Property Powerhouse: living sectors take centre-stage in Asia-Pacific investment

Living sectors have become a haven for investors, despite the challenging economic backdrop. Capital allocations to this asset class surged as investors seek stability and resilience.

2 minutes to read

In the Horizon: Asia-Pacific Tomorrow report, we explore how investors, in their pursuit of risk mitigation in portfolios, find the living sectors to be an attractive option.

The benefits of living sectors are evident in its relatively stable income stream, while not completely impervious to economic conditions, the living sectors have demonstrated resilience. Broadly defined to include various real estate types where individuals reside at different stages of their lives, such as student housing, co-living spaces, multi-family properties, and senior living facilities, the sector boasts defensive characteristics influenced by demographic shifts, evolving lifestyles, and technological advancements.

Despite economic challenges, the living sectors remain buoyant, benefiting from long-term demographic shifts, shifting lifestyles, and technological advancements. Broadly defined to include various real estate types where individuals reside at different stages of their lives, such as student housing, co-living spaces, multi-family properties, and senior living facilities, these sectors offer a unique mix of defensive qualities as they meet basic needs across all life stages. As the world evolves, living sectors continue to evolve too, offering investors stability and opportunity in uncertain times.

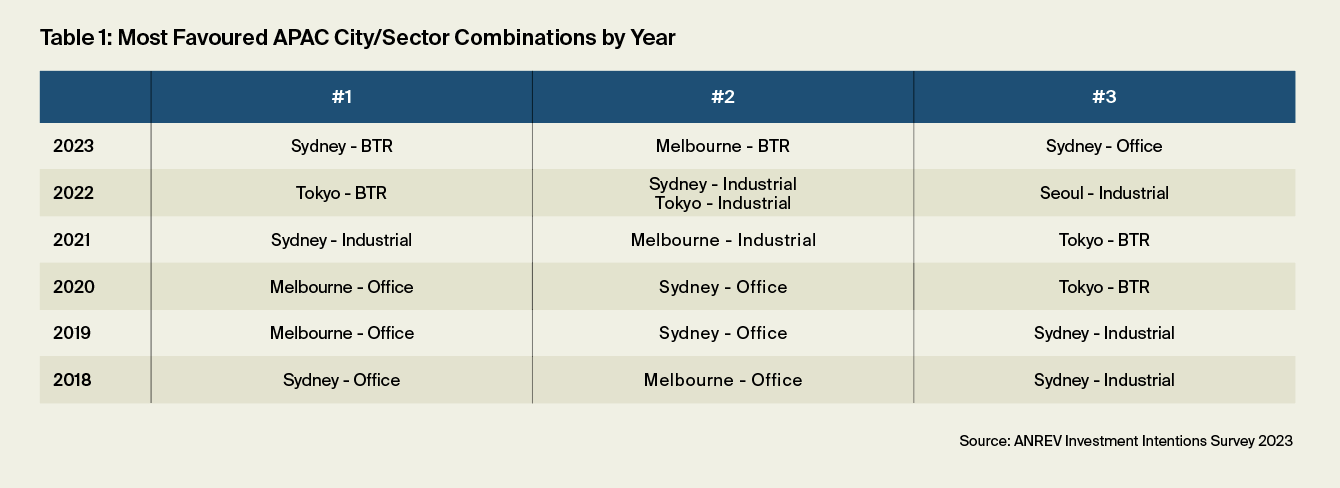

Rising star: Build-to-Rent transforms Asia-Pacific property market

The Build-To-Rent (BTR) market has exploded recently, as the market cap reached US$ 6 billion a decade ago, with Japan leading the charge in Asia-Pacific. However, Australia's nascent BTR market is rapidly gaining traction, with investors exploring development opportunities, particularly in the sustainable and impact housing sub-sectors. This growth is a testament to the market's potential for providing long-term rental accommodation in a rapidly changing real estate landscape.

China's hidden gem: Tapping into the untapped potential of Living Sectors

China's living sectors market is burgeoning, fuelled by a confluence of factors: an ageing population, more unmarried people, and the challenges of home ownership. Despite being in its early stages, the market's growth potential is vast. Institutional investors are seizing this opportunity, becoming trailblazers in the space, and capitalising on the chance to establish a presence in a market poised for growth.

As the living sectors market in China continues to expand, savvy institutional investors are seizing the opportunity to establish a foothold in this growing market. These players are capitalising on the significant potential for growth presented by factors such as an ageing population, increasing singlehood, and challenges in home ownership. With a strategic and early mover advantage, these investors are poised to reap the rewards of this burgeoning market.

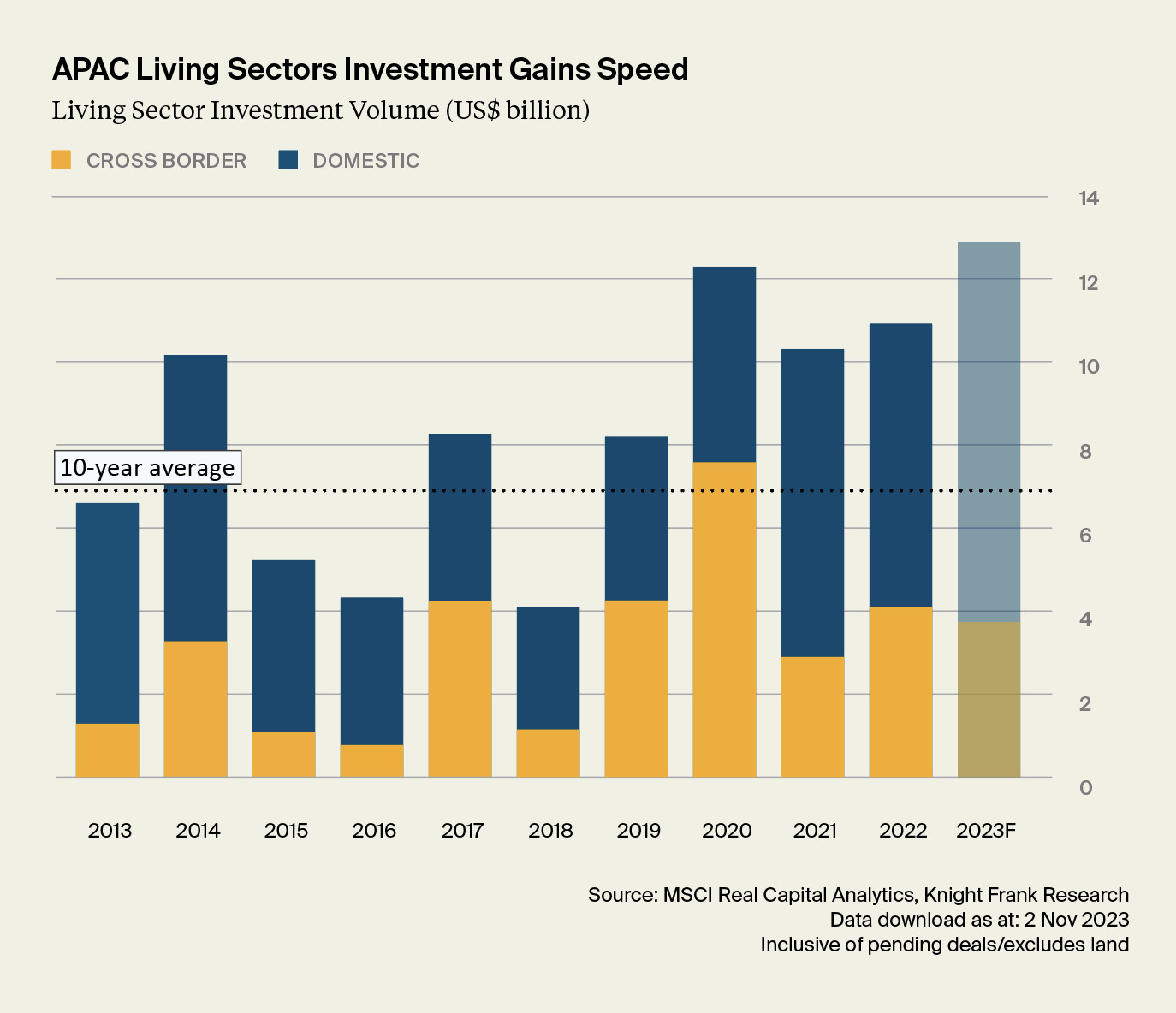

Asia-Pacific's living sectors industry is thriving, with new trends catalysing its rapid growth. Opportunities in this segment prevail, appealing to investors seeking fresh asset classes to enhance their portfolio diversification. With substantial deals in the pipeline, the total Asia-Pacific multi-family investment volume for the year is set to surpass the previous high in 2020, with domestic activities dominating the scene.