ESG in the City: Demand-led drive for sustainability in the London office market

What is the demand for green-rated buildings in central London? We explore leasing and investment activity of BREEAM-rated versus non-BREEAM rated in the capital over the past three years.

4 minutes to read

Whether as a strategy to achieve ESG and net zero commitments or to attract and retain talent, the growing and persistent demand for the best-in-class office space has been well-documented. Our research confirms that demand is far outstripping supply for buildings with the highest sustainability certifications, proportionally double in some instances, indicating that the established rental premium from these buildings will endure. In addition, we analyse market evidence to demonstrate investment positions from different investor types.

Enduring commitment to most sustainable buildings

Demand among occupiers for sustainable and amenity rich buildings has been evidenced, particularly in the wake of the pandemic and continues to strengthen, despite economic headwinds.

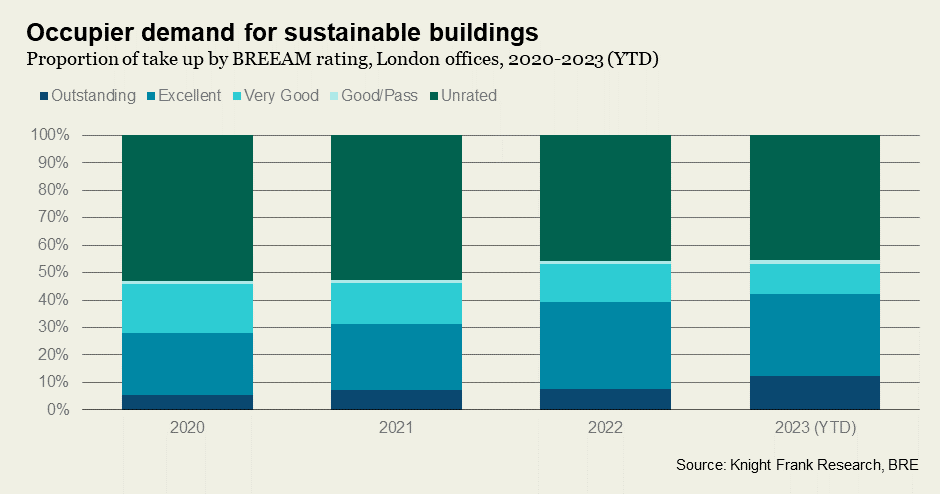

Of the 4,500+ office leasing transactions in central London from 2020 to 2023 there has been a substantial rise, from 28% to 42%, in the share of leases for buildings with the highest BREEAM ‘Excellent' or 'Outstanding' certifications. This is in line with the rise of take-up for new or refurbished space, which has gone from 56% in 2020 to 63% in 2023, with just over half (51%) of this space for 2023 rated BREEAM ‘Excellent' or 'Outstanding'

The shift underscores the increasing importance occupiers place on environmentally conscious and sustainable properties, presenting a compelling opportunity for property investors and occupiers alike.

Not only driven by the competition for talent, but ESG commitments are on the rise and with interim targets fast approaching, where companies have a reduction target by 2025, and 2030 on the horizon, real estate has a pivotal role to play. Demonstrating this growing commitment towards emissions reductions, over the past four years, the UK has witnessed a surge in companies submitting Science Based Targets . In 2023 alone, there was a remarkable 32% increase in firms adopting these targets compared to the previous year.

Is the growth in uptake due to demand or supply?

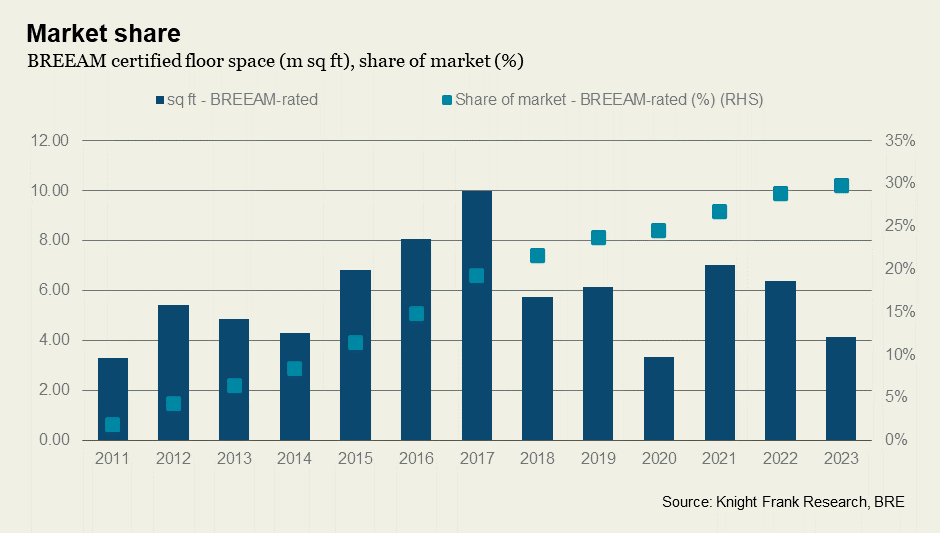

While some may argue this is a reflection in the market stock, the demand for the most sustainable buildings has outpaced supply. The proportion of London office stock with some level (Pass to Outstanding) of BREEAM certification has risen from around 6% in 2013 to 30% in 2023 – yet they account for more than half of leasing transactions.

The disparity is even more pronounced at the higher levels. Under 20% of floorspace is either BREEAM ‘Excellent’ or ‘Outstanding’, yet these accounted for over 40% of leasing activities in 2023 thus far. In terms of future looking supply, just shy of a quarter of available space is in the top two levels of BREEAM.

This imbalance, where the proportion of take-up is twice the level seen in the wider office stock, with this unlikely to materially shift when looking at availability, reinforces our previous analysis with the most pronounced rental premia for the highest certification levels. BREEAM ‘Outstanding’ certified offices, for example, can command a rental premium of up to 12.3%, for those with a ‘Very Good’ or ‘Excellent’ rating the premiums sit at 4-5%.

Despite a more uncertain and difficult economic climate, we expect that this trend will continue with the flight to quality likely to intensify.

The impact on investment strategies

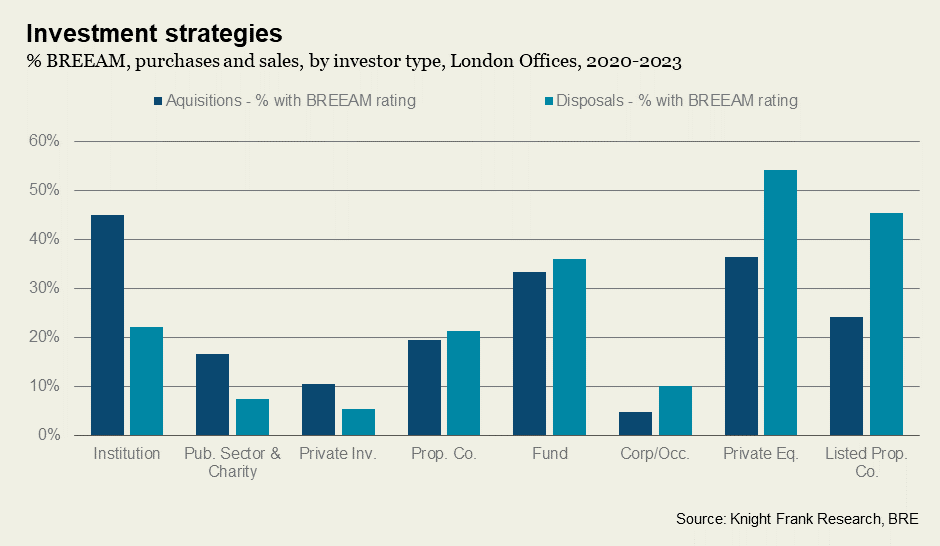

Those more aligned to core investment strategies, such as institutional investors lean towards more sustainable buildings with 46% of acquisitions over the last four years for offices holding a BREEAM rating. Our 2023 survey of UK and European property market investors found that 77% now factor minimum environmental certifications into their investment decisions and some 40% require EU Taxonomy compliance which is more likely to be adhered to with higher-rated buildings.

In contrast, those aligning to value-add strategies, both private equity (PE) and listed property companies have over the past four years predominantly acquired buildings with lower sustainability criteria, with BREEAM-certified offices accounting for 36% and 24% of acquisitions respectively, and sold those with higher, where BREEAM certified account for 54% and 45% of disposals respectively.

With 58% of investors surveyed actively pursuing poor-ESG performing buildings in order to upgrade and/or reposition, we could see a great level of interest and volume of transactions in unrated buildings. Especially with persistent and potentially increasing demand as we approach near-term 2030 net zero and transition targets.

1 Science-based targets provide a clearly-defined pathway for companies to reduce greenhouse gas (GHG) emissions. They are more stringent that a solely stated ESG commitments as they are assessed and verified by the SBTi as to whether the targets are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to 1.5°C above pre-industrial levels.