The last gasps of this era's 'Great Inflation'

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

This was a pivotal week for the global economy.

The US Federal Reserve stuck to its guns on Wednesday by reiterating that it expects to make three interest rate cuts before the year is out. That's despite a run of warm inflation data and new forecasts suggesting the economy will expand more than 2% this year.

A day later, Bank of England (BoE) Governor Andrew Bailey said rate cuts are now "on the way" and agreed that it's "reasonable" to expect two or three rate cuts this year. I wondered on Wednesday whether the final two hawks on the BoE's Monetary Policy Committee would capitulate in the face of tumbling inflation, and indeed they did. Barring anything unforeseen, all members of the MPC now agree that tightening is over. One member voted for a cut.

Traders are betting on at least three quarter-point cuts from the Fed, the European Central Bank and the BoE this year. All three are expected to begin in June. Not everybody is happy to wait: the Swiss National Bank executed a 25 basis point cut to its key interest rate yesterday, citing the fact that inflation is likely to run no higher than 1.5% through to 2026.

Markets surge

Sentiment tends to whipsaw. Markets were gripped by euphoria in December when the Fed began forecasting rate cuts but signs of persistent inflation muddied the waters. This is another of those moments: the S&P 500 and the Nasdaq Composite hit record highs, as did the Stoxx Europe 600, the CAC40 in Paris and Germany’s Dax. The FTSE rose to its highest level in 11 months.

Investors are now convinced that inflation is beaten, and whether current momentum can be sustained is the most immediate question. The next is where rates will settle - over the coming two years we will find out whether the post financial crisis period of ultra-low rates was an anomaly or a more permanent feature. I touched on the cases for and against in November.

The folding of the two hawks on the BoE's MPC is a crucial factor in the UK's changing outlook, but new language in the meeting minutes also points to a shift. Members now believe monetary policy will remain restrictive even if the base rate begins to fall - that suggests we don't need to wait for some of the more stubborn aspects of inflation to return to target before cuts arrive.

Sentiment

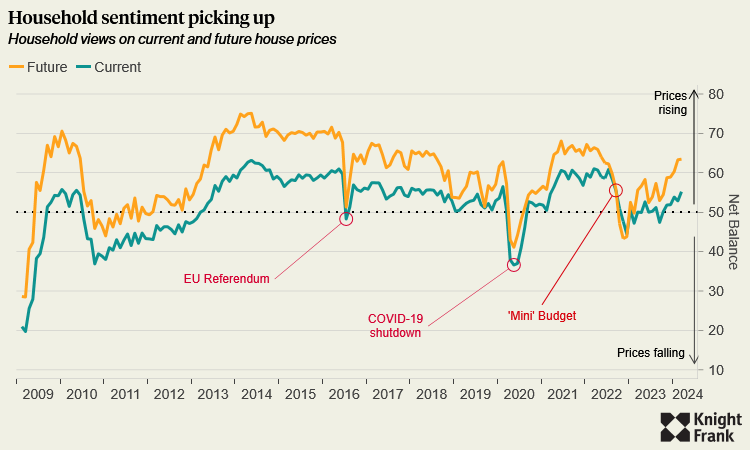

Consumers are now positive about the outlook for their personal finances for the first time in two years. Sentiment about the current and future trajectory of house prices is also picking up rapidly (see chart).

Businesses are also pretty upbeat, though respondents to the latest S&P Global Flash PMI are beginning to voice concerns about lacklustre growth prospects and political uncertainty. The release pointed to a solid upturn in outlook during March, all-but confirming that the UK economy has exited the brief recession of the final part of 2023. The manufacturing sector ended a twelve-month run of declining output.

Cost pressures show why the Bank of England is sitting tight on rates for now. A combination of rising costs and resilient demand meant that output prices charged across the private sector rose at the fastest rate in eight months.

Later living

The UK's population is rapidly ageing. In 2023, around 11 million people in England were aged over 65, equating to approximately one in five of us. That number is projected to increase by 30.5% between 2023 and 2043, resulting in an additional 4 million people.

The need for local authorities to provide suitable and age-appropriate housing options for individuals in their later years is becoming increasingly urgent, yet progress is slowing. In 2017, we started to analyse and grade local plans for all local authorities in England based on their approach to housing for seniors. Working alongside Irwin Mitchell, we have focused on whether they have either a policy for seniors housing or have made site-specific allocations for this use. This year, as in previous iterations of the report, we’ve supplemented that research by looking at: wider demographic changes, recent seniors housing delivery, residential pricing, and housing wealth.

Whilst previous versions of this report have shown significant progress, the pace of change has stalled over the last two years. Between 2017 and 2022, there was a 13.5% increase in English local authorities that had both adopted planning policies and allocated sites for seniors housing. Between 2022 and 2024, the figure has remained static. There was an improvement in the number of local authorities who either had a policy or an allocation, but it is slight – at 1.3% and 3.4% respectively.

This static national picture masks an increasing number of regressions in the data. In our last survey, in 2022, thirteen local authorities had moved backwards when compared to their previous score. In 2024, the number of authorities whose position has regressed over the last two years stands at 34. See the report for more.

In other news...

Housing developments axed as Tory planning reforms take effect (FT), and finally, Greece lifts Golden Visa threshold in bid to ease housing crisis (Bloomberg).