Do homeowners value and seek sustainability?

With the roll back on net zero policies billed as a cost saving exercise, we examine whether UK homeowners value sustainability and how property marketing can play a role.

6 minutes to read

The words people speak and their actions can often greatly diverge. According to YouGov/The Times polling, 72% of the public support the net zero by 2050 goal, although only if it is at no additional cost to them).

Yet, a YouGov/Times poll of over 2,100 adults after the announcements found that the public were pretty evenly split. Some 36% supported the changes, 35% opposed them and 29% did not know.

In our twice-a-year Residential Property Sentiment Survey, we found that 72% rate a home's energy efficiency as more important than before the Ukraine conflict. Does that translate into additional value for the most efficient homes?

Whilst the cost of energy was still the single-most important factor when purchasing an energy efficient home, scoring 28% (compared with 35% in December 2022 at the height of the energy bill crisis), it isn't the only factor. The prospect of future environmental regulations negatively affecting the value of their property (22%) and preference for a 'greener' home (21%) were also key motivators.

Indeed, our previous research found that improving EPC ratings can add up to 20% to the value, depending on how many bands improved. Below we look at taking this further with evidence pointing to a premium for net zero-enabled homes and also how marketing of properties is evolving.

Is there a price premium for net zero homes?

By examining net zero carbon (NZC) homes, our research finds an average premium of 3.8% in sales value, when compared to ‘standard’ new-built homes over the past decade. However, the premium has narrowed in recent years given the rising standards of new builds and may be eroded further.

Our research, undertaken by Johan Hagstrom, has identified around 7,500 NZC homes across England and Wales according to the following criteria:

- energy use of 35 kWh per square metre per annum (kWh/m2/yr.), in line with RIBA 2030 Goals recommendation to achieve net zero;

- CO2 emissions less than or equal to 1 kg C02/m2/yr.;

- new-build homes only; and

- houses only

We analysed the price differential between properties that achieve the NZC criteria against those that don’t, taking into account local authority, size, property type, and year of sale. This is net zero in operation and does not account for embodied emissions.

This analysis found that NZC properties commanded an average premium of 3.8% over non-NZC properties since 2012. However, this has lowered to 2.8% over the last three years. This may be attributable to the rising standards of new-builds across that period.

Indeed, we find that the energy efficiency of new-build homes has, on average, seen a considerable improvement. Whilst still more than double the net zero level, average energy consumption fell from 120 kWh/m2/yr. in 2009 to 80 in 2022.

However, the pace of reduction has levelled off in recent years and is highly scheme dependent.

Have peaked in house building technology?

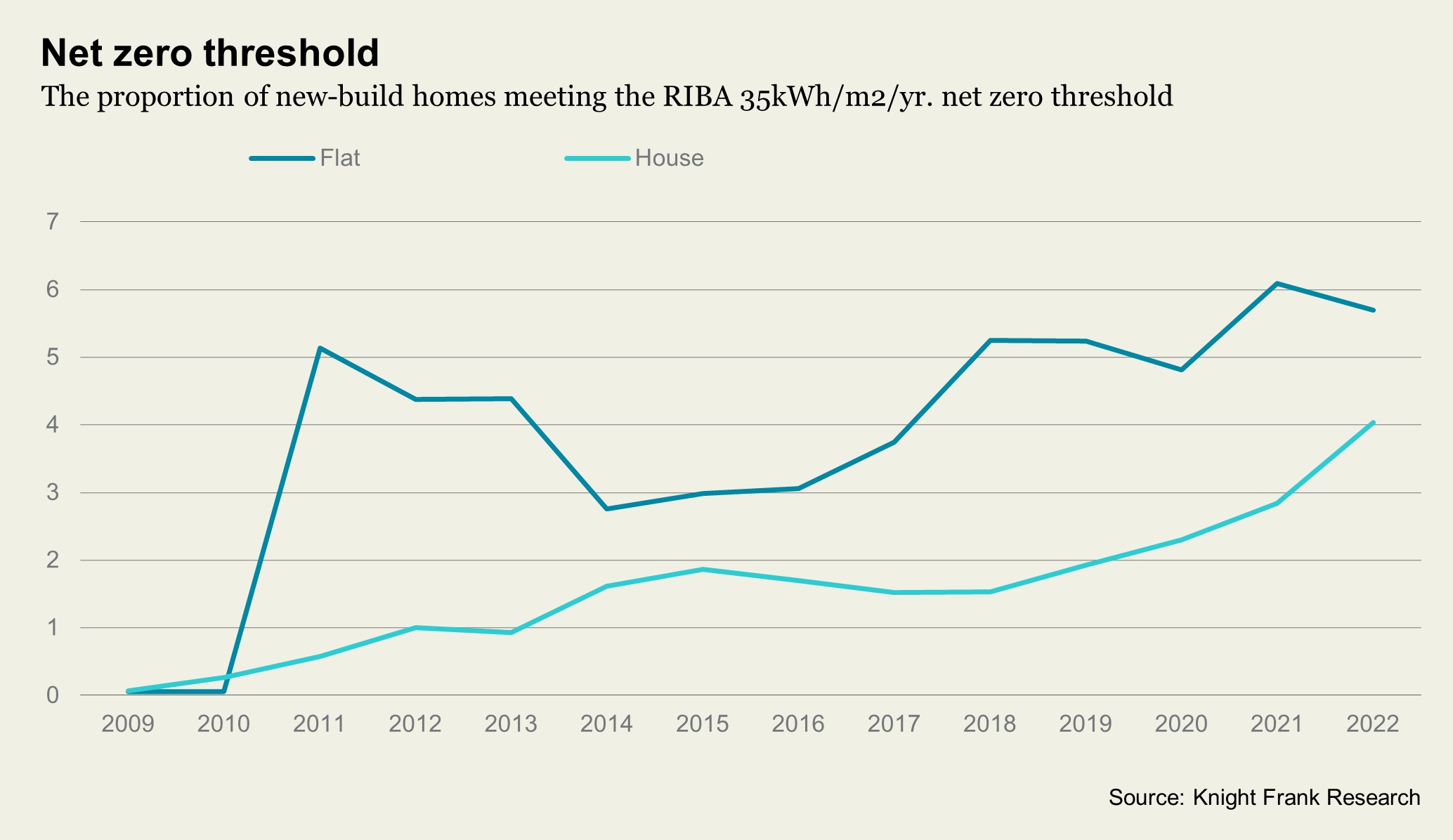

Encouragingly, when we dig deeper the proportion of new builds meeting the 35kWh/m2/yr. or net zero threshold has risen from under 0.1% for both houses and flats in 2009, to 4% of houses and 5.7% of flats in 2022.

Amenities and finance

Whilst we have considered many factors to isolate the impact of net zero homes versus other new builds, there may be some that haven’t been accounted for such as amenities which may also create a premium.

In addition, according to our Knight Frank Residential Sentiment Survey, just shy of 10% of respondents said their interest in a more energy efficient home was driven by cheaper mortgage finance.

Matthew Fleming-Duffy of Knight Frank Finance notes that “many lenders offer favourable terms for owners or purchasers of energy efficient properties. Typically, lenders run cashback schemes - such as Halifax who offer a post-completion cashback of £250 or Coutts who offer up to £2,000, both on EPC A/ B rated properties – or a reduced arrangement fees.

Mortgage products and their terms constantly change, particularly in times of market volatility, and the development of the green mortgage market has been painfully slow; however more products and solutions are expected to appear in 2024.” As this market evolves we could see a greater level of interest in more efficient homes driven by finance.

Decarbonising the energy grid

Another metric in the net zero criteria, carbon emissions, the shift away from gas (although recently delayed) will mean that emissions from electrified homes will fall through the decarbonisation of our national grid.

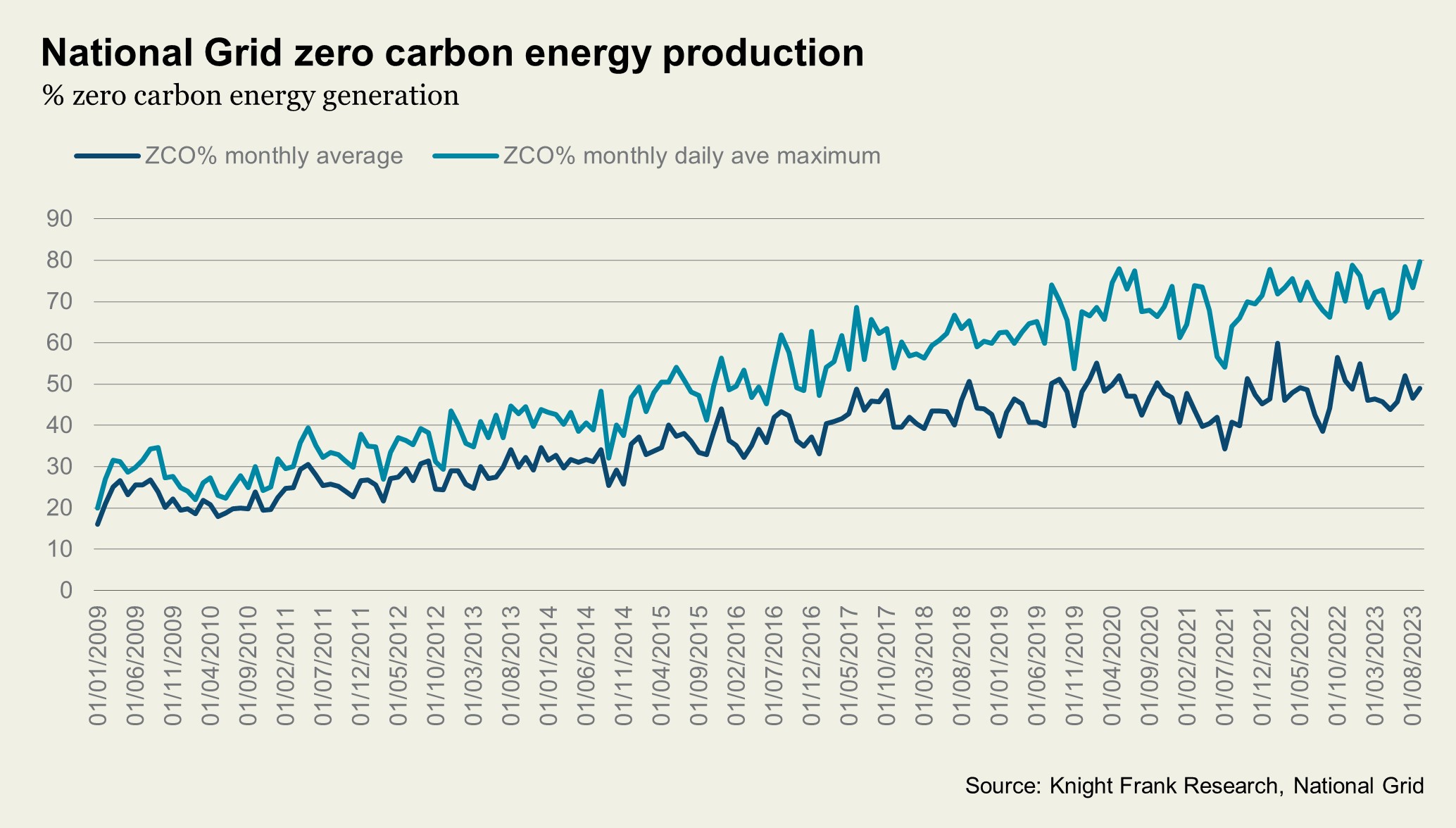

The UK is already producing a record amount of zero carbon (wind, solar, hydropower, nuclear, battery and pumped storage) energy in 2023, see chart below. Wind alone has accounted for more than 30% of grid energy in 2023 and solar for around 2%. In practice, this means any home which runs off grid electricity will be zero carbon when the grid is fully decarbonised – meaning in time all typical new homes will be zero carbon.

As a consequence, it is worth considering what this means for “net zero” homes and perhaps the focus will solely be on energy efficiency from a pure cost rather than emissions perspective.

In addition, the embodied carbon debate on building materials use will become of greater importance. There is also the fact that the majority of homes already exist and those will need to be the focus of ensuring greater energy efficiency of the residential sector.

Sustainability knowledge

There is a small but increasing prevalence of sustainability language in marketing which may enhance understanding and show awareness.

As mentioned, homeowners and purchasers are increasingly considering energy efficiency of their home, and this may become of even greater importance as the grid decarbonises, but is the marketing of homes for sale accounting for this?

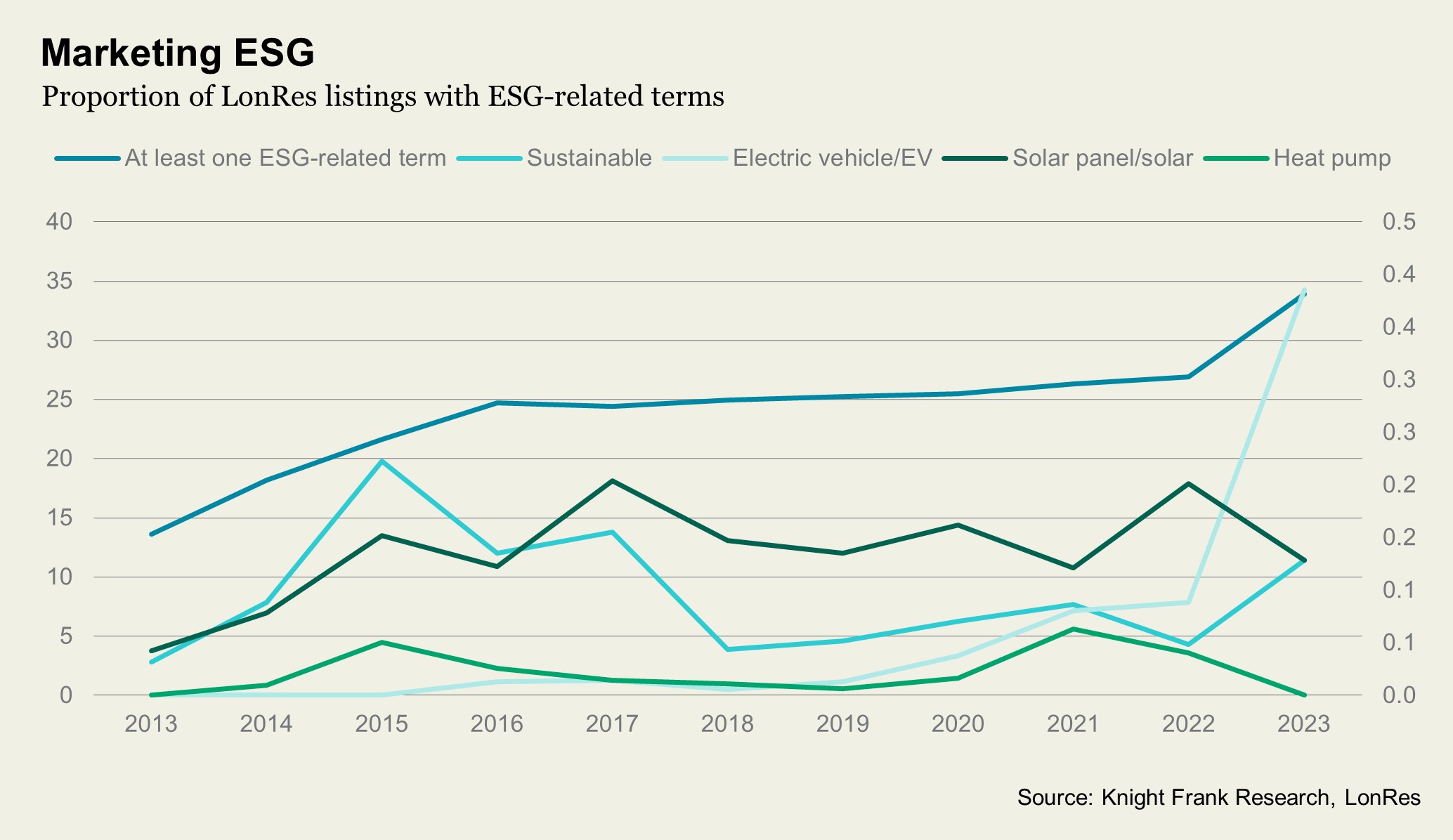

Marta Ferreira analysed listings via LonRes, which encompasses prime central London, over the past ten years and found an uptick in ESG-related terms*.

Since 2013 the proportion of listings with at least one ESG-related term has more than doubled, from just shy of 14% to 34%. Out of terms we studied, one notable rise has been in the mentions of electric vehicle/EV – especially in 2023 thus far with 0.4% of listings mentioning them.

Again, small numbers but awareness is growing and for real change within the industry it will need to be consumer driven. It is likely that we will increasingly see ESG-related terms rise and become a ‘normal’ part of marketing material – but we have some way to go there.

*Within our criteria we included terms such as; sustainability, sustainable, eco, eco-friendly, environmental, efficient, electric vehicle/EV, solar panel/solar, heat pump, gym, cycle, climate, performance, green, responsible & renewable.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here