European office occupier market Q2 2023

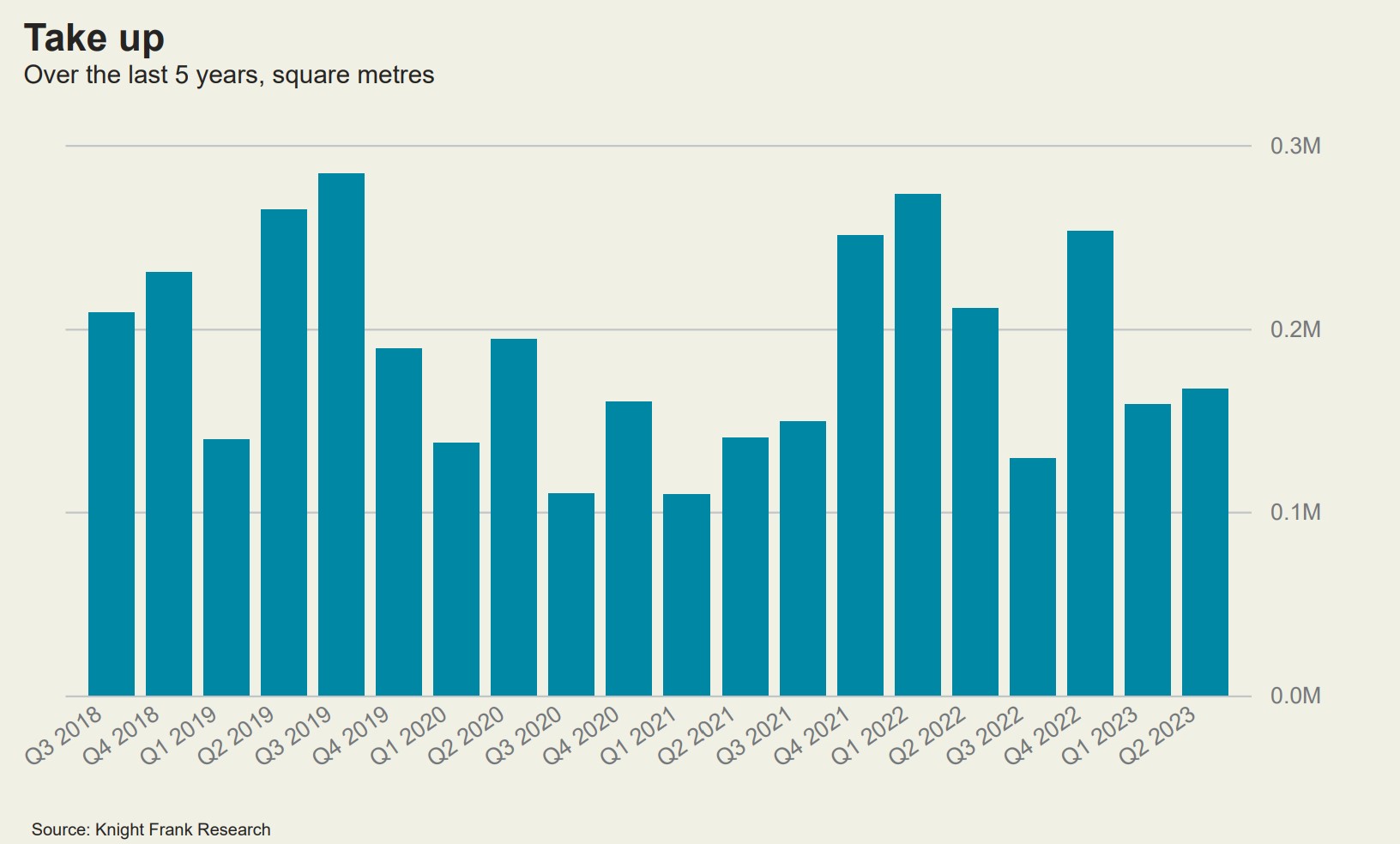

Take-up in European office occupier activity has softened in many markets, but prime rents remain resilient.

11 minutes to read

Local experts across the Knight Frank network have analysed the latest occupier activity in their region in the second quarter of 2023.

Updated quarterly, the dashboards provide a concise synopsis of occupier activity in Europe's office markets.

Discover vacancy rates, take-up and prime rents from cities across Europe in more detail by exploring the dashboards for Q2 2023 at the bottom of each section.

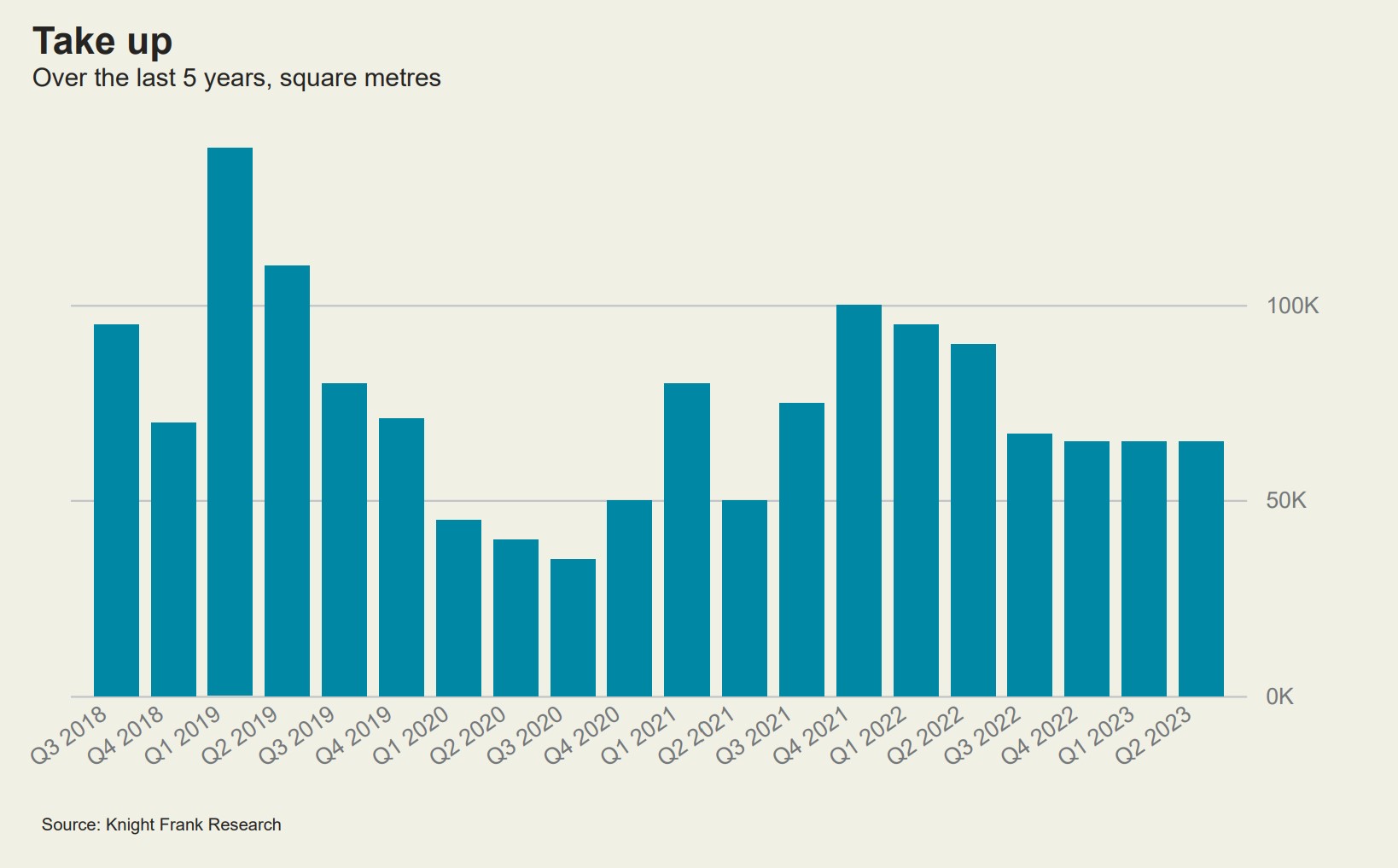

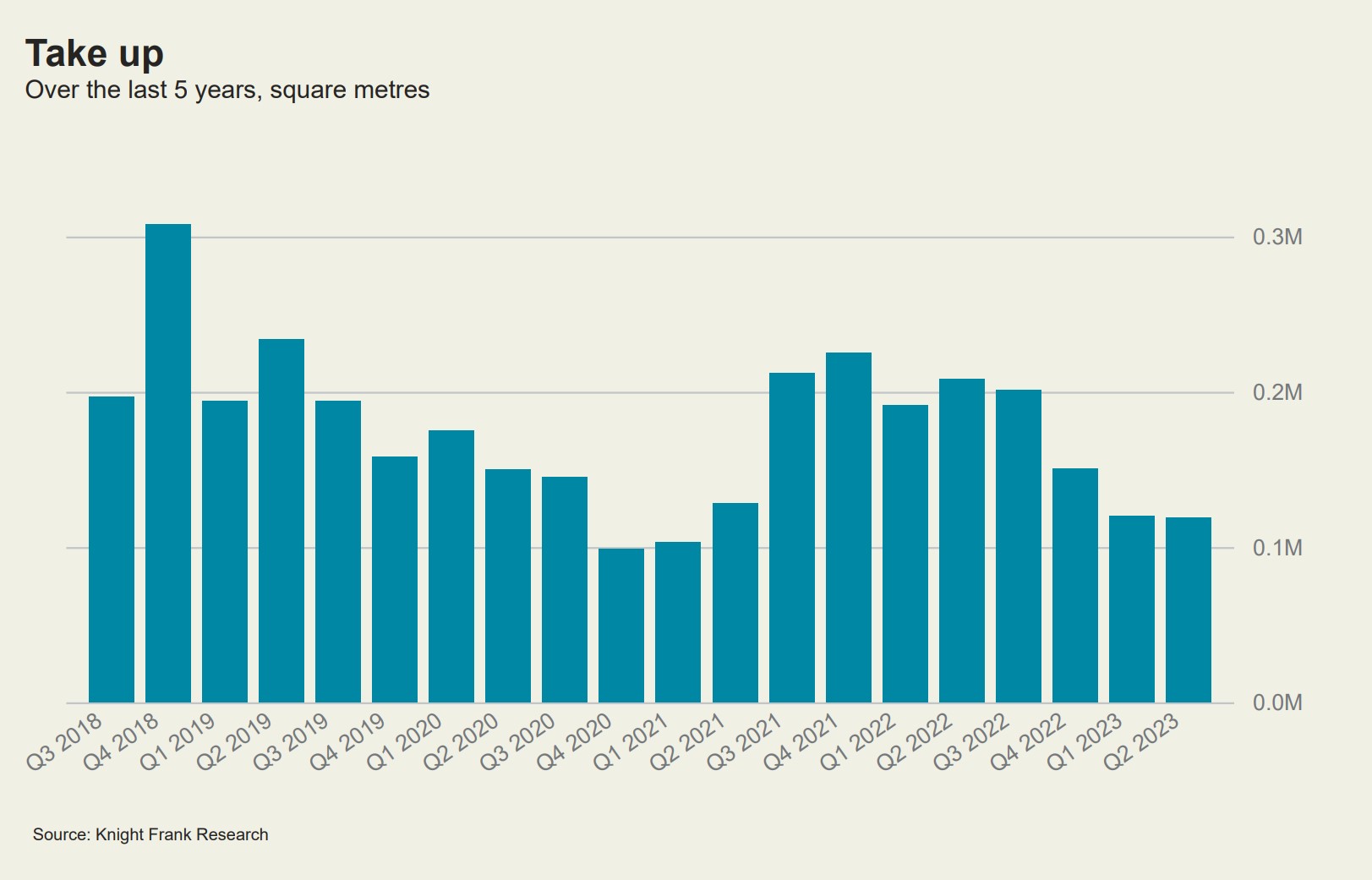

Barcelona office market

In the second quarter of 2023, the Barcelona office market recorded 65,000 sqm of take up, bringing the total for H1 2023 to 130,000 sqm. This represents a 30% decrease from the take up volume in H1 2022, and is 23% below the five-year H1 average.

Two notable deals signed in Q2 included Travelperk for 9,417 sqm, and Social Point for 4,900 sqm.

There are approximately 6.6 million sqm of office stock in the Barcelona market, and a further 600,000 sqm of new supply are expected to be added to the market during 2023 and 2024. The districts of 22@, La Fira, and the rest of the 'New Business Area' are to be the main areas of office development in the city.

The vacancy rate has remained unchanged since Q1 2023 at 10.4%. This represents a 20% increase in the vacancy rate year-on-year, largely due to the addition of new stock to the market of 203,240 sqm in 2022, the volume of which surpasses the current leasing demand.

Prime rents have also held firm at €336 psqm per annum, a level unchanged for the last few years. Rents are expected to rise moderately in coming quarters, and market favourability currently tipped towards the tenants may balance as a result.

View the latest dashboard

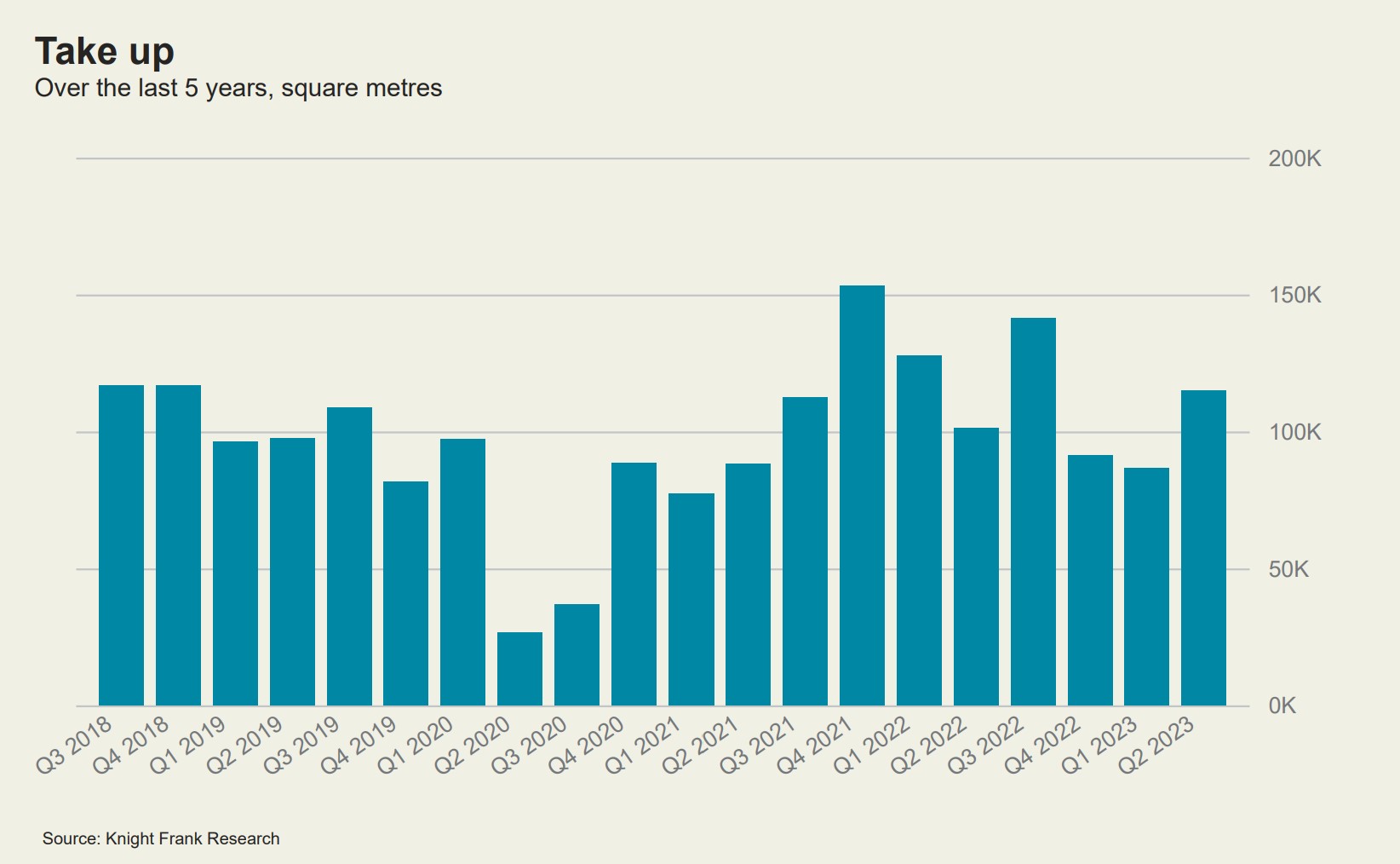

Berlin office market

Office take up in the Berlin market totalled 114,000 sqm in the second quarter of 2023, down 46% from the volume seen in Q2 2022. This level of take up has not been seen since about ten years ago.

New remote and hybrid concepts have led to higher demand for small and medium size segments, and these size ranges showed steady activity. There were no deals larger than 10,000 sqm recorded in Q2, while there were two in Q1. The vacancy rate in Q2 increased 30 bps since last quarter, coming to 3.9%. This represents a 29% increase year-on-year, and can in large part be attributed to sublet space.

Prime rents increased to €528 psqm per annum, demonstrating a willingness to pay top rents for high-quality and ESG-compliant spaces in well-connected locations. This demand, together with inflationary price pressures, has led to a 2.3% increase in prime rents year-on-year.

View the latest dashboard

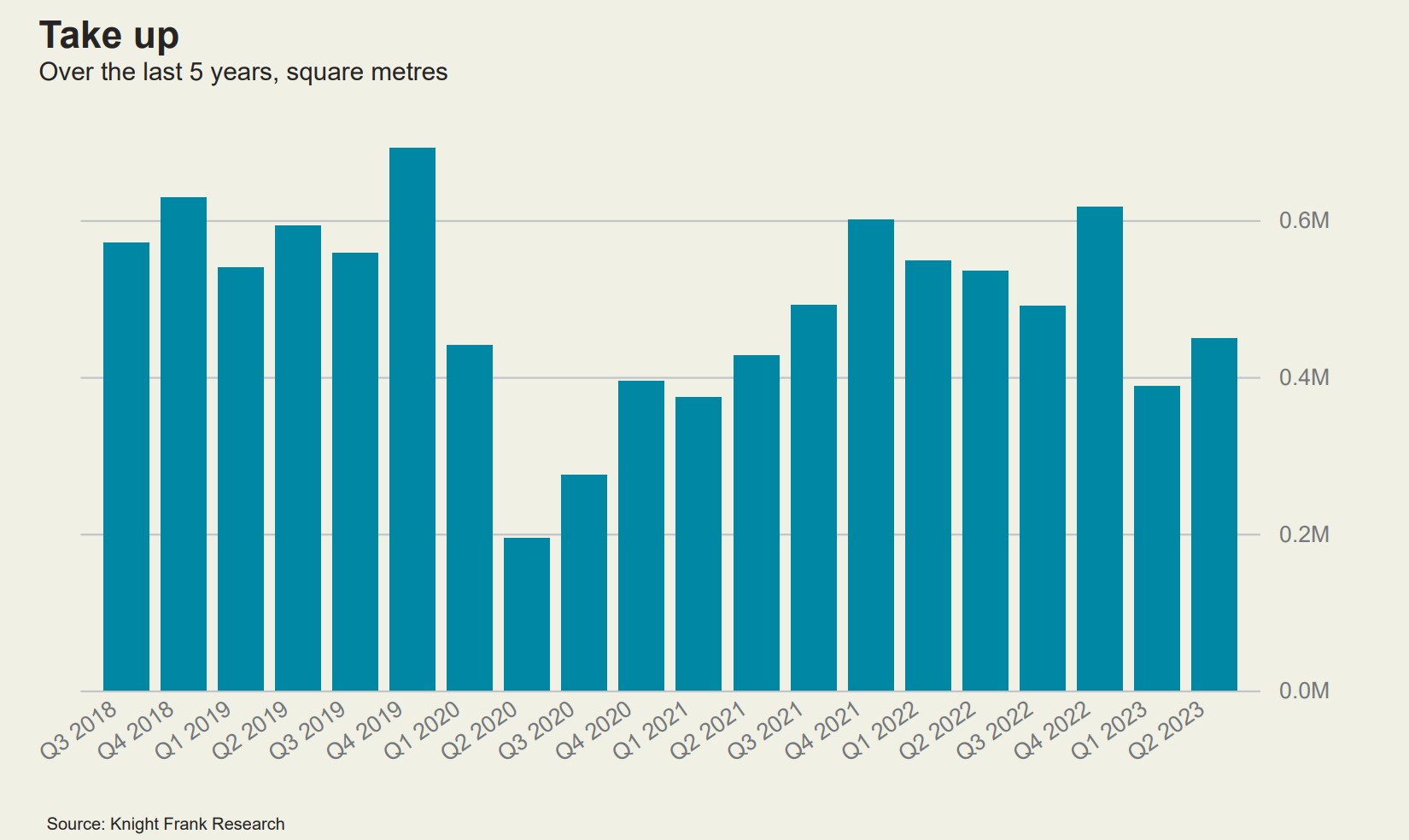

Bucharest office market

After a slow start to the year, Q2 saw a resurgence in activity, with 120,000 sqm of take up recorded. This is the highest quarterly take up figure since Q4 2019, and the strongest Q2 on record in the last 10 years.

There were a total of 62 transactions signed during the quarter, double the number seen in Q2 2022. Of these, two notable deals included Honeywell for 24,000 sqm and Emag for 10,000 sqm. Renewals were found to comprise 50% of the deal activity for the quarter, and the IT & Communications sector remained the most active, making up 48% of total take up.

Despite the large volume of take up, the vacancy rate ticked upwards in Q2 to 16%, up from 15% in Q1 2023. This also represents a 100 bps increase year-on-year. Many of the relocations in Q2 were found to be downsizing of footprint, with companies moving to smaller spaces in better locations. Some renewals were also partial disposals of space.

There were 28,000 sqm of construction completions recorded, up 14% from levels seen in the second quarter of last year, but 43% below the five year quarterly average for the figure. All 28,000 sqm of new supply were delivered vacant, also contributing to the climb in vacancy.

Prime rents were found to climb to €240 psqm per annum, 8% higher than the year before in Q2 2022.

View the latest dashboard

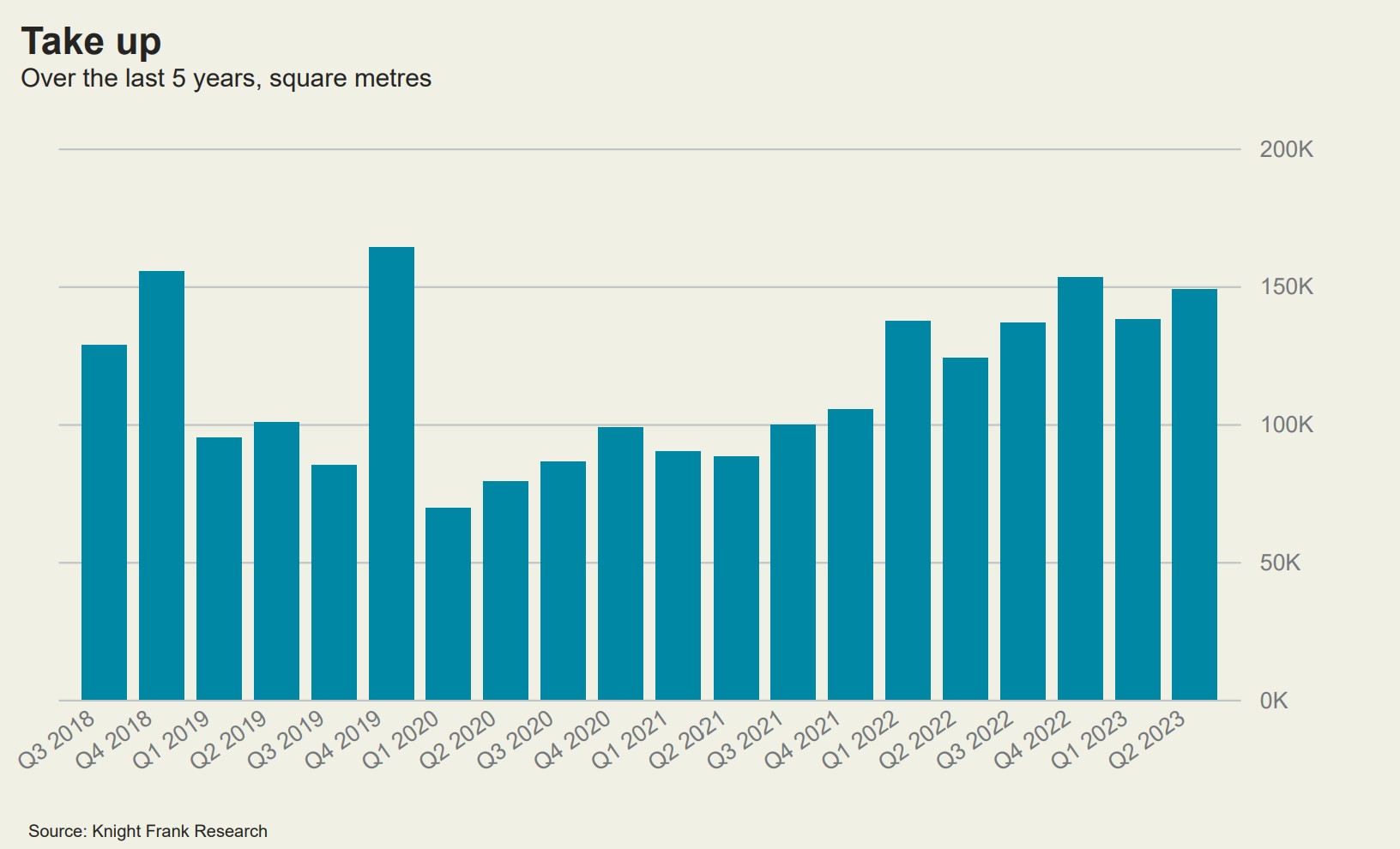

Madrid office market

The Madrid office market saw 110,000 sqm of take up in the second quarter of 2023, the same volume recorded in Q1. This brings the total H1 2023 take up to 220,000 sqm, 14% below what was seen in H1 2022 but well above the totals from the first halves of both 2021 and 2020.

Two notable leasing deals recorded in Q2 2023 included Kyndryl España for 8,473 sqm and TeamLabs for 6,000 sqm.

The vacancy rate ticked upwards by 30 bps since Q1, recorded at 11.8% in Q2. The most recent peak for the figure was in Q1 2022 at 12%, and the most recent low was 11.1% in Q3 of the same year.

There were 2,552 sqm of construction completions delivered in Q2, but the demolition of 5,548 sqm of stock has brought the net change to total stock to a decrease of 2,996 sqm. There are an estimated 90,000 sqm of remaining new supply expected in 2023, and a further 207,600 sqm anticipated throughout 2024 and 2025.

Prime rents have continued to hold firm for the fourth quarter in a row at €402 psqm per annum. The market favourability is currently tipped toward the tenant but is expected to balance in 2024.

View the latest dashboard

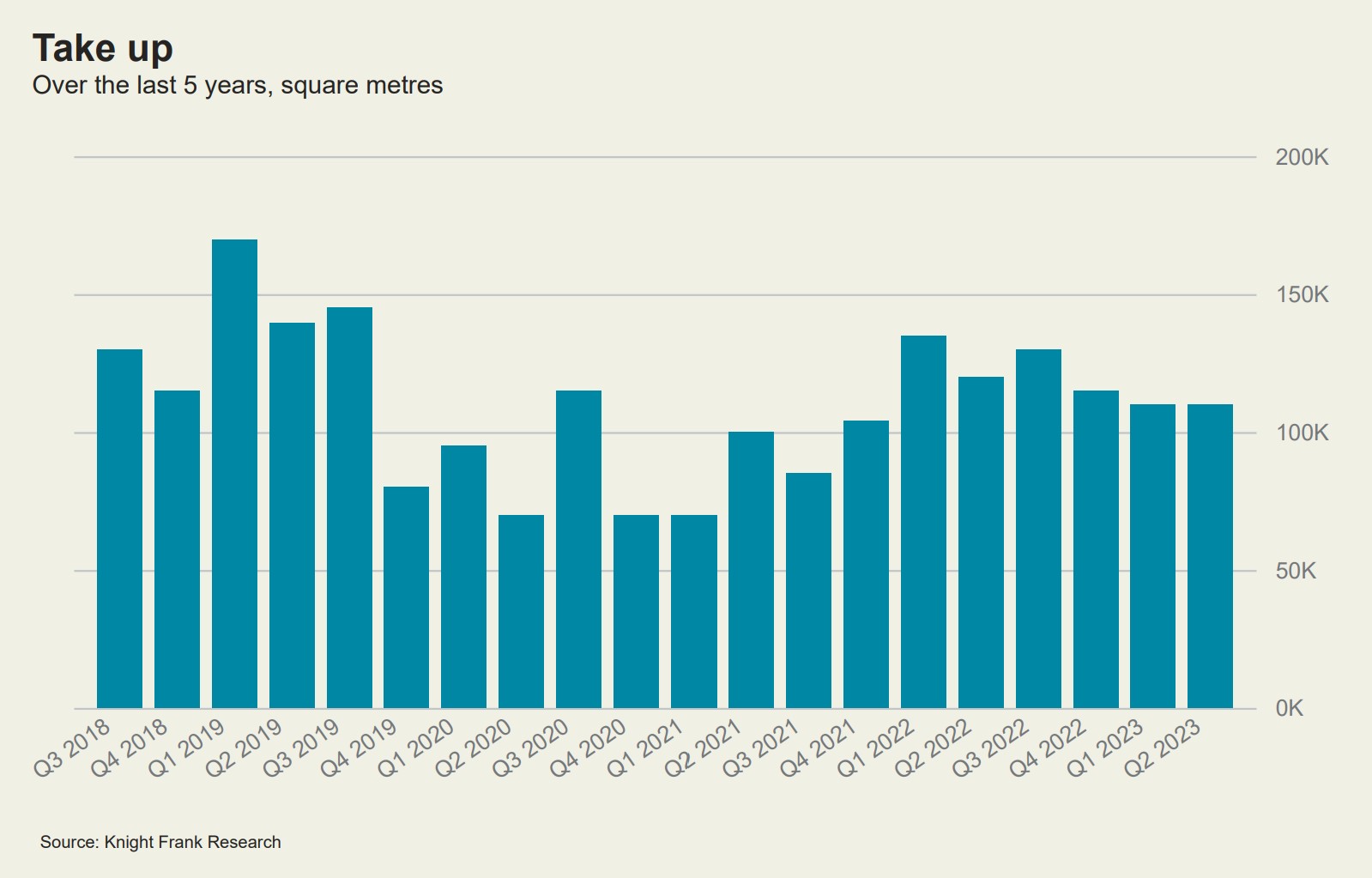

Munich office market

Demand in the Munich office market remains at a low level for the second quarter in a row.

Last quarter's weak take up figure was undercut in the second quarter, recorded at 118,900 sqm. This brings the total for H1 2023 to 239,100 sqm, representing a 40% decrease from levels seen in the first half of 2022, but above those seen in H1 2021 and H1 2020.

The vacancy rate continues its upward trajectory, coming to 5.7% in Q2, and amounting to an increase of 12% year-on-year. The last time the vacancy rate was at this level was more than nine years ago.

Nevertheless, an increase in the prime rent was recorded, as the supply of space in central locations continues to be scarce. At €552 psqm per annum, the prime rent in Q2 has reached a historically high level, up 8% when compared to Q2 2022. The current expectation is for prime rents to continue to climb.

There were 71,100 sqm of construction completions in Q2 2023, bringing the total for the first half of the year to 191,300 sqm. This is significantly above last year's volume for the same time period of 54,500 sqm, and is also greater than the five-year H1 average of 157,700 sqm. There are more than 800,000 sqm of stock expected to be delivered throughout 2024 and 2025.

View the latest dashboard

Paris CBD office market

The Paris Central Business District (CBD) office market saw an improvement in leasing momentum in Q2 2023 after a slow first quarter, registering 115,006 sqm of take up. This is 14% more than what was recorded in Q2 2022, and brings the total for the first half of the year to 201,497 sqm, which is 12% less than the volume in H1 2022 but 8% about the 10 year average for the figure.

There were four new deals recorded in the CBD that were larger than 5,000 sqm in Q2 2023, while there were none in Q1. The most significant transaction was Rothschild & Co. who have signed 20,500 sqm in the 8th arrondissement.

The small to medium-sized segments also performed well, especially in sectors such as finance and luxury.

Construction completions totalled 31,105 sqm in Q2 2023, with a further 42,993 sqm in the pipeline for the year. This is expected to bring the total for 2023 to under 100,000 sqm, well below the five-year average for annual completions of 130,000 sqm. The CBD benefits from a pre-leasing rate for current projects under construction (> 5,000 sqm) at 55%.

With vacancy remaining low in the CBD, unchanged in Q2 2023 at 2.6%, the shortage of supply is continuing to uphold prime rents. They have held firm at €980 psqm per annum in Q2, representing a 3% increase year-on-year.

View the latest dashboard

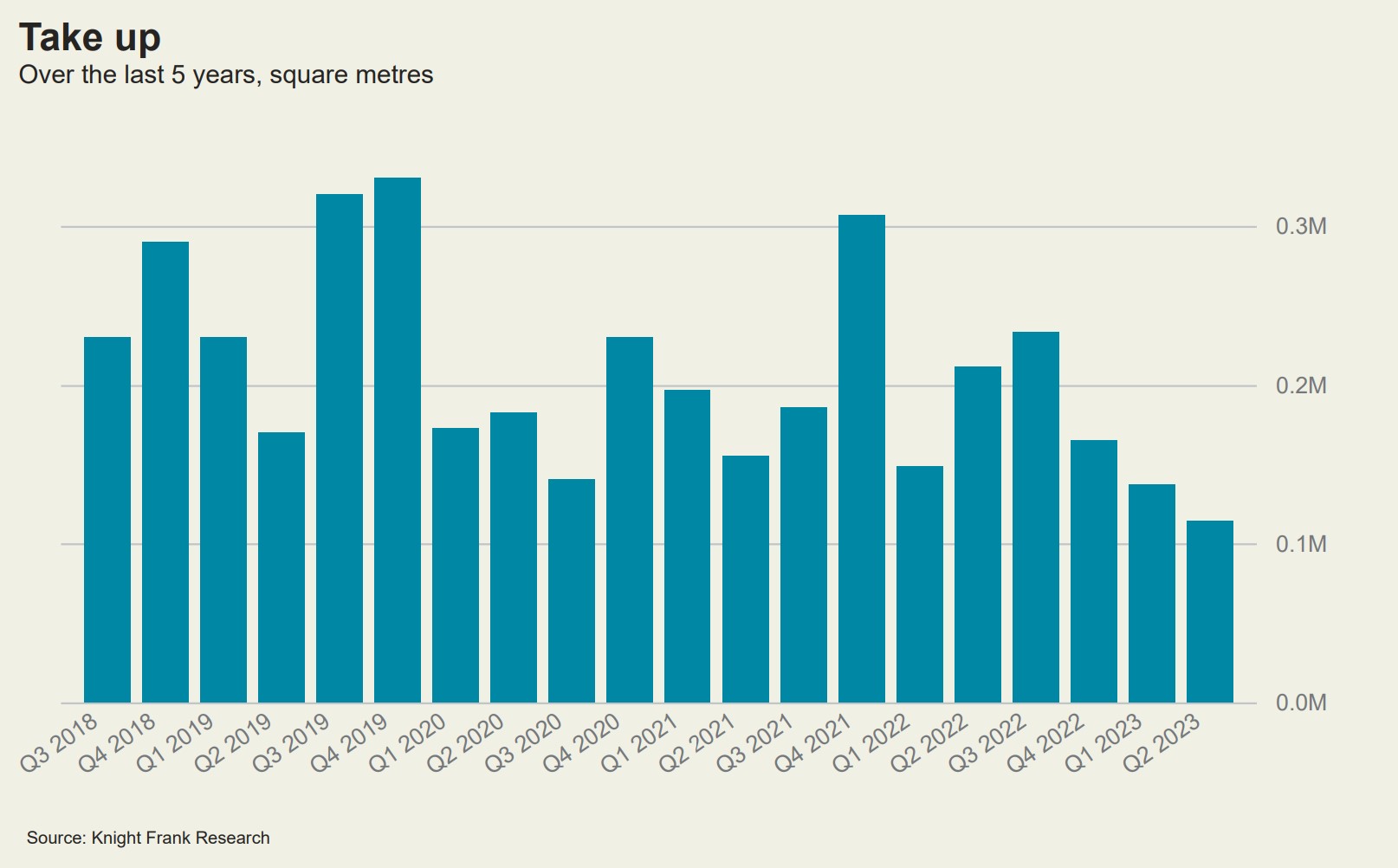

Paris IDF office market

In the second quarter of 2023, the Île-de-France (IDF) office market saw 449,635 sqm of take up, 9% more than the volume seen in Q1 2023. This brings the total for the first half of the year to 863,591 sqm, representing a drop of 20% compared to H1 2022 and 16% relative to the H1 10-year average. This suggests that the strong leasing performance in 2022 was only a temporary surge resulting from pent-up demand after the pandemic.

Faced with a challenging economic environment, companies are taking more time to finalise their office space decisions. They must balance motivations to improve their space with pressures to mitigate costs, and thus an increasing number have been found to renegotiate their existing leases rather than relocate.

In H1, the low levels of leasing activity affected all size ranges. Large transactions were especially slow – only 21 deals above 5,000 sqm were recorded, 30% less than in the same period last year and the lowest H1 number since 2000.

Average rents for the region increased slightly this quarter to € 485 psqm per annum, up 7% from Q2 2022.

The vacancy rate also ticked upwards again in Q2 2023 to 7.9%. This represents an increase of 10 bps compared to last quarter and of 70 bps since Q2 2022. The disparity in vacancy by submarket is apparent, oscillating between 10-15% in the periphery, and close to 20% in the Peri-Défense and Northern Inner Suburbs.

View the latest dashboard

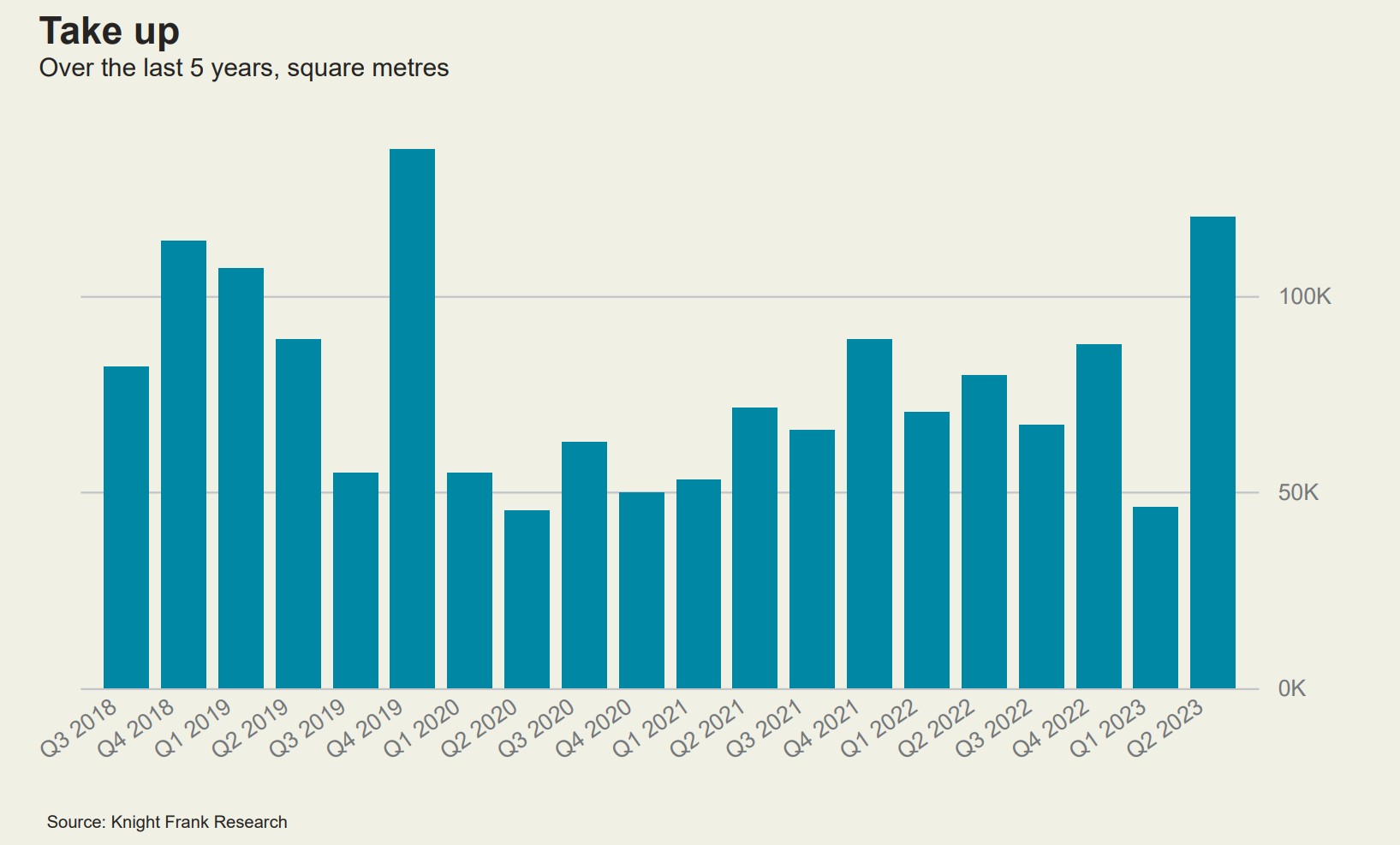

Prague office market

The Prague office market saw strong take up in Q2 2023 of 148,800 sqm. This is 8% more than what was recorded in Q1 of this year, and 20% above the volume from Q2 2022. It is also the highest level of Q2 take up seen in the last 5 years.

The market saw an elevated number of renegotiations, amounting to 53% of the take up volume. Of the remainder, 41% were found to be new leases and expansions, 4% were pre-leasing deals, and 2% were subleases. The two largest deals in the quarter were both renegotiations, one with DHL Information Services in 18,000 sqm and the other with Microsoft in in 16,100 sqm.

Vacancy compressed by 20 bps to 7.3%, continuing the downward trajectory in place since the most recent peak of 8.24% in Q1 2022.

After a large volume of construction completions in Q1 2023, there were no new supply

deliveries in Q2.

For the fourth consecutive quarter, no new construction or refurbishment projects were launched. The under construction pipeline for upcoming quarters is light, making relocation options for tenants seeking top quality, ESG-compliant premises very limited.

Many projects are stuck in planning stages given the environment of developer caution surrounding rising construction costs and challenges with obtaining financing.

Prime rental rates held firm at € 324 psqm per annum. This represents an 8% increase year-on-year. They have been steadily on the rise since a recent low of € 264 psqm in Q3 2021.

The prime rental growth is driven mainly by new construction in the City Centre, which has allowed landlords of older buildings to increase their rental levels as well, although not quite as high as the prime rent. However, their rent still exceeds what was the prime rent in the city only a few years ago, despite the fact that the buildings have aged.

View the latest dashboard

Warsaw office market

The second quarter of the year in the Warsaw office market continued to see limited tenant activity, especially when compared to the momentum in 2022. Take up of 167,120 sqm were recorded, bringing the total for H1 2023 to 326,120 sqm. This represents a 33% decrease relative to the same period last year.

The three largest deals in Q2 2023 were all renegotiations, including Lionbridge Poland for 7,100 sqm in the Taifun building, a business services company for 5,900 sqm in Warsaw Spire A, and an IT sector tenant for 5,200 sqm in the Horizon building. In H1 2023, new agreements accounted for the largest share of transactions, making up more than 60% of total volume. Of the remainder, nearly 35% were found to be renegotiations and only a small number, just under 5%, were expansions.

The city's Central submarket was the most popular with tenants, seeing 58% of space leased in H1 2023. Other popular submarkets included Jerozolimskie Corridor and Służewiec, with 15% and 14% of deal volume respectively.

Only three new development projects have been delivered so far this year, totalling 18,700 sqm, all completed in Q2 2023. As such, the total volume for H1 2023 stands 90% below what was seen in H1 2022. There are currently only 265,000 sqm of office space under construction, with 55,900 sqm expected to be completed before the end of year.

The tightening new supply pipeline may be a factor in the vacancy rate reaching its lowest level since Q1 2021, at 11.4% in Q2 2023. This is 50 bps lower than the vacancy rate seen in Q2 2022. In the Central submarket, the vacancy rate was 9.9%, while the rest of the city saw varying levels. The lowest vacancy rates were recorded in the North (5.1%), and in Ursynów and Wilanów (5.8%), while the highest was recorded in Służewiec (20.6%).

Prime rents held firm in Q2 2023 at € 312 psqm per annum for the fourth quarter in a row, representing a 4% increase compared to Q2 2022. Rents are expected to remain stable in the near future.

View the latest dashboard