Who should profit from a valuable planning permission?

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Mortgage rates

Mortgage rates are trending upwards following last week's hot inflation reading, but so far the moves have been relatively small.

The average rate on two and five-year fixed rate mortgages has risen 0.04% since the beginning of last week, according to Moneyfacts figures. Meanwhile, the number of mortgage products available has fallen to 5,012, from 5,385, as some lenders reassess how they plan to proceed.

The situation is disappointing, but isn't comparable to the volatility we saw following the mini-budget - that's despite a comparable spike in gilt yields last week. Mortgage product choice is still more than double the level we saw back in October and average two and five year fixed rates remain 0.05% and 0.18% lower, respectively.

Hope value

The Labour Party says it will introduce legislation allowing councils to buy land via compulsory purchase order (CPO) at a price that excludes so-called 'hope value', according to a report in the FT over the long weekend.

At present, councils acquiring sites through CPO must factor hope value into the purchase price - effectively the added value based on the likely granting of a more valuable planning permission. Under the proposal, local authorities would have the right to acquire sites at existing use value.

The announcement is one of several made by Labour over the past month as it tries to portray itself as the party of housebuilding. Others have included giving councils more power to build on green belt land and reinstating local housebuilding targets.

Land supply

Critics of the hope value system say it throttles the amount of land made available for housebuilding and funnels windfalls to landowners rather than the councils that ultimately grant the valuable consents. Land worth £22,520 per hectare as agricultural land can on average be worth £6.2mn per hectare with permission — 275 times more — according to Centre for Progressive Policy data cited by the original FT report.

The current administration has acknowledged that the prevailing system has flaws and has tabled changes via the Levelling Up and Regeneration Bill which, if approved, would cap payments to landowners at existing use value "where it could be shown that the public interest in doing so would be justified for a specific scheme."

The Home Builders Federation said previously that it was wary of those changes, in part because they would alleviate pressure on the government to implement more wide-ranging reforms of the planning system that would ensure an adequate supply of developable land in the first place. It continued:

"Landowners and developers should view warily any move by government that increases its ability to seize assets at existing use value. There is the possibility that government could continue to tighten further the supply of land, thereby boosting the potential development value of a limited number of allocated sites, but then seize these assets at existing value and profit from the increase in value deriving from the restrictions it has created."

Prime London

The prime London property market has had a busy start to the year as demand gravitates back towards the capital following the pandemic.

The number of new prospective buyers was 35% above the five-year average in the first four months of this year, excluding 2020. Supply is also picking up and the number of sales instructions was 16% higher over the same period, which helped push the number of exchanges up by 8%.

Prime markets have also been buoyed by the return of international travel, a relatively weak pound, and the fact average prices in prime central London (PCL) are still 15% below their last peak in mid-2015. In prime outer London (POL), the equivalent drop is 7%.

Transaction activity was particularly strong in higher price brackets, with the number of exchanges above £5 million up by 40% over the same period. Below £2 million, there was a 3% decline. You can see the update from Tom Bill for more.

Tom also published an update on the prime London rental market yesterday, where the number of new prospective tenants is running 39% higher than the five-year average.

The White Lotus

Italy’s flat tax, the lifestyle offering and the delivery of new branded residences is putting Sicily on the radar of international buyers. A feature on Netflix’s ‘White Lotus’ has helped too.

Google searches for “Sicily property” increased 54% in April 2023 compared to a year earlier.

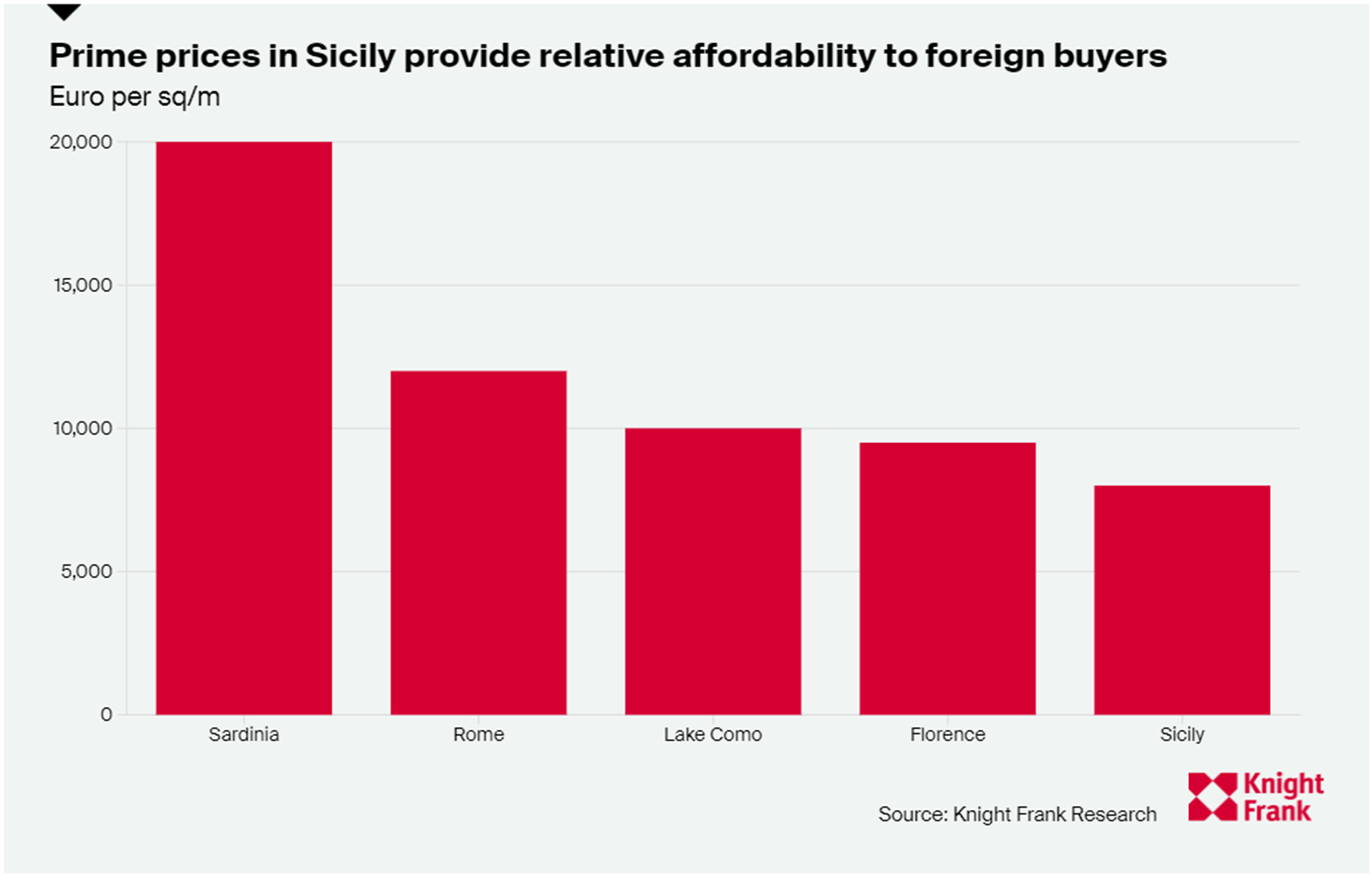

At around €8,000 per sq m, prime prices in Sicily are competitive compared with other established European second home destinations and key Italian cities and resorts (see chart). Kate Everett-Allen has more.

In other news...

UK business confidence dips in May, inflation pressures persist (Reuters), shop price inflation strikes new record high (Reuters), and finally. JP Morgan builds unit for world's richest families in wealth bet (Bloomberg).