Asia-Pacific's thriving offshoring hubs: emerging opportunities

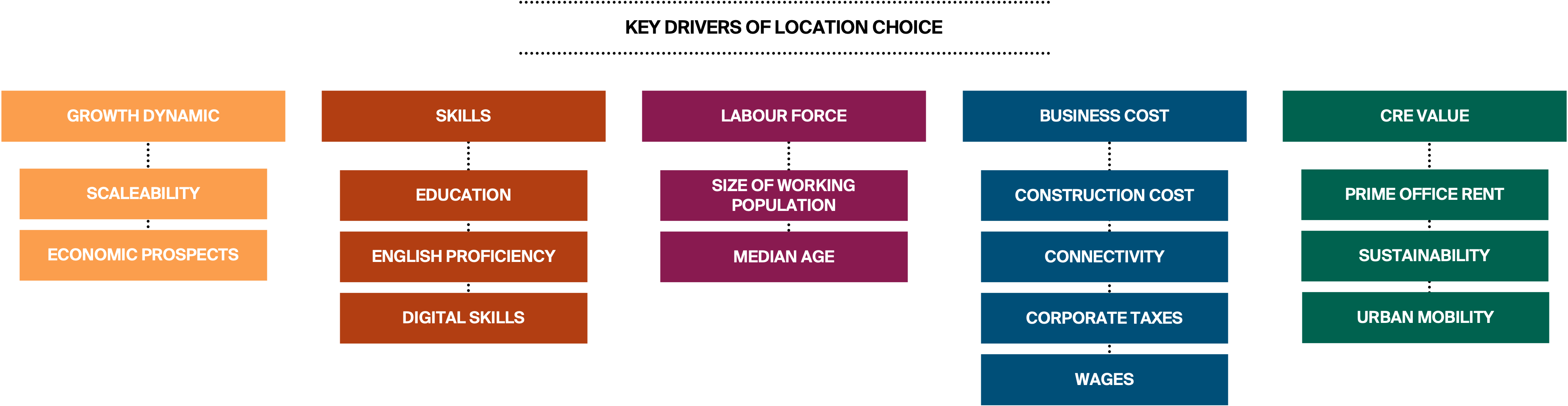

Choosing the right location for a company's offshore facility requires a comprehensive analysis of numerous factors.

3 minutes to read

While cost considerations and talent availability are undoubtedly significant, cultural compatibility and linguistic factors also play a vital role in this decision-making process. In an increasingly competitive market for offshoring contracts, it is crucial to evaluate a range of criteria, such as comparative advantages, existing skill sets, and future growth prospects.

Each country in the Asia-Pacific region offers its distinct value proposition, with some areas demonstrating strength in specific business processes or IT support while others offer competitive pricing.

Knight Frank's Asia-Pacific Horizon: Harnessing the Potential of Offshoring identifies the five main pillars characterising the region's major offshoring hubs and develops a composite score for each. The score highlights each country's relative strengths and limitations, providing a snapshot of the options available to occupiers.

Growth dynamic

A key consideration for firms assessing their offshoring strategies is the potential for growth and value addition over time. This factor gauges whether the parent company can envision a viable growth strategy for its offshore facility. Growth dynamics, determined by scalability and economic conditions, offer insight into a facility's capacity to adapt and evolve.

Skills of the labour force

The pool and quality of human resources is a critical consideration for the offshoring industry. A sufficiently deep talent pool also ensures that wage inflation will be manageable due to a constant supply of workers. It is also indicative of the extent of the skills gap in a workforce. As offshoring locations in the region largely serve corporations from English-speaking countries, proficiency in that language is also required.

Since many offshoring locations in the Asia-Pacific region primarily provide services to corporations from English-speaking countries, English language proficiency is an important component in evaluating the suitability of a location. Companies must assess the linguistic capabilities of potential workforces to ensure effective communication and collaboration between teams across geographical boundaries.

Business Costs

A primary motivation for offshoring is creating value for stakeholders by reducing costs or enhancing the quality of inputs through partnerships with external suppliers. To achieve this, companies seek advantages that cannot be easily replicated. When contemplating offshoring processes, firms typically analyse various input costs, including labour, infrastructure expenses such as internet access, and the corporate tax environment.

CRE Value

Optimising occupancy costs is a key priority for organizations in managing their corporate real estate (CRE) expenses. However, with a growing number of global companies adopting Environmental, Social, and Governance (ESG) goals and sustainability targets, tenants are increasingly seeking well-located and environmentally compliant office spaces. This trend is also applicable to companies in the offshoring services sector.

As organisations strive to balance cost management with their sustainability commitments, they must consider the following aspects:

Location: Assessing proximity to transport hubs, amenities, and local talent pools to ensure operational efficiency and employee satisfaction.

Green credentials: Evaluating buildings' energy efficiency, waste management systems, and green certifications to meet ESG targets.

Flexibility: Opting for flexible lease terms and adaptable workspaces to accommodate future growth and evolving business needs.

By carefully considering these factors, businesses can secure the necessary talent to drive their offshoring initiatives and maintain a competitive edge in the global market.

A closer look at how India, the Philippines, Malaysia and Vietnam scored in the full report.