The age of change

While the distribution of wealth may be shifting between world regions, change is also happening between generations. Liam Bailey assesses the investment implications

3 minutes to read

1. Wealth shifts will super-change existing trends

Over the next 20 years, a transfer of wealth and assets will occur as the silent generation and baby boomers hand over the reins younger generations*. The transfer is happening amid seismic changes in how wealth is put to use. The difference in outlook between younger and older generations will result in a substantial reappraisal of marketing strategies for anyone wanting to sell products or services to this newly wealthy group.

2. Wealth is becoming more diverse

It may be starting from a low base, but the trend is undeniable. Recent survey findings from Altrata suggest women make up around 11% of global UHNWIs. While still not a large share, this represents rapid growth from just 8% less than a decade ago. Given the attitudes of female Gen Z-ers we note below, this looks likely to remain the direction of travel. Businesses looking to attract wealthy investors will need to adapt their strategies to ensure they are relevant to this new, broader market.

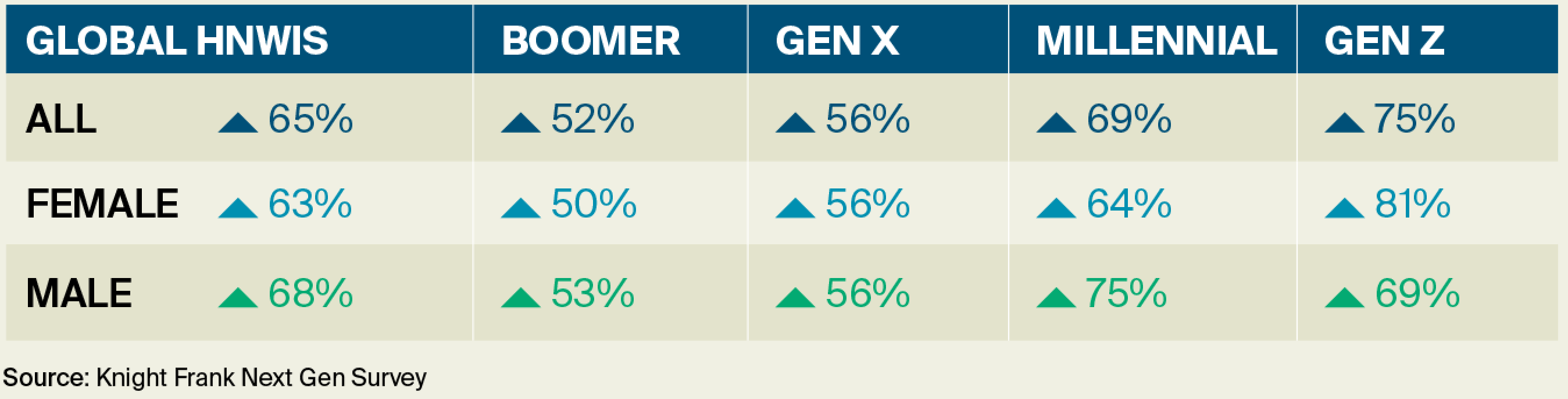

3. Gen Z are most confident in their ability to create wealth

As our Attitudes Survey reveals (see page 68), 71% of UHNWIs globally anticipate growth in their wealth this year. For HNWIs, our Next Gen Survey reveals a more conservative figure of 65% (see chart above). A clear pattern emerges when data is analysed by age: younger affluent groups are more confident about the economic outlook compared with older groups. Only 52% of HNWI boomers anticipate growing their wealth in the next 12 months, in contrast to 75% of Gen Z-ers, with 43% expecting “significant growth”.

Male HNWIs express greater confidence than women. This is particularly pronounced among male millennials, with 75% expecting their wealth to grow, compared with 64% of women. However, for Gen Z, these expectations are entirely reversed, with a remarkable 81% of women in this group expecting growth. Half expect “significant growth”.

4. Environmental concerns will influence investment decisions

Climate change is an area where our results show clear generational differences in priorities. Looking at the top line question on carbon emissions from our main Attitudes Survey (see page 50), millennials appear to have got the message when it comes to cutting consumption – 80% of male and 79% of female respondents say they are trying to shrink their carbon footprints.

Male boomers take a different view with just 59% trying to reduce their impact, well below their female peers (67%). Recent work undertaken by The Future Laboratory confirms a shift in attitudes around wealth, with younger groups looking at the opportunity it provides to act as a force for change.

5. Property remains key FOR all wealthy groups

Where 22% of UHNWIs are expected to invest in a home purchase this year, only 19% of HNWIs are expected to take the same route. Boomers appear most reticent (8% and 7% for females and males respectively) while millennials are most active, with scores approaching UHNWI levels (23% for females, 21% for males).

When it comes to commercial property, 19% of UHNWIs are considering investing this year. Given the larger financial commitment required, it is probably unsurprising that a much smaller percentage of HNWIs are considering a similar move: only 7% overall, with male millennials the most committed (9%) and male boomers the least (3%).

*A January 2022 study by Cerulli Associates indicated a transfer of approximately US$84.4 trillion in the US, from older generations to younger generations and charities, over a two-decade period. Taking into account asset price movements up to December, this figure could equate to close to US$90 trillion.

Download the full report here