Luxury residential markets proved resilient in the face of interest rate hikes in 2023

Kate Everett-Allen explores our unique Prime International Residential Index (PIRI), which tracks the performance of 100 city, sun and ski locations globally

2 minutes to read

Key Findings

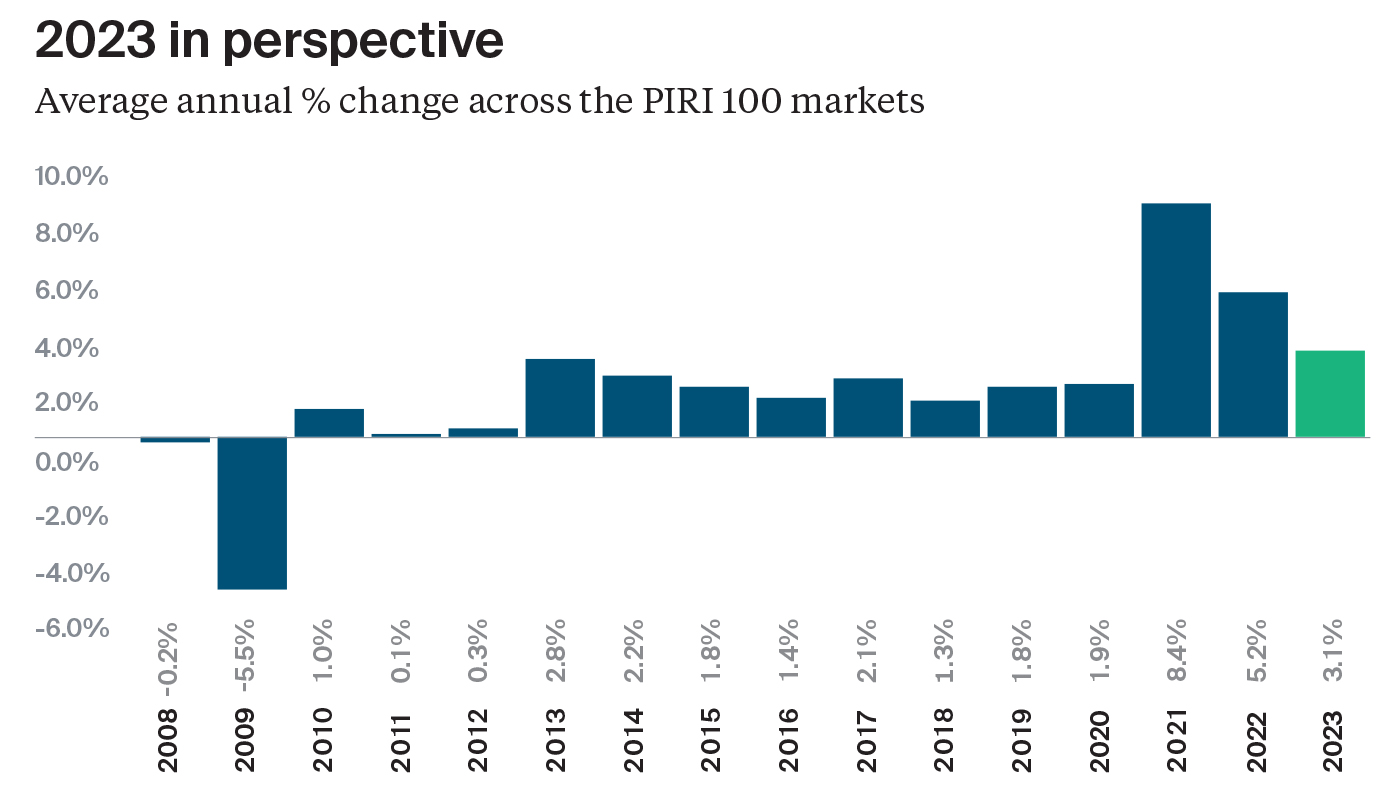

- Luxury prices climbed 3.1% on average in 2023.

- Sales volumes, not prices, were the main casualty of higher interest rates.

- Manila leads, with Dubai in second place.

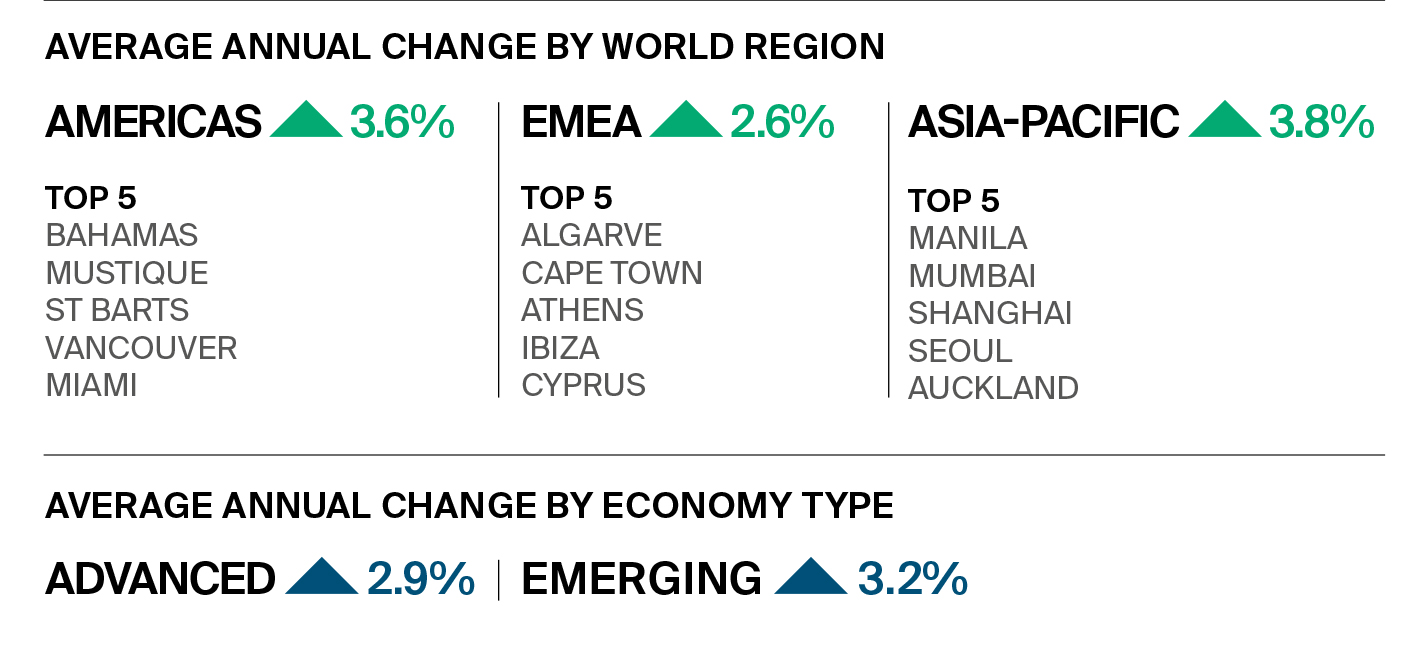

- Asia-Pacific was the strongest-performing world region.

- London and New York remain closely aligned.

The results

The Prime International Residential Index (PIRI 100) surprised on the upside in 2023. Of the 100 markets tracked, 80 recorded flat or positive annual price growth.

Yet at the start of 2023, economists were expecting a much weaker outcome. Stock markets were headed for more pain, inflation was veering out of control and the pandemic-fuelled property boom was set to end in tears as borrowing costs hit 15-year highs in some markets. Right? Wrong.

The “soft landing” adage applied as much to luxury property markets as to monetary policy, with the index posting a solid 3.1% gain overall. Manila (26%) leads but last year’s frontrunner, Dubai (16%), slipped only one spot. Asia-Pacific (3.8%) pipped the Americas (3.6%) to the title of strongest-performingworld region, with Europe, the Middle East and Africa trailing (2.6%).

As predicted last year, sun locations continued to outperform, up 4.7% on average with ski resorts close behind (3.3%) and cities on 2.7%.

The year in review

As markets adjusted to the higher cost of debt, sales took a bigger hit than prices. In London, New York, Dubai, Singapore, Hong Kong and Sydney, luxury sales declined on average by 37% year-on-year.

Some markets corrected after strong falls due to rapid rate hikes (Auckland, Seoul), while others moved up the rankings in part due to supply shortages (Sydney, Singapore). Some were influenced by policy and tax shifts, easing (Hong Kong) or tightening (Los Angeles), and some markets benefited from significant wealth inflows (Dubai, Miami).

Prices in both New York and London dipped around 2% in 2023 and sit 8% and 17% below their most recent market peaks respectively, presenting a strong opportunity for prospective buyers. Iberia proved a hotspot, occupying five of the top 20 rankings with the Algarve and Ibiza (both 12%) leading the pack.

Seeking value?

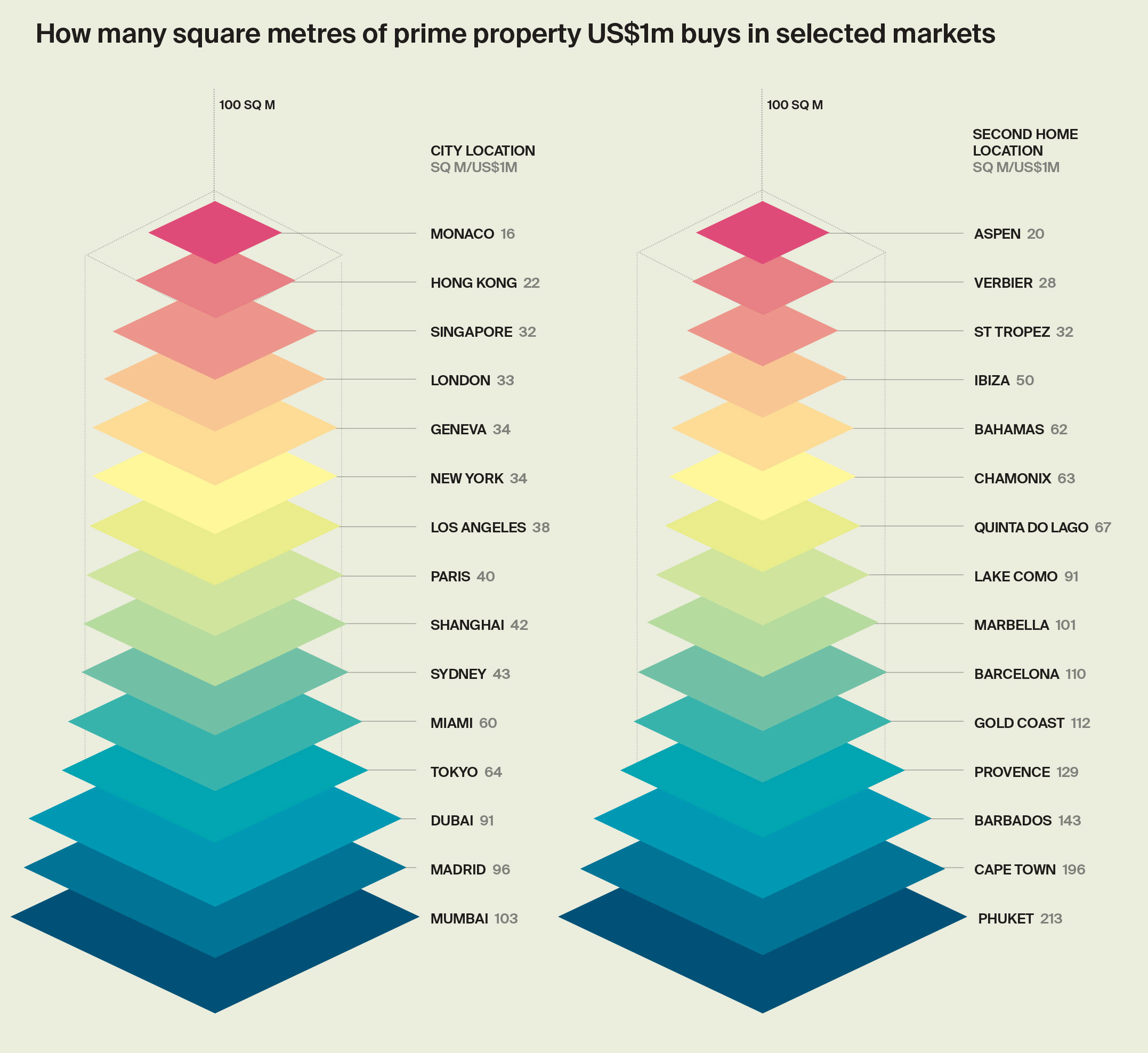

Our PIRI pricing graphics provide an annual guide to how much space your money will buy you when it comes to prime residential property

There is significant variation in prime prices across luxury residential markets, which often surprises buyers. Prime prices in Dubai may sit 134% higher than at the start of the pandemic but they are still noticeably lower than in more established markets. Here, US$1 million buys 91 sq m, four times the equivalent in Hong Kong.

It’s a similar story for second homes, as shown in our new chart focusing on rural, coastal and alpine markets. In Barbados, for example, US$1 million will garner 143 sq m, more than four times as much luxury space as in St Tropez.

Image by Dylan Gonzales from Pixabay

Download the full report here