Build to Rent in Asia-Pacific: a compelling global investment opportunity

After a long wait, Build To Rent is now emerging as an attractive investment opportunity in Australia and Asia-Pacific.

4 minutes to read

In recent years, the construction industry has witnessed a shift in the housing market with the rise of Build-to-Rent (BTR) developments. After a long wait, BTR is now emerging in Australia and Asia-Pacific.

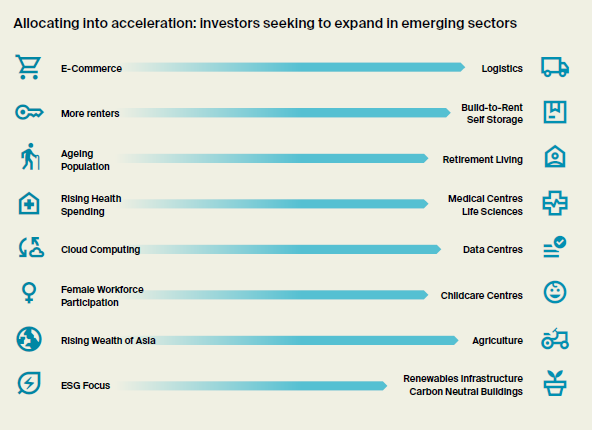

In our latest BTR report, Breaking the Shackles: The Rise of BTR, we found that investors seek more significant exposure to alternative sectors globally across all regions. The residential ‘living’ sectors are at the front of the queue, led by BTR, but also encompassing student accommodation and retirement living.

This was borne out in the most recent Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV) survey of global investor intentions, which highlighted that, for the first time, residential is the most sought-after sector for international investors targeting Asia-Pacific region. The shift to living sectors is part of a broader shift from major institutions globally to focus predominantly on core investment strategies in 2023 and commensurately reduce their allocation to value-add and opportunistic strategies.

Survey evidence from the ANREV survey highlights this shift down the risk curve in response to a more uncertain global economic outlook and cyclical correction in other sectors. The tilt in strategic approach to focus on core investments stand in clear contrast with the late-cycle approach evident from 2018 to 2020, when defensive investments were assigned a lower priority as investors pursued a more risk-on approach to take advantage of rapid rental growth and yield compression in other sectors

For the first time, residential is the most sought-after sector for global investors targeting Asia-Pacific, with Sydney and Melbourne as preferred locations.

BTR and income-aligned inflation

Investors are gravitating toward the residential sector because of the perception that it offers the ability to adjust rental income streams more quickly than other sectors in response to high inflation. Historic experience certainly bears this out. Residential rents have consistently kept pace with inflation over the long term, with the ABS’s housing rents index growing by 3.0% over the past 20 years, slightly exceeding the 2.8% average growth in the overall CPI basket over the same period.

Besides keeping pace with inflation, rents have also exhibited a high degree of correlation with fluctuations in inflation, in contrast with other major asset classes such as office and industrial, where the rental cycle has fluctuated more widely depending on the prevailing supply-demand dynamic. An analysis of the relationship between annual rental growth rates in the residential sector and annual movements in inflation reveals a very high degree of correlation.

However, contrary to the widespread perception that the market is primarily driven by offshore capital, many local groups in Australia are also jumping on board, with 65% of existing and proposed units currently owned by domestic capital and 35% by global capital either exclusively or through joint venture partnerships.

How is Built-To-Rent different from traditional residential properties?

BTR developments are significantly different from traditional residential properties in that they are purposefully designed, constructed, and managed for the sole purpose of renting out to tenants. One of the defining characteristics of the BTR trend is its resilience in the face of changing market dynamics, and investors are gravitating toward the residential sector partly because of its defensive characteristics, specifically the ability to adjust rental income streams more quickly than other sectors in response to high inflation.

Residential rents have consistently kept pace with inflation over the long term and also exhibited a high degree of correlation with fluctuations in inflation, in contrast with other major asset classes where the rental cycle has fluctuated more widely depending on the prevailing supply-demand dynamic.

We believe that the BTR trend is not just a fad but a lasting and transformative phenomenon that will continue to redefine the housing rental landscape.

Reshaping rental markets for the next decade

In the current macroeconomic landscape, which has posed challenges across various sectors, BTR is emerging as a standout performer due to its capacity to yield stable, inflation-linked income over extended periods.

The BTR model aims to align the interests of investors seeking to secure long-term income streams with the interests of tenants, and over time, this will result in a more diverse product mix that promises to improve the service offering and to widen the range of options for renters. The sustained expansion of the potential tenant market and a deep and liquid investment landscape provide ideal conditions for BTR to establish itself as the next major institutional asset class.

The investor pivot towards residential sectors is expected to profoundly impact Australia due to its substantial growth potential, amplified by its currently favourable starting position.

In the coming months, the potential development pipeline is likely to expand further as developers seek to position themselves to benefit from the current surge in rental growth. However, the actual quantum of schemes under construction may be slower to accelerate until construction cost pressures ease.

For more on the prospects of BTR in Asia-Pacific, listen to my views on MoneyFM https://okt.to/l9WXUc