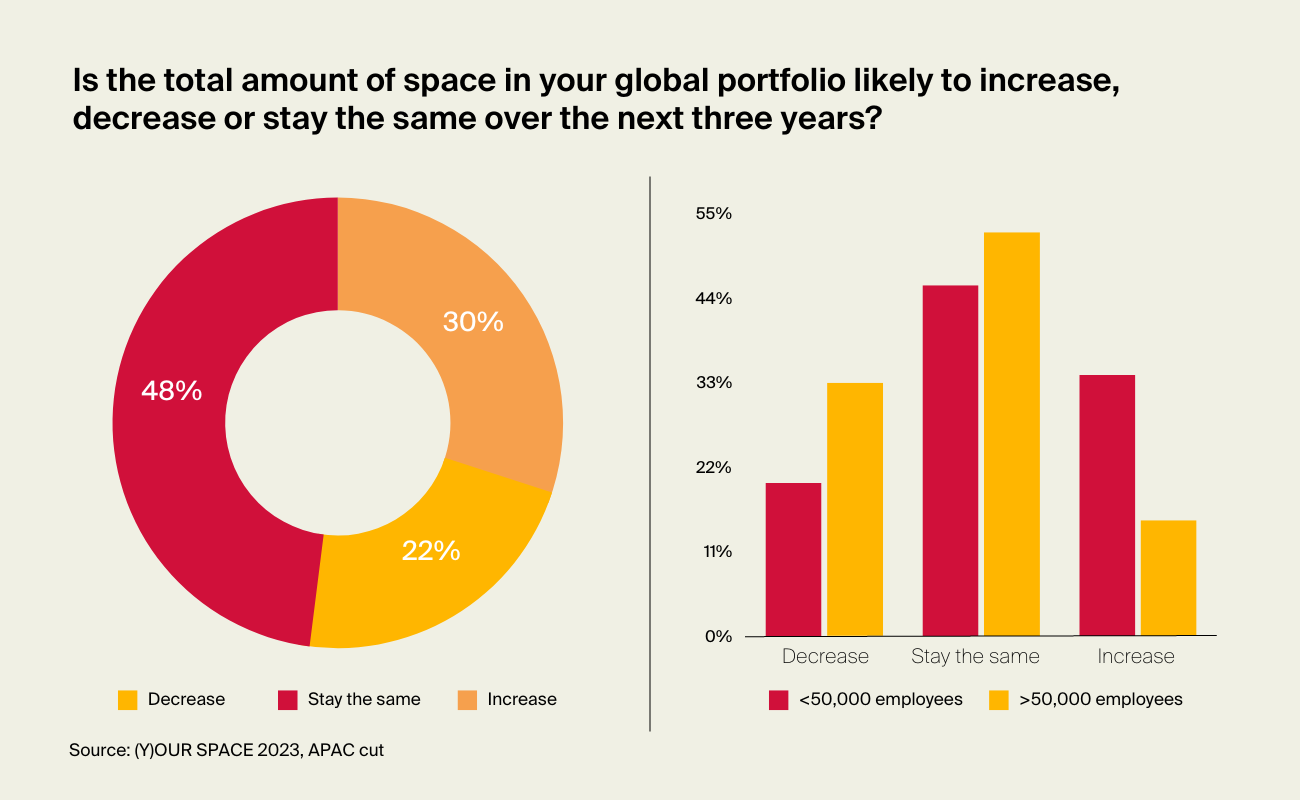

As indicated in Knight Frank | Cresa’s (Y)OUR SPACE 2023 survey, more than three-quarters of Asia-Pacific-based respondents are expecting their office portfolios to expand or remain the same over the next three years.

The tendency to expand footprint, at 30%, remains higher than those expecting to downsize (22%).

Compared to 2021’s survey, the shift towards an unchanged footprint stands out, which indicates that occupiers are gradually adjusting to post-pandemic work trends.

The tendency to remain status quo is strongest among companies with less than 10,000 staff. This could be explained by occupiers not having strong enough signals from a return to office to make decisions. Hence, choosing to stay the same is an optimal response until signals are stronger or lease events force action.

When it comes to downsizing, companies with larger headcounts are more likely to reduce their office spaces. Specifically, over a third of firms with global staff headcounts exceeding 50,000 plan to decrease their office footprint in three years, whereas only a fifth of respondents with smaller headcounts intend to do the same.

Discover more

Delve deeper into (Y)OUR SPACE research to discover data-led insights about the future direction of travel in corporate real estate.