Revisiting structural themes in Asia-Pacific

Asia-Pacific is home to some of the world's largest economies, with its role further solidified by strong fundamentals. What factors are currently propelling the Asia-Pacific region forward?

2 minutes to read

In our New Horizon Outlook 2024: Asia-Pacific Tomorrow report, we explore the key megatrends driving growth that will affect the region's real estate markets.

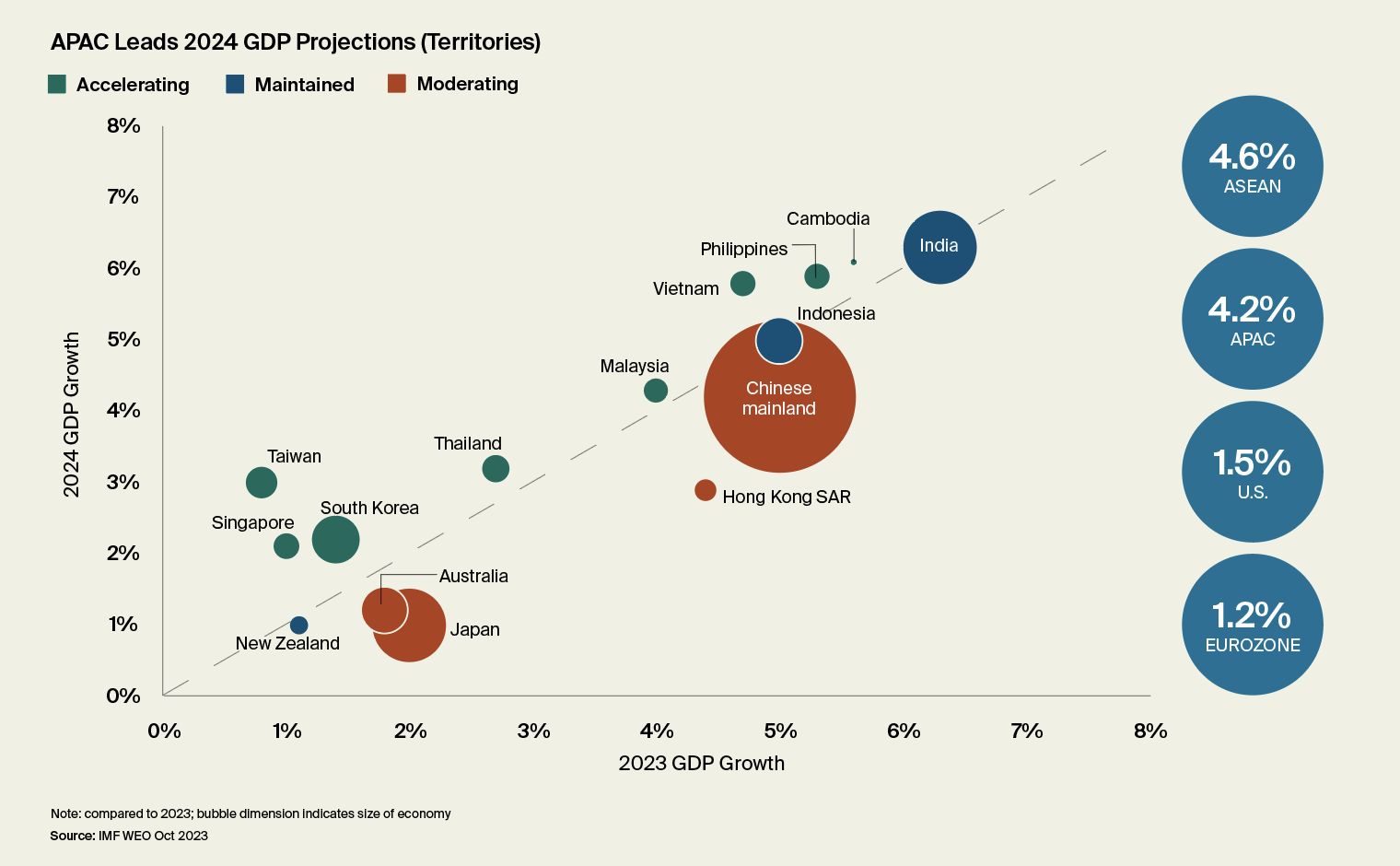

Asia-Pacific’s dominance in global economic growth

Despite a globally cautious economic outlook, the Asia-Pacific region is poised to remain as the world’s growth engine in 2024, as reaffirmed by forecasts from the International Monetary Fund's World Economic Outlook.

With over two-thirds of the region's major economies projected to sustain or amplify growth, one of the driving forces behind this resilience is Southeast Asia (SEA). The overall picture is dampened by diminishing momentum in the Chinese mainland, which is a wildcard for the region. The trajectory, however, could shift as the Chinese government, in a bid to stimulate growth, has adopted a more accommodative approach, potentially leading to forecast upgrades for the entire region.

Asia-Pacific’s long-term economic and demographic fundamentals remain intact. In most of the crucial drivers that power real estate fundamentals, the statistics remain heavily tilted towards Asia-Pacific. We identify the key features that will continue to propel the region's real estate markets that are key to capturing their long-term growth dynamics.

Megatrends

-

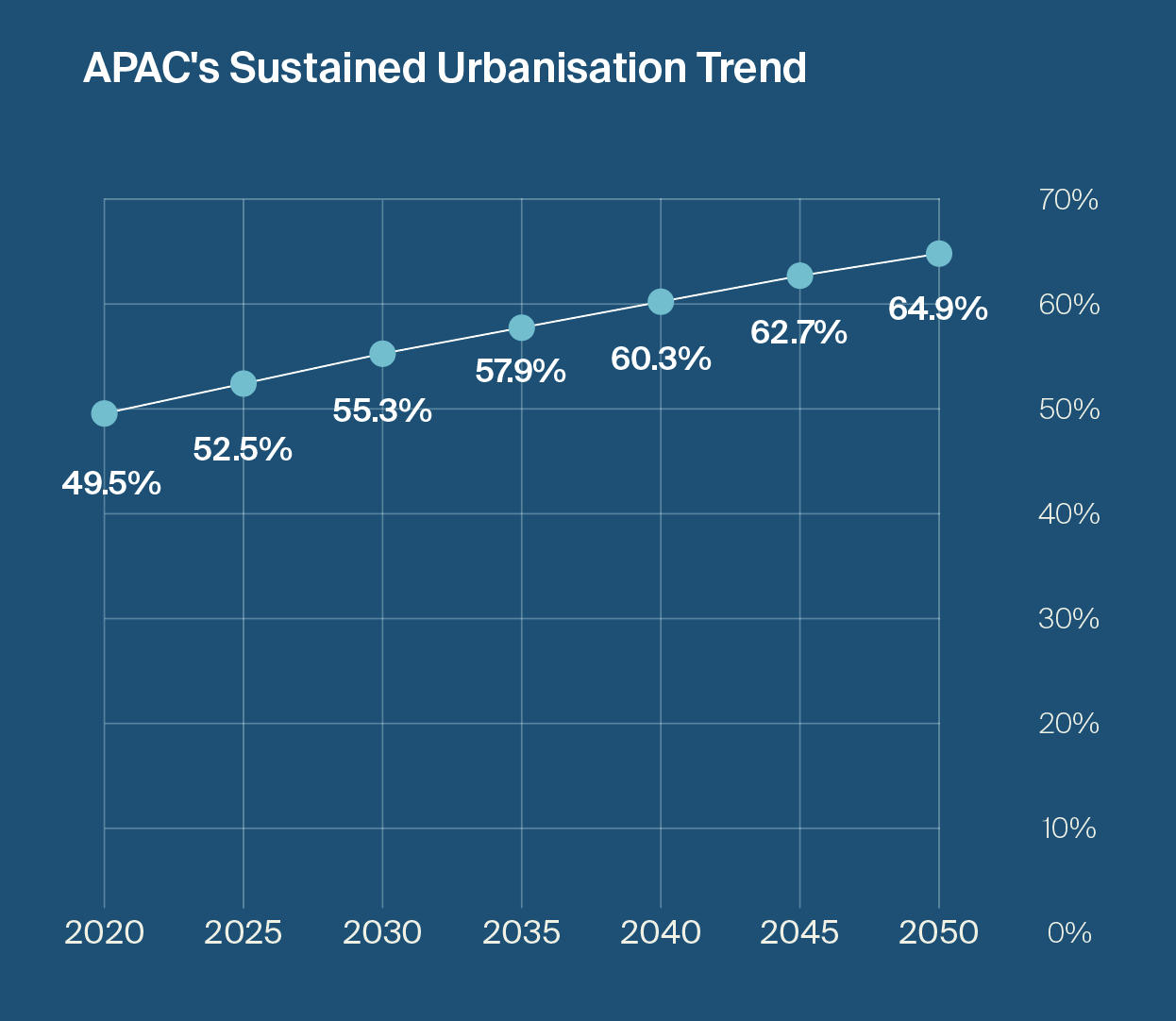

Urban Transformation

The region’s demographic challenges are well-known. A declining number of marriages and the resultant fall in birth rates – a consequence of rapid economic progress – will see population growth slow through the decades ahead. However, its urban population will continue to grow, fuelled by the ongoing rural-to-urban migration trend.

Source: World Urbanisation Prospects

-

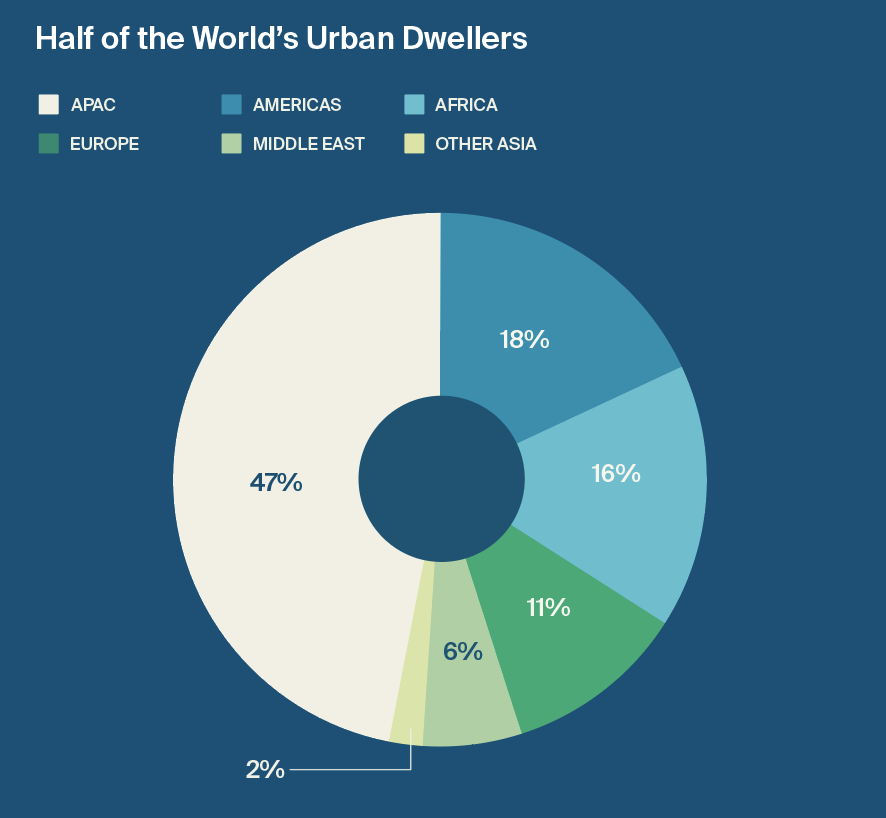

The highest concentration of the urban population

Asia - Pacific is already is home to the majority of the world's urban residents. By the end of the decade, the region’s cities are expected to increase by close to 300 million.

Source: World Urbanisation Prospects

-

Expanding middle class

According to World Data Lab, over half of the region will be middle class sometime in 2024. Among the 113 million that will join the ranks of the global middle class, over 80% will be in Asia. It marks a watershed moment, in which, for the first time, less than half of the region will be below the poverty line.

Source: Visual Capitalist

-

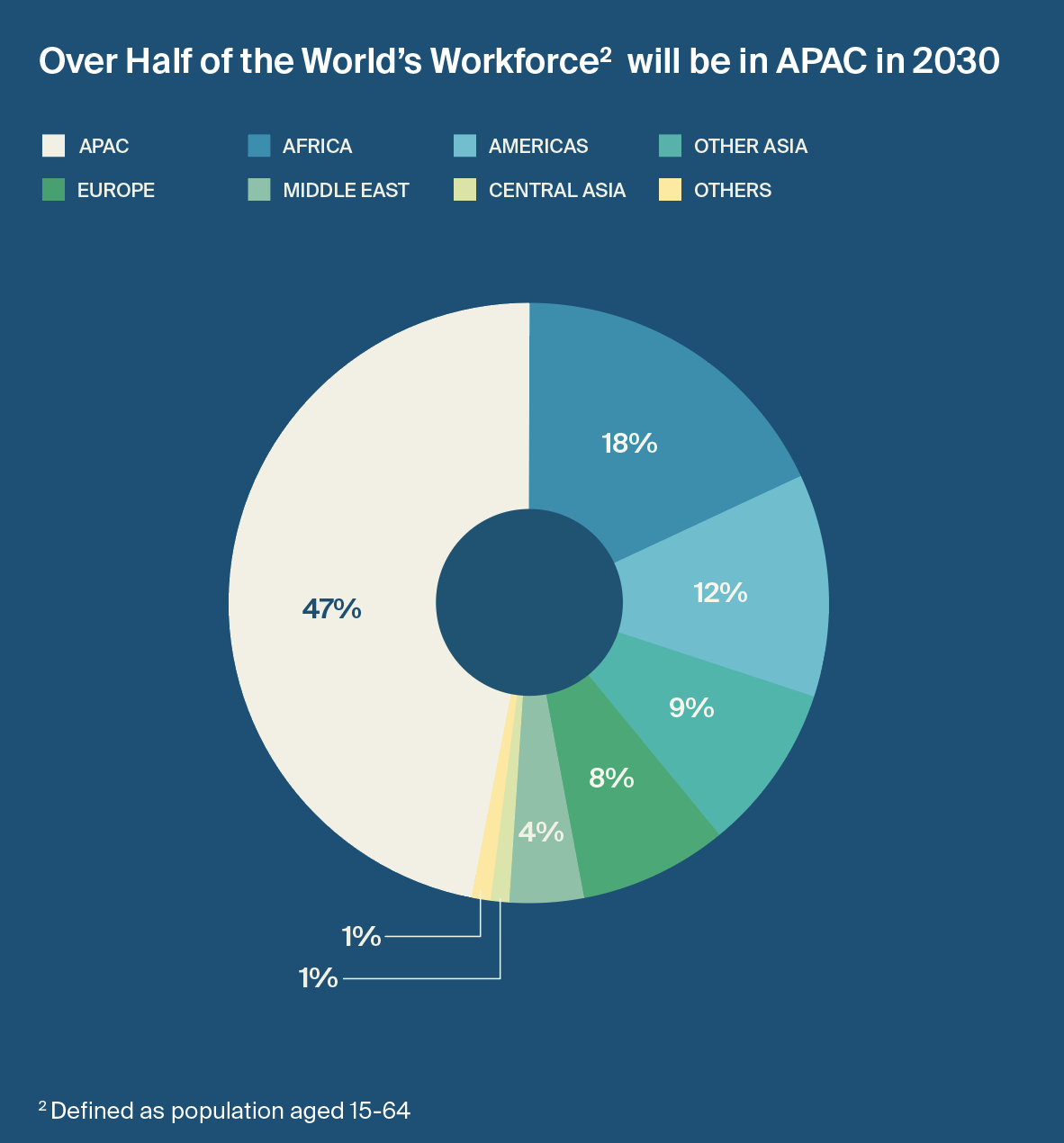

Largest working-age population

Paired with conducive policies, the young, fast-growing labour pools in South Asia and most parts of Southeast Asia are expected to fuel the region’s competitive advantage continually. By 2025, about 68% of the population in the ASEAN region will be of working age. Unlike more mature countries, the region’s working population surpasses its older dependents, spurring economic expansion, growing consumer and investment spending, and wealth accumulation.

Source: UN Population Division

-

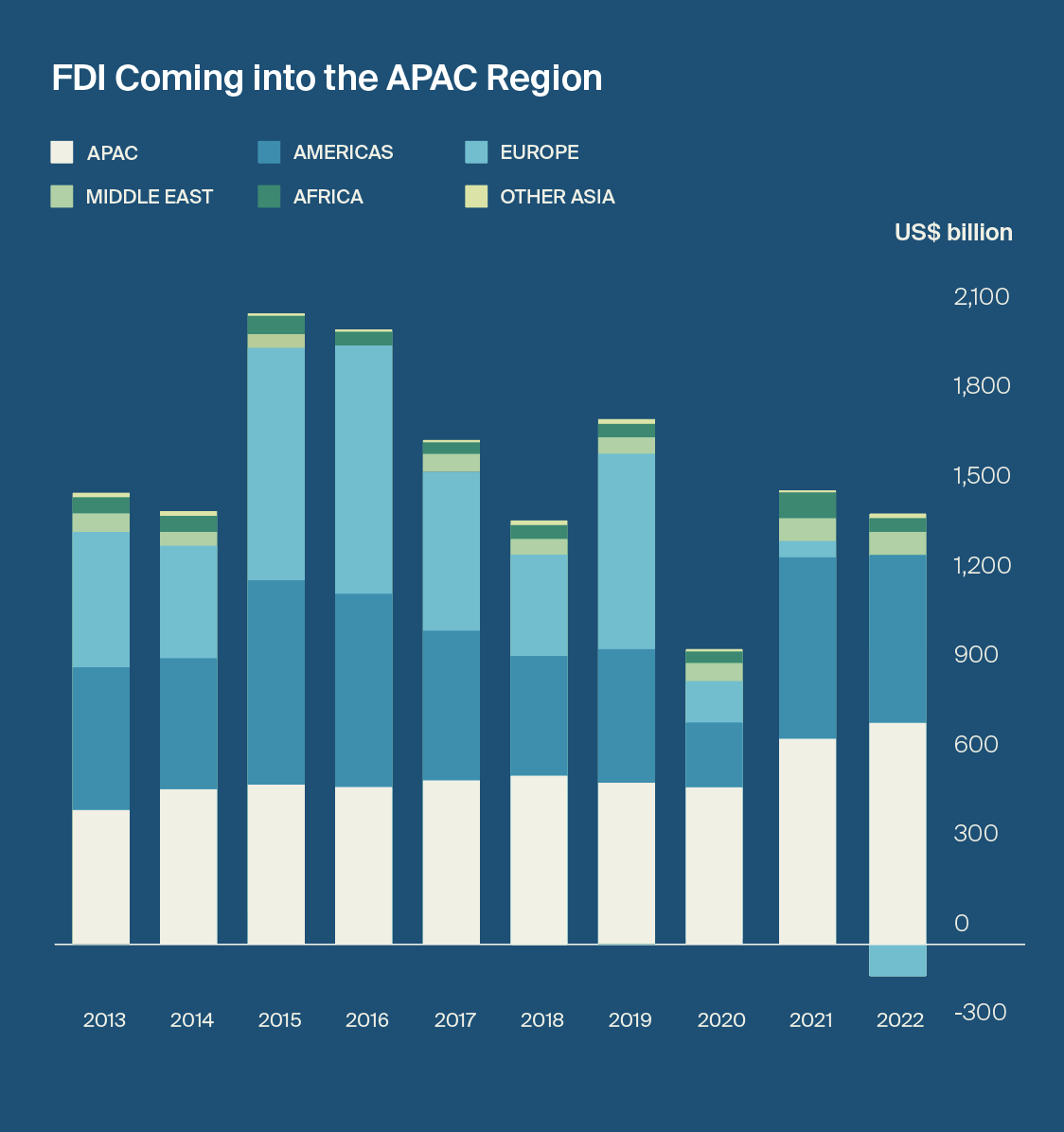

Magnet for foreign investments

Foreign direct investment (FDI) inflows from UNCTAD show a tectonic shift in investments towards Asia-Pacific following the pandemic. While inward FDI fell by 12.4% globally in 2022, those into the region have bucked the trend to rise by close to 8%. The region accounted for 55% of global inward FDI in 2022.

Source: United Nations conference on Trade and Development (UNCTAD)